PAYROLL BACKPAY REQUEST FORM

What is the Payroll Backpay Request Form

The Payroll Backpay Request Form is a formal document used by employees to request compensation for wages that were not paid in a timely manner. This form is essential for documenting the request and ensuring that the employer acknowledges the claim. It typically includes details such as the employee's name, the period for which back pay is requested, and the reasons for the request. Understanding the purpose of this form is crucial for employees seeking to resolve wage discrepancies effectively.

How to Use the Payroll Backpay Request Form

Using the Payroll Backpay Request Form involves several steps to ensure that your request is clear and complete. First, gather all necessary information, including your employment details and the specific pay periods in question. Next, fill out the form accurately, providing detailed explanations for the back pay request. Once completed, submit the form to your employer's payroll or human resources department. Keeping a copy for your records is advisable, as it serves as proof of your request.

Steps to Complete the Payroll Backpay Request Form

Completing the Payroll Backpay Request Form requires attention to detail. Follow these steps for a successful submission:

- Begin by entering your personal information, including your full name and employee ID.

- Specify the pay periods for which you are requesting back pay.

- Clearly outline the reasons for your request, providing any supporting documentation if necessary.

- Review the form for accuracy and completeness before submitting it.

- Submit the form according to your employer's guidelines, whether electronically or in person.

Legal Use of the Payroll Backpay Request Form

The Payroll Backpay Request Form has legal implications, as it serves as a formal request for owed wages. To ensure its legal validity, the form must be completed accurately and submitted within the appropriate time frame. Employers are required to address these requests in accordance with labor laws, which vary by state. Familiarizing yourself with these laws can help you understand your rights and the obligations of your employer regarding back pay.

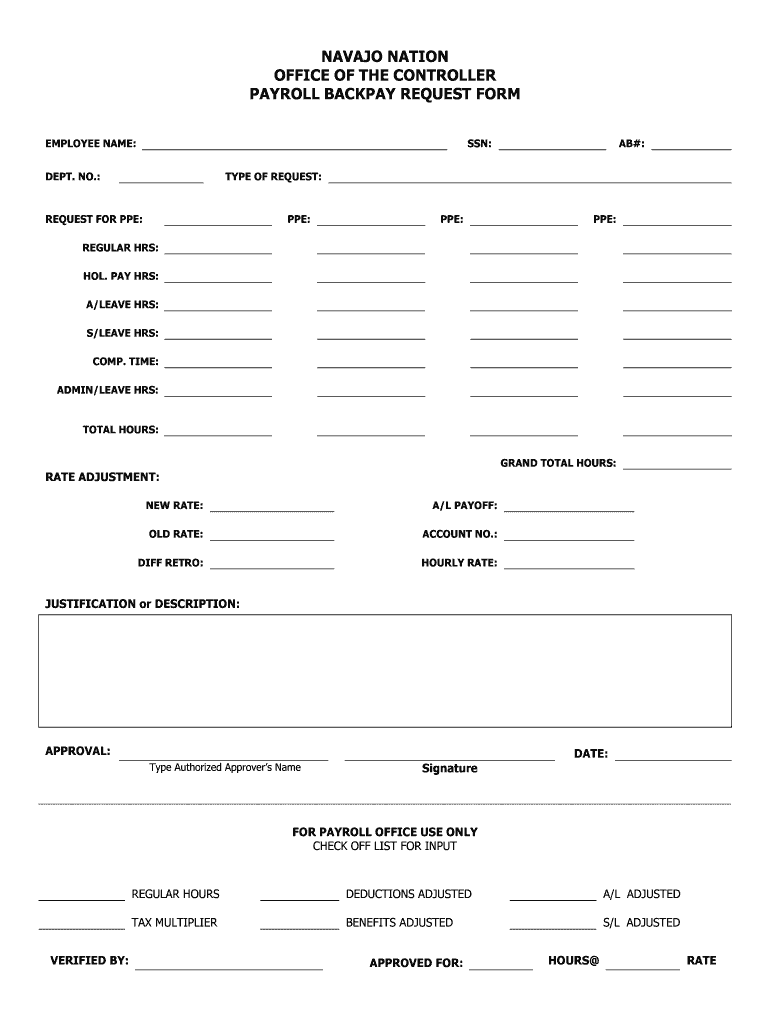

Key Elements of the Payroll Backpay Request Form

Several key elements should be included in the Payroll Backpay Request Form to ensure it is effective:

- Employee Information: Full name, employee ID, and contact details.

- Details of the Pay Period: Specific dates for which back pay is requested.

- Reason for Request: A clear explanation of why back pay is owed.

- Signature: Your signature to validate the request.

Form Submission Methods

The Payroll Backpay Request Form can be submitted through various methods, depending on your employer's policies. Common submission methods include:

- Online Submission: Many employers allow electronic submission via their payroll systems.

- Mail: You can send the completed form through postal mail to the appropriate department.

- In-Person: Handing in the form directly to your HR or payroll department can ensure immediate acknowledgment.

Quick guide on how to complete payroll backpay request form

Effortlessly Prepare PAYROLL BACKPAY REQUEST FORM on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to swiftly create, edit, and eSign your documents without any delays. Manage PAYROLL BACKPAY REQUEST FORM on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The Easiest Way to Edit and eSign PAYROLL BACKPAY REQUEST FORM with Ease

- Locate PAYROLL BACKPAY REQUEST FORM and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize essential sections of the documents or obscure sensitive data with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to apply your changes.

- Select your preferred method for sending your form—by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form searching, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign PAYROLL BACKPAY REQUEST FORM and ensure outstanding communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the payroll backpay request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for tracking back pay requests?

airSlate SignNow provides comprehensive tracking features that help users manage their documents efficiently. When learning how to firmly follow up back pay, these features allow you to monitor the status of your requests and receive notifications, ensuring nothing falls through the cracks.

-

How can I use airSlate SignNow to automate back pay follow-ups?

By utilizing the automation tools in airSlate SignNow, users can set up reminders and follow-up emails related to back pay requests. This enables businesses to learn how to firmly follow up back pay without manual intervention, streamlining their workflow signNowly.

-

Is airSlate SignNow cost-effective for small businesses managing back pay?

Yes, airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes, including small businesses. When considering how to firmly follow up back pay, the cost-effective solution allows you to maintain your budget while efficiently managing your documents.

-

What integrations does airSlate SignNow provide for payroll and HR software?

airSlate SignNow seamlessly integrates with various payroll and HR applications, enhancing its functionality. Learning how to firmly follow up back pay becomes easier when you can consolidate systems and automate processes across platforms.

-

How secure is airSlate SignNow for handling sensitive back pay information?

Security is a top priority for airSlate SignNow, which employs advanced encryption to protect your data. This is crucial when you are figuring out how to firmly follow up back pay, as you want to ensure all sensitive employee information remains confidential.

-

Can I customize documents in airSlate SignNow for back pay agreements?

Absolutely! airSlate SignNow allows users to create and customize documents to fit their specific needs, including back pay agreements. This flexibility can greatly aid in understanding how to firmly follow up back pay while ensuring that all legal requirements are met.

-

What support options are available for airSlate SignNow users?

airSlate SignNow provides various support options, including tutorials and customer service. If you ever need assistance with learning how to firmly follow up back pay, the support team is ready to help you resolve any issues quickly.

Get more for PAYROLL BACKPAY REQUEST FORM

- General notice of default for contract for deed west virginia form

- West virginia disclosure 497431521 form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497431522 form

- West virginia annual form

- Notice of default for past due payments in connection with contract for deed west virginia form

- Final notice of default for past due payments in connection with contract for deed west virginia form

- Assignment of contract for deed by seller west virginia form

- Notice of assignment of contract for deed west virginia form

Find out other PAYROLL BACKPAY REQUEST FORM

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free