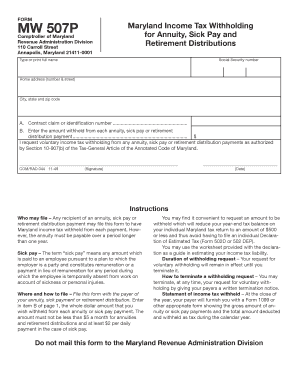

Mw507p Form

What is the Mw507p

The Mw507p form is a tax document used by residents of Maryland to claim a personal exemption on their state income tax returns. This form is particularly relevant for individuals who wish to adjust their state withholding amounts based on their personal financial circumstances. By completing the Mw507p, taxpayers can ensure they are not over-withheld, allowing them to manage their cash flow more effectively throughout the year.

How to use the Mw507p

To utilize the Mw507p form, individuals must first obtain a copy from the Maryland State Comptroller's website or other official sources. After acquiring the form, taxpayers should fill it out with accurate personal information, including their name, address, and Social Security number. Once completed, the form should be submitted to the employer or payroll department to adjust the withholding amounts accordingly. It is essential to keep a copy for personal records and future reference.

Steps to complete the Mw507p

Completing the Mw507p form involves several straightforward steps:

- Download the Mw507p form from the official Maryland State Comptroller's website.

- Fill in your personal details, including your full name, address, and Social Security number.

- Indicate the number of exemptions you are claiming based on your specific situation.

- Review the information for accuracy to prevent any issues with your employer.

- Submit the completed form to your employer’s payroll department.

Legal use of the Mw507p

The Mw507p form is legally binding when filled out correctly and submitted to the appropriate employer or payroll department. It is crucial to ensure that all information provided is accurate, as discrepancies can lead to issues with tax withholding and potential penalties. The form must comply with Maryland state tax laws to be considered valid and enforceable.

Filing Deadlines / Important Dates

Filing deadlines for the Mw507p form typically align with the Maryland state income tax return deadlines. Taxpayers should submit the form to their employer as soon as they determine the need for an adjustment in withholding. It is advisable to complete the Mw507p before the start of the tax year to ensure accurate withholding throughout the year. Keeping track of any changes in personal circumstances that may affect exemptions is also important.

Required Documents

When completing the Mw507p form, individuals may need to gather specific documents to support their claims. Required documents can include:

- Proof of residency in Maryland.

- Social Security card or number for identification.

- Previous year’s tax return, if applicable, to determine the number of exemptions.

Examples of using the Mw507p

Examples of scenarios where the Mw507p form may be used include:

- A single individual who recently moved to Maryland and wants to adjust their withholding based on their new residency.

- A married couple who have had a change in income and wish to claim additional exemptions to reduce their tax withholding.

- A parent who has recently had a child and wants to claim an exemption for their dependent.

Quick guide on how to complete mw507p

Prepare Mw507p seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents promptly without delays. Handle Mw507p on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered operation today.

How to modify and eSign Mw507p effortlessly

- Obtain Mw507p and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device. Modify and eSign Mw507p and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mw507p

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mw507p and how does it relate to airSlate SignNow?

The mw507p is a specific document type that can be efficiently managed through airSlate SignNow. Our platform provides a seamless way to send, sign, and store mw507p forms digitally, enhancing your workflow and accuracy.

-

What are the key features of airSlate SignNow for mw507p users?

airSlate SignNow offers various features tailored for mw507p users, including document templates, signature tracking, and customizable workflows. These tools help simplify the management of mw507p documents and ensure compliance with legal requirements.

-

Is airSlate SignNow a cost-effective solution for handling mw507p documents?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing mw507p documents. With affordable pricing plans, businesses can save money while ensuring they have the necessary tools to handle electronic signatures and document management.

-

Can I integrate airSlate SignNow with other applications for mw507p processing?

Absolutely! airSlate SignNow offers robust integration options with various applications that can streamline the handling of mw507p documents. This allows businesses to easily sync their workflows, enhancing productivity and efficiency.

-

How secure is the airSlate SignNow platform for mw507p documents?

The airSlate SignNow platform prioritizes security, employing advanced encryption and compliance measures to protect mw507p documents. Users can trust that their sensitive information remains secure during the signing process.

-

What benefits does airSlate SignNow provide for businesses using mw507p?

By utilizing airSlate SignNow for mw507p documents, businesses can streamline their operations, reduce processing time, and minimize paperwork. The platform enhances collaboration while ensuring that all signatures are legally valid.

-

Is it easy to set up airSlate SignNow for my mw507p needs?

Yes, setting up airSlate SignNow for your mw507p needs is a straightforward process. Our user-friendly interface and guided setup help ensure you can start sending and signing mw507p documents quickly.

Get more for Mw507p

- Globe life insurance application pdf form

- Form 9 application for an estimate of service retirement

- Arkansas department of human services verification of earnings form

- Release authorization pueblo community health center form

- Mover box form

- Phlebotomy is the practice of drawing blood from patients and taking the blood specimens to the laboratory to prepare form

- Ama university form

- Pdf medvantx pharmacy services po box 5736 sioux falls sd form

Find out other Mw507p

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer