John Hancock Simple Ira Transmittal Form

What is the John Hancock Simple IRA Transmittal Form

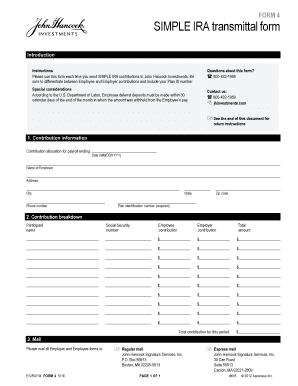

The John Hancock Simple IRA Transmittal Form is a crucial document used by employers to facilitate the establishment and management of a SIMPLE IRA plan. This form allows for the seamless transfer of funds from employee contributions into the retirement account, ensuring compliance with IRS regulations. It serves as a formal request to initiate the establishment of the SIMPLE IRA, enabling employees to save for retirement through tax-deferred contributions. Understanding the purpose and function of this form is essential for both employers and employees participating in the SIMPLE IRA plan.

How to use the John Hancock Simple IRA Transmittal Form

Using the John Hancock Simple IRA Transmittal Form involves several straightforward steps. First, ensure you have the correct version of the form, which can typically be obtained from your employer or directly from John Hancock's resources. Next, fill out the required information, including your personal details and contribution amounts. After completing the form, review it for accuracy before submitting it to your employer or the designated financial institution. This process ensures that your contributions are processed correctly and that your retirement savings are on track.

Steps to complete the John Hancock Simple IRA Transmittal Form

Completing the John Hancock Simple IRA Transmittal Form requires attention to detail. Follow these steps for a successful submission:

- Obtain the form from your employer or John Hancock's website.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the amount you wish to contribute to your SIMPLE IRA.

- Sign and date the form to validate your submission.

- Submit the completed form to your employer or the financial institution managing your SIMPLE IRA.

Legal use of the John Hancock Simple IRA Transmittal Form

The legal use of the John Hancock Simple IRA Transmittal Form is governed by IRS regulations that dictate how SIMPLE IRAs should be established and maintained. Proper completion and submission of this form are essential to ensure that contributions are made in compliance with federal laws. Additionally, the form must be retained for record-keeping purposes, as it may be required for future audits or inquiries regarding your retirement savings. Understanding these legal requirements helps safeguard both employees and employers in the management of retirement funds.

Key elements of the John Hancock Simple IRA Transmittal Form

Several key elements are essential to the John Hancock Simple IRA Transmittal Form. These include:

- Personal Information: Accurate details about the employee, including name and Social Security number.

- Contribution Amount: The specific dollar amount the employee wishes to contribute.

- Employer Information: Details about the employer managing the SIMPLE IRA plan.

- Signature and Date: Required to validate the form and confirm the employee's intent to contribute.

Form Submission Methods

The John Hancock Simple IRA Transmittal Form can be submitted through various methods, depending on the employer's processes. Common submission methods include:

- Online Submission: Many employers offer electronic submission options for convenience.

- Mail: The completed form can be mailed to the employer or the financial institution.

- In-Person: Employees may also submit the form directly to their HR department or designated representative.

Quick guide on how to complete john hancock simple ira transmittal form

Effortlessly prepare John Hancock Simple Ira Transmittal Form on any device

The management of online documents has gained popularity among organizations and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly and without delay. Manage John Hancock Simple Ira Transmittal Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and eSign John Hancock Simple Ira Transmittal Form without effort

- Find John Hancock Simple Ira Transmittal Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, and errors that require new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and eSign John Hancock Simple Ira Transmittal Form to ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the john hancock simple ira transmittal form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the john hancock simple ira transmittal form?

The john hancock simple ira transmittal form is a document used to facilitate the transfer of funds into a SIMPLE IRA account. It helps streamline the onboarding process for new accounts. With airSlate SignNow, you can easily fill out and eSign this form, ensuring a hassle-free experience.

-

How do I fill out the john hancock simple ira transmittal form?

Filling out the john hancock simple ira transmittal form is straightforward. Once you access the form through airSlate SignNow, you can input your information, review the details, and eSign it within minutes. Our platform makes it easy to manage your paperwork digitally.

-

Is the john hancock simple ira transmittal form secure?

Yes, the john hancock simple ira transmittal form is secure when processed through airSlate SignNow. We employ advanced encryption methods to protect your sensitive information. You can trust that your data is safe with our electronic signing solution.

-

What are the benefits of using airSlate SignNow for the john hancock simple ira transmittal form?

Using airSlate SignNow for the john hancock simple ira transmittal form offers numerous benefits, including convenience, speed, and improved organization. You can eSign documents from anywhere at any time, which saves time and eliminates the need for physical storage. Plus, you track your documents easily.

-

Are there any costs associated with the john hancock simple ira transmittal form?

While the john hancock simple ira transmittal form itself does not have a direct cost, using airSlate SignNow requires a subscription. Our pricing plans are designed to be cost-effective for businesses of all sizes. You can choose a plan that best suits your needs.

-

Can I integrate airSlate SignNow with other tools for managing the john hancock simple ira transmittal form?

Absolutely! airSlate SignNow offers various integrations that allow you to manage the john hancock simple ira transmittal form seamlessly with other applications. This includes CRM systems and cloud storage services, enhancing your workflow and productivity.

-

How long does it take to process the john hancock simple ira transmittal form with airSlate SignNow?

Processing the john hancock simple ira transmittal form with airSlate SignNow can take just minutes. Once all parties have eSigned the document, you can instantly send it to the necessary financial institutions. This expedites the setup of your SIMPLE IRA account.

Get more for John Hancock Simple Ira Transmittal Form

- Letter from tenant to landlord containing notice of termination for landlords noncompliance with possibility to cure new form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497318642 form

- Tenant landlord security form

- New hampshire landlord form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497318645 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497318646 form

- New hampshire landlord 497318647 form

- New hampshire lease form

Find out other John Hancock Simple Ira Transmittal Form

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple