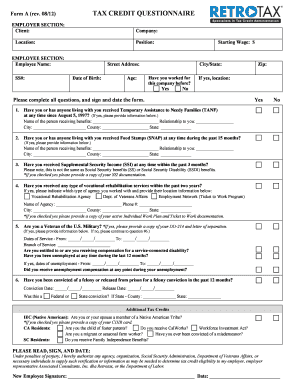

TAX CREDIT QUESTIONNAIRE Form

What is the tax credit questionnaire?

The tax credit questionnaire is a vital document used to determine eligibility for various tax credits, including the Work Opportunity Tax Credit (WOTC). This form collects essential information about the taxpayer's background, employment status, and other relevant factors that influence tax credit eligibility. By gathering this data, the questionnaire helps streamline the process of claiming tax credits and ensures compliance with IRS regulations.

Steps to complete the tax credit questionnaire

Completing the tax credit questionnaire involves several important steps:

- Gather necessary personal information, including your name, Social Security number, and contact details.

- Provide employment history, including the names of employers, job titles, and dates of employment.

- Answer questions related to eligibility criteria, such as your status as a veteran or your participation in certain assistance programs.

- Review your responses for accuracy and completeness before submission.

Legal use of the tax credit questionnaire

The tax credit questionnaire serves as a legally binding document when filled out correctly. To ensure its validity, it must comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This means that electronic signatures and submissions are recognized as legally acceptable forms of documentation, provided that the process adheres to established legal standards.

Eligibility criteria

Eligibility for tax credits varies based on specific criteria outlined by the IRS. Common factors include:

- Employment status and history

- Participation in government assistance programs

- Demographic factors, such as age and veteran status

Understanding these criteria is essential for accurately completing the tax credit questionnaire and maximizing potential tax benefits.

Required documents

To complete the tax credit questionnaire effectively, certain documents may be required. These typically include:

- Proof of identity, such as a driver's license or passport

- Social Security card

- Employment records and pay stubs

- Documentation of participation in assistance programs, if applicable

Having these documents ready can facilitate a smoother completion process and ensure that all necessary information is provided.

Form submission methods

The tax credit questionnaire can be submitted through various methods, including:

- Online submission via secure platforms that support electronic signatures

- Mailing a printed copy to the appropriate tax authority

- In-person submission at designated tax offices

Choosing the right submission method can depend on personal preferences and the specific requirements of the tax credit being claimed.

Quick guide on how to complete tax credit questionnaire

Prepare TAX CREDIT QUESTIONNAIRE effortlessly on any device

Digital document management has become a favorite among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents quickly without delays. Manage TAX CREDIT QUESTIONNAIRE on any device with airSlate SignNow Android or iOS applications and simplify any document-driven procedure today.

How to modify and electronically sign TAX CREDIT QUESTIONNAIRE without stress

- Obtain TAX CREDIT QUESTIONNAIRE and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of your documents or redact private information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your chosen device. Modify and electronically sign TAX CREDIT QUESTIONNAIRE and maintain excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax credit questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax credit questionnaire?

A tax credit questionnaire is a document used to gather essential information from individuals or businesses in order to determine eligibility for various tax credits. By utilizing airSlate SignNow, you can easily streamline the process of completing and eSigning your tax credit questionnaire, ensuring that all necessary details are collected efficiently.

-

How does airSlate SignNow simplify the tax credit questionnaire process?

airSlate SignNow simplifies the tax credit questionnaire process by providing an intuitive platform for creating, sending, and signing documents electronically. The user-friendly interface allows you to customize your tax credit questionnaire, making it easier for recipients to fill out and eSign, thus speeding up the eligibility determination process.

-

Are there any additional fees for using the tax credit questionnaire feature?

With airSlate SignNow, there are no hidden fees when using the tax credit questionnaire feature. Our pricing is transparent, and it varies based on the plan you choose, allowing you to access essential features without worrying about unexpected costs while preparing your tax credit questionnaire.

-

Can the tax credit questionnaire be integrated with other software?

Yes, airSlate SignNow offers seamless integrations with a variety of software solutions, enhancing your workflow when managing tax credit questionnaires. By integrating with platforms such as CRM systems, you can ensure that your tax credit questionnaire data is efficiently managed and easily accessible.

-

What benefits does eSigning a tax credit questionnaire offer?

eSigning your tax credit questionnaire with airSlate SignNow provides numerous benefits, including faster processing times and enhanced security. The digital signature ensures that your document is legally binding while also reducing the hassle of physical paperwork, making it easier to manage important tax-related documents.

-

How secure is my data when using the tax credit questionnaire with airSlate SignNow?

airSlate SignNow prioritizes data security and employs industry-standard encryption to protect all information within your tax credit questionnaire. Our platform is designed to safeguard sensitive data, ensuring that your personal and financial information remains confidential and secure during the signing process.

-

Can I track the status of my tax credit questionnaire?

Absolutely! airSlate SignNow provides real-time tracking for your tax credit questionnaire, allowing you to monitor its status from sending to completion. You will receive notifications when the document is viewed, signed, or requires further action, ensuring you stay informed throughout the process.

Get more for TAX CREDIT QUESTIONNAIRE

- 3 day notice to pay rent or lease terminated for residential property new mexico form

- Increase rent lease form

- New mexico increase rent form

- Nm increase rent form

- 24 hour notice form

- 3 day notice to pay rent or lease terminated for nonresidential or commercial property new mexico form

- Assignment of mortgage by individual mortgage holder new mexico form

- Assignment of mortgage by corporate mortgage holder new mexico form

Find out other TAX CREDIT QUESTIONNAIRE

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed