To Open PDF Version of the W 9 Form Page 1 Business and Www Bfs Ucsd

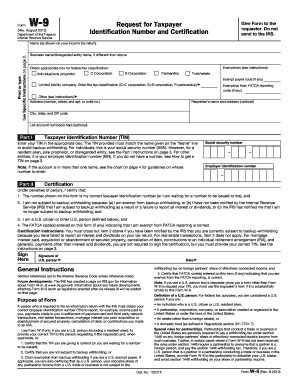

What is the W-9 Form?

The W-9 form is an Internal Revenue Service (IRS) document used in the United States by individuals and businesses to provide their taxpayer identification information. This form is primarily utilized by freelancers, contractors, and other non-employees to report income to the IRS. By filling out the W-9, individuals confirm their name, address, and taxpayer identification number, which is essential for tax reporting purposes.

Steps to Complete the W-9 Form

Completing the W-9 form is straightforward. Follow these steps to ensure accuracy:

- Provide your name as it appears on your tax return.

- Enter your business name if applicable.

- Select the appropriate federal tax classification, such as individual, corporation, or partnership.

- Fill in your address, including city, state, and ZIP code.

- Enter your taxpayer identification number, which can be your Social Security number or Employer Identification Number.

- Sign and date the form to certify that the information is correct.

Legal Use of the W-9 Form

The W-9 form serves a critical legal purpose in the U.S. tax system. It is used by businesses to collect taxpayer information from contractors and freelancers. This information is necessary for reporting income to the IRS and for issuing Form 1099 at the end of the tax year. Properly completed W-9 forms help ensure compliance with IRS regulations and protect both the payer and payee from potential tax issues.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines for completing and submitting the W-9 form. It is important to follow these guidelines to avoid penalties. The IRS requires that the W-9 be filled out accurately and submitted upon request by the payer. Additionally, the form should be updated whenever there are changes to your taxpayer information, such as a name change or change of address.

Form Submission Methods

The W-9 form can be submitted in various ways, depending on the payer's preference. Common submission methods include:

- Emailing the completed form as a PDF attachment.

- Mailing a hard copy to the requesting party.

- Submitting the form in person if required.

It is essential to ensure that the method chosen maintains the confidentiality and security of your taxpayer information.

Penalties for Non-Compliance

Failure to provide a completed W-9 form when requested can lead to significant penalties. If a business does not receive a W-9 from a contractor, they may be required to withhold taxes from payments made to that contractor. Additionally, inaccuracies on the W-9 can result in penalties from the IRS, including fines and interest on unpaid taxes. It is crucial to complete and submit the W-9 form accurately and promptly to avoid these consequences.

Quick guide on how to complete to open pdf version of the w 9 form page 1 business and www bfs ucsd

Complete To Open Pdf Version Of The W 9 Form Page 1 Business And Www bfs Ucsd effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents quickly without delays. Manage To Open Pdf Version Of The W 9 Form Page 1 Business And Www bfs Ucsd on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign To Open Pdf Version Of The W 9 Form Page 1 Business And Www bfs Ucsd without hassle

- Obtain To Open Pdf Version Of The W 9 Form Page 1 Business And Www bfs Ucsd and click Get Form to begin.

- Make use of the tools we provide to finish your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Edit and eSign To Open Pdf Version Of The W 9 Form Page 1 Business And Www bfs Ucsd and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the to open pdf version of the w 9 form page 1 business and www bfs ucsd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a W9 form and why is it important?

The W9 form is a tax document used in the United States by individuals and businesses to provide their taxpayer identification information to the IRS. It's crucial for ensuring accurate tax reporting and compliance, especially for freelancers and contractors who need to report income. Using airSlate SignNow, you can easily complete and eSign a W9 form, streamlining the process.

-

How can airSlate SignNow help me manage W9 forms?

airSlate SignNow allows you to create, send, and eSign W9 forms seamlessly. With our intuitive platform, you can quickly gather required information, store signed documents securely, and ensure that all parties have access to the finalized W9 form. This enhances your workflow and saves you time on paperwork.

-

Is airSlate SignNow cost-effective for handling W9 forms?

Yes, airSlate SignNow offers a cost-effective solution for managing W9 forms and other documents. Our pricing plans are designed to suit a variety of business needs without compromising on features. You can optimize your document management while keeping costs low.

-

What features does airSlate SignNow offer for W9 forms?

airSlate SignNow provides several features specifically for W9 forms, including customizable templates, real-time tracking, and secure electronic signatures. You can also utilize automated reminders for outstanding signatures and easily share documents with clients or contractors. This ensures all your W9 forms are handled efficiently.

-

Can I integrate airSlate SignNow with other applications for W9 forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications and platforms such as Google Drive, Salesforce, and more. This allows you to manage your W9 forms alongside your other documents and workflows, enhancing productivity and collaboration across your tools.

-

Is it safe to send W9 forms through airSlate SignNow?

Yes, sending W9 forms through airSlate SignNow is safe and secure. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your completed W9 forms will be transmitted safely and stored securely.

-

How do I get started with airSlate SignNow for my W9 forms?

Getting started with airSlate SignNow for your W9 forms is quick and easy. Simply sign up for a free trial, where you can explore our features and create your first W9 form. Our user-friendly interface guides you through the process, ensuring you can eSign documents without any hassle.

Get more for To Open Pdf Version Of The W 9 Form Page 1 Business And Www bfs Ucsd

- Wisconsin property agreement form

- Wisconsin agreement form

- Wisconsin postnuptial form

- Quitclaim deed from husband and wife to an individual wisconsin form

- Warranty deed from husband and wife to an individual wisconsin form

- Wi form

- Warranty deed two grantors to three grantees as joint tenants wisconsin form

- Wisconsin subpoena form

Find out other To Open Pdf Version Of The W 9 Form Page 1 Business And Www bfs Ucsd

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed