Fpi Rental Application Form

What is the FPI Rental Application?

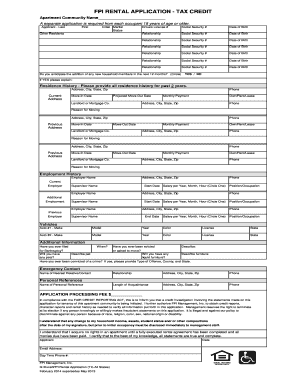

The FPI rental application is a standardized form used by tenants to apply for rental housing managed by FPI Management. This application collects essential information about the applicant, including personal details, employment history, and rental history. It serves as a crucial tool for landlords to assess the suitability of potential tenants. Understanding this application is vital for anyone seeking to rent a property managed by FPI.

Steps to Complete the FPI Rental Application

Completing the FPI rental application involves several key steps:

- Gather necessary documents, such as identification, proof of income, and rental history.

- Fill out personal information, including your name, contact details, and social security number.

- Provide details about your current and previous residences, including addresses and landlord contacts.

- Disclose your employment information, including your employer's name, address, and your position.

- Review the application for accuracy and completeness before submission.

Eligibility Criteria

To qualify for rental housing through the FPI rental application, applicants must meet specific eligibility criteria. These may include:

- Stable income that meets the minimum income requirements set by FPI.

- A positive rental history, with no evictions or significant issues in previous tenancies.

- Good credit history, which may be assessed through a credit check.

- Compliance with any additional requirements specified by the property management.

Legal Use of the FPI Rental Application

The FPI rental application is legally binding once completed and signed by the applicant. It is essential to ensure that all information provided is accurate and truthful, as providing false information can lead to disqualification or legal repercussions. The application must comply with local, state, and federal housing laws, including fair housing regulations.

Form Submission Methods

Applicants can submit the FPI rental application through various methods:

- Online submission via the FPI Management website, which allows for a quick and efficient process.

- Mailing a printed version of the application to the designated FPI office.

- In-person submission at the FPI rental office, providing an opportunity to ask questions directly.

Required Documents

When completing the FPI rental application, several documents are typically required to support the information provided. These may include:

- A valid government-issued ID, such as a driver's license or passport.

- Proof of income, which can include pay stubs, tax returns, or bank statements.

- References from previous landlords or employers.

- Any additional documentation requested by FPI Management during the application process.

Quick guide on how to complete fpi rental application

Effortlessly prepare Fpi Rental Application on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Fpi Rental Application on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to edit and eSign Fpi Rental Application with ease

- Locate Fpi Rental Application and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Select relevant sections of your documents or hide sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device of your choice. Modify and eSign Fpi Rental Application and guarantee excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fpi rental application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a rental application tax credit?

A rental application tax credit is a tax benefit available to eligible renters that helps reduce their tax liabilities. This credit can be claimed on your tax return to offset some of the costs associated with renting a property, making housing more affordable. Understanding how to apply for this credit can be beneficial for tenants looking to maximize their financial situation.

-

How can airSlate SignNow assist with the rental application tax credit process?

airSlate SignNow streamlines the rental application process by allowing landlords and tenants to eSign and manage documents efficiently. By digitizing rental applications, it simplifies the submission of necessary documentation for claiming the rental application tax credit. This saves time for both parties and ensures all relevant forms are correctly filled out and submitted.

-

Is there a cost to use airSlate SignNow for managing rental applications related to the tax credit?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. The cost reflects the convenience and features available for managing rental applications, including the ability to quickly and securely eSign documents. Investing in this solution could ultimately help you navigate the rental application tax credit process more effectively.

-

What features does airSlate SignNow offer for managing rental applications?

airSlate SignNow includes features such as customizable templates, secure eSigning, document tracking, and automated workflows. These tools are particularly useful for landlords and tenants dealing with rental applications. By facilitating the eSigning process for documents related to the rental application tax credit, airSlate SignNow enhances efficiency and reduces paper clutter.

-

Are there integrations available with airSlate SignNow for tax-related applications?

Yes, airSlate SignNow integrates with various platforms and software, simplifying the tax-related application process. These integrations allow users to easily import and export documents required for the rental application tax credit. This seamless connectivity helps ensure that all necessary documentation is managed efficiently.

-

How does airSlate SignNow improve document security for rental applications?

airSlate SignNow prioritizes document security with advanced encryption methods and secure access controls. This is crucial for protecting sensitive information shared in rental applications, especially when claiming the rental application tax credit. By ensuring the integrity and confidentiality of these documents, users can confidently manage their applications.

-

Can multiple users access the rental application documents in airSlate SignNow?

Yes, airSlate SignNow allows multiple users to access and collaborate on rental application documents simultaneously. This feature is beneficial for landlords, property managers, and tenants as they navigate the rental application tax credit process together. Enhanced collaboration leads to quicker resolutions and streamlined approvals.

Get more for Fpi Rental Application

Find out other Fpi Rental Application

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form

- Sign Missouri Business Insurance Quotation Form Mobile

- Sign Tennessee Car Insurance Quotation Form Online

- How Can I Sign Tennessee Car Insurance Quotation Form

- Sign North Dakota Business Insurance Quotation Form Online

- Sign West Virginia Car Insurance Quotation Form Online

- Sign Wisconsin Car Insurance Quotation Form Online

- Sign Alabama Life-Insurance Quote Form Free

- Sign California Apply for Lead Pastor Easy

- Sign Rhode Island Certeficate of Insurance Request Free

- Sign Hawaii Life-Insurance Quote Form Fast

- Sign Indiana Life-Insurance Quote Form Free

- Sign Maryland Church Donation Giving Form Later

- Can I Sign New Jersey Life-Insurance Quote Form