Firpta Certificate Form

What is the Firpta Certificate

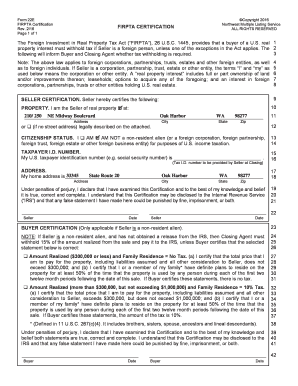

The FIRPTA certificate, or Foreign Investment in Real Property Tax Act certificate, is a crucial document for foreign investors selling U.S. real estate. This certificate serves to ensure that the appropriate tax is withheld on the sale of the property, protecting both the seller and the buyer from potential tax liabilities. The FIRPTA law mandates that buyers withhold a percentage of the sales price to cover any tax obligations that the foreign seller may incur. Understanding the FIRPTA certificate is essential for anyone involved in real estate transactions that include foreign entities.

How to Obtain the Firpta Certificate

To obtain a FIRPTA certificate, foreign sellers must complete IRS Form 8288-B, which requests a withholding certificate. This form requires detailed information about the property, the seller, and the transaction. Once submitted, the IRS reviews the application and determines whether to grant the withholding certificate. If approved, the certificate indicates the amount to be withheld, if any. It is advisable for sellers to seek assistance from tax professionals to navigate the process effectively and ensure compliance with all requirements.

Steps to Complete the Firpta Certificate

Completing the FIRPTA certificate involves several key steps:

- Gather necessary information, including the property details and seller's tax identification number.

- Fill out IRS Form 8288-B accurately, providing all required information about the transaction.

- Submit the form to the IRS, ensuring it is sent to the correct address based on your location.

- Await the IRS response regarding the withholding certificate, which may take several weeks.

- Once received, provide the certificate to the buyer to ensure proper withholding during the transaction.

Legal Use of the Firpta Certificate

The FIRPTA certificate is legally binding and plays a vital role in ensuring compliance with U.S. tax laws for foreign sellers. It protects buyers from potential liabilities by ensuring that the correct amount of tax is withheld from the sale proceeds. Failure to comply with FIRPTA regulations can lead to significant penalties for both buyers and sellers. Therefore, understanding the legal implications and ensuring proper use of the FIRPTA certificate is essential for all parties involved in the transaction.

Required Documents

When applying for a FIRPTA certificate, several documents are necessary to support the application:

- IRS Form 8288-B, fully completed.

- Proof of foreign status, such as a passport or other identification.

- Details of the property being sold, including the address and sales price.

- Any additional documentation requested by the IRS, which may vary based on individual circumstances.

Filing Deadlines / Important Dates

Timely submission of the FIRPTA certificate application is crucial. The IRS typically requires that Form 8288-B be submitted before the closing of the sale. It is important to note that the withholding tax must be paid to the IRS within twenty days of the sale. Being aware of these deadlines helps avoid penalties and ensures a smooth transaction process.

Quick guide on how to complete firpta certificate

Manage Firpta Certificate effortlessly on any device

Digital document management has gained popularity among companies and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents quickly without delays. Handle Firpta Certificate on any device using airSlate SignNow applications for Android or iOS and enhance any document-related process today.

The easiest way to modify and eSign Firpta Certificate effortlessly

- Locate Firpta Certificate and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Select pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misdirected documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Firpta Certificate and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the firpta certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FIRPTA and how does it affect real estate transactions?

FIRPTA, or the Foreign Investment in Real Property Tax Act, is a U.S. law that mandates foreign sellers to pay tax on gains from the sale of U.S. real estate. Understanding FIRPTA is crucial for international buyers and sellers to comply with tax regulations during real estate transactions, ensuring a smoother closing process.

-

How can airSlate SignNow help with FIRPTA documentation?

AirSlate SignNow simplifies the eSigning process for FIRPTA documentation by allowing users to electronically sign necessary forms securely and efficiently. This streamlines the completion of FIRPTA forms, making it easier for both foreign sellers and buyers to comply with legal obligations without the hassle of paper documents.

-

What are the costs associated with using airSlate SignNow for FIRPTA transactions?

AirSlate SignNow offers cost-effective pricing plans that cater to various business needs, including those involved in FIRPTA transactions. By providing affordable solutions, businesses can manage their eSigning requirements while ensuring compliance with FIRPTA regulations without breaking the bank.

-

Are there features in airSlate SignNow specifically tailored for FIRPTA compliance?

Yes, airSlate SignNow includes features that facilitate FIRPTA compliance, such as customizable templates and the ability to store essential documents securely. These tools help businesses ensure that all necessary FIRPTA paperwork is properly handled, streamlining the real estate transaction process.

-

Can airSlate SignNow integrate with other platforms for FIRPTA document management?

AirSlate SignNow seamlessly integrates with various platforms to enhance FIRPTA document management. Whether you're using accounting software or CRM platforms, these integrations ensure that FIRPTA-related documents are managed efficiently within your existing workflows.

-

How does eSigning with airSlate SignNow benefit users dealing with FIRPTA?

eSigning with airSlate SignNow provides users dealing with FIRPTA signNow time and cost savings. It eliminates the need for printing, scanning, and mailing documents, allowing real estate transactions to proceed more swiftly while maintaining compliance with FIRPTA requirements.

-

What support does airSlate SignNow offer for FIRPTA-related questions?

AirSlate SignNow provides dedicated support for users facing FIRPTA-related questions. Whether you need assistance with eSigning processes or specific FIRPTA documentation, our knowledgeable support team is ready to help you navigate these complexities.

Get more for Firpta Certificate

- Legal last will and testament for married person with minor children from prior marriage west virginia form

- Legal last will and testament form for married person with adult children from prior marriage west virginia

- Legal last will and testament form for divorced person not remarried with adult children west virginia

- Legal last will and testament form for divorced person not remarried with no children west virginia

- Legal last will and testament form for divorced person not remarried with minor children west virginia

- Legal last will and testament form for divorced person not remarried with adult and minor children west virginia

- Mutual wills package with last wills and testaments for married couple with adult children west virginia form

- Mutual wills package with last wills and testaments for married couple with no children west virginia form

Find out other Firpta Certificate

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free