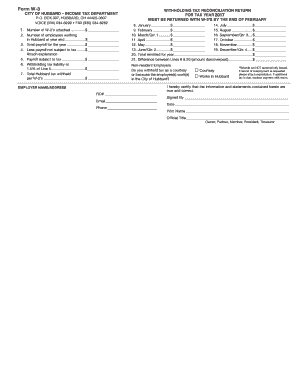

City of Hubbard Income Tax Form

What is the City of Hubbard Income Tax

The City of Hubbard income tax is a municipal tax levied on individuals and businesses operating within Hubbard, Ohio. This tax is typically based on earned income, including wages, salaries, and business profits. The revenue generated from this tax supports local services such as public safety, infrastructure, and community programs. Understanding the specifics of this tax is essential for residents and business owners to ensure compliance and proper financial planning.

Steps to Complete the City of Hubbard Income Tax

Completing the City of Hubbard income tax form involves several key steps:

- Gather necessary documents, including W-2 forms, 1099s, and any other income statements.

- Determine your filing status, which may affect your tax rate.

- Fill out the income tax form accurately, ensuring all income sources are reported.

- Calculate the total tax owed based on the applicable rates for your income level.

- Review the completed form for accuracy before submission.

Required Documents

To file the City of Hubbard income tax, you will need to provide several documents:

- W-2 forms from all employers for the tax year.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation of any deductions or credits you plan to claim.

Form Submission Methods

The City of Hubbard income tax form can be submitted through various methods to accommodate different preferences:

- Online: Many residents opt to file electronically through the city’s tax portal, which offers a streamlined process.

- Mail: Completed forms can be printed and sent via postal service to the Hubbard tax office.

- In-Person: Residents may also choose to submit their forms directly at the Hubbard tax office during business hours.

Penalties for Non-Compliance

Failure to comply with the City of Hubbard income tax regulations can result in significant penalties. These may include:

- Late fees for overdue payments.

- Interest on unpaid taxes, which accrues over time.

- Potential legal action for persistent non-compliance, including liens on property.

Legal Use of the City of Hubbard Income Tax

The City of Hubbard income tax is legally binding and must be filed in accordance with local laws. Compliance with the tax regulations ensures that residents contribute to the funding of essential services. The tax office provides guidelines and resources to help taxpayers understand their obligations and rights under the law.

Quick guide on how to complete city of hubbard income tax

Complete City Of Hubbard Income Tax effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage City Of Hubbard Income Tax on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The easiest way to edit and eSign City Of Hubbard Income Tax without stress

- Locate City Of Hubbard Income Tax and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to share your form, either by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your chosen device. Edit and eSign City Of Hubbard Income Tax and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the city of hubbard income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the city of Hubbard income tax rate?

The city of Hubbard income tax rate is currently set at 2.5%. This means that any taxable income earned by residents within the city of Hubbard is subject to this rate. It is important for residents to stay informed about any changes to the city of Hubbard income tax to ensure compliance.

-

How does airSlate SignNow help in filing the city of Hubbard income tax?

airSlate SignNow provides a convenient platform for streamlining the documentation process involved in filing the city of Hubbard income tax. With its electronic signature capabilities, you can easily sign and send all necessary forms securely and efficiently. This reduces paperwork and saves time during tax season.

-

Are there any discounts available for services related to the city of Hubbard income tax through airSlate SignNow?

Yes, airSlate SignNow often has promotional discounts on its services, which can help reduce costs associated with managing the city of Hubbard income tax. Check our website regularly for updates on special offers that could make document signing and management even more affordable.

-

Can airSlate SignNow integrate with accounting software for calculating city of Hubbard income tax?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to calculate your city of Hubbard income tax correctly. This seamless integration ensures that all financial data is accurately reflected in your tax documents, reducing the risk of errors and streamlining your filing process.

-

What features make airSlate SignNow ideal for managing city of Hubbard income tax documents?

airSlate SignNow comes with features like customizable templates, bulk signing, and secure storage that are perfect for managing city of Hubbard income tax documents. These features facilitate a smooth and organized workflow, allowing you to focus on maximizing your tax benefits rather than getting lost in paperwork.

-

How does using airSlate SignNow benefit small businesses dealing with city of Hubbard income tax?

For small businesses, airSlate SignNow offers a cost-effective solution to manage city of Hubbard income tax efficiently. Its user-friendly interface allows small business owners to quickly sign, send, and store documents, thereby saving time and reducing administrative costs associated with tax compliance.

-

Is airSlate SignNow compliant with city of Hubbard income tax regulations?

Yes, airSlate SignNow complies with all regulations pertaining to the city of Hubbard income tax. The platform is designed to meet the legal requirements for electronic signatures and document management, ensuring you remain compliant while using our services to handle tax-related documents.

Get more for City Of Hubbard Income Tax

- Common interest karaoke form

- 10 2 arithmetic sequences and series answer key form

- Idnr construction in a floodway permit form

- Registration statement for corporation partnership form

- Protected area permit application form

- Single page es cdw spanish doc form

- Begin privacyenhanced message form

- Mo ppa formsend

Find out other City Of Hubbard Income Tax

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast