Cr Form

What is the Cr Form

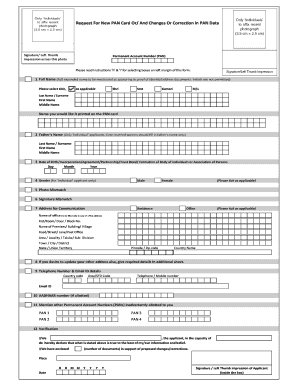

The Cr Form is a crucial document used in various administrative and legal processes. It serves as a formal request or declaration, often required for tax purposes or to provide specific information to governmental agencies. Understanding the purpose and requirements of the Cr Form is essential for ensuring compliance and avoiding potential penalties.

How to use the Cr Form

Using the Cr Form involves several steps that ensure accurate completion and submission. First, gather all necessary information and documents needed to fill out the form correctly. Next, carefully follow the instructions provided with the form, ensuring that all fields are completed accurately. Once filled, the form can be submitted online, by mail, or in person, depending on the specific requirements outlined by the issuing authority.

Steps to complete the Cr Form

Completing the Cr Form requires attention to detail. Begin by downloading the latest version of the form from an official source. Fill in your personal information, ensuring accuracy in names and identification numbers. Next, provide any additional details required, such as financial information or specific declarations. Review the completed form for any errors before submission. Finally, submit the form according to the guidelines, ensuring you retain a copy for your records.

Legal use of the Cr Form

The legal validity of the Cr Form hinges on proper completion and adherence to relevant regulations. It is essential to ensure that all information provided is truthful and accurate. Additionally, the form must be signed and dated appropriately, as required by law. Compliance with federal and state regulations regarding the use of the Cr Form is crucial to avoid legal complications.

Required Documents

When completing the Cr Form, specific documents may be required to support the information provided. Commonly required documents include identification proof, financial statements, or previous tax returns. It is advisable to check the specific requirements for the Cr Form to ensure that all necessary documentation is included with your submission.

Form Submission Methods

The Cr Form can typically be submitted through various methods, including online platforms, mail, or in-person at designated offices. Online submission is often the fastest and most efficient method, allowing for immediate processing. If submitting by mail, ensure that you use the correct address and consider tracking your submission for confirmation. In-person submissions may be necessary for certain circumstances, allowing for immediate clarification of any questions.

Who Issues the Form

The Cr Form is typically issued by governmental agencies or specific organizations that require the information contained within the form. This may include state tax authorities, federal agencies, or other regulatory bodies. Understanding the issuing authority is essential for ensuring that the form is completed correctly and submitted to the appropriate entity.

Quick guide on how to complete cr form

Prepare Cr Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Cr Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to alter and eSign Cr Form effortlessly

- Find Cr Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information with specific tools that airSlate SignNow provides for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to secure your changes.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that lead to printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Cr Form and ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cr form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CR form and how does it work with airSlate SignNow?

A CR form is a customizable document template that allows you to collect electronic signatures seamlessly. With airSlate SignNow, you can easily create, send, and manage your CR forms, ensuring that your documents are securely signed and stored.

-

Can I integrate CR forms with other applications?

Yes, airSlate SignNow offers robust integration options for CR forms with popular business applications such as Salesforce, Google Workspace, and more. This allows you to streamline your workflow and maintain a high level of efficiency.

-

What are the pricing options for using CR forms on airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan provides different features and capabilities for CR forms, ensuring you can find a solution that fits your budgetary needs.

-

What features are included with CR forms in airSlate SignNow?

CR forms in airSlate SignNow come with features such as customizable templates, automated workflows, and real-time tracking of document status. These features enhance the overall signing experience and improve efficiency in document management.

-

How can CR forms benefit my business?

Utilizing CR forms can signNowly streamline your document signing process, reducing turnaround times and improving compliance. By adopting airSlate SignNow for CR forms, you can enhance productivity and experience a more organized workflow.

-

Is it easy to create a CR form using airSlate SignNow?

Absolutely! airSlate SignNow offers a user-friendly interface that makes it easy to create CR forms from scratch or modify existing templates. The intuitive design ensures that users, regardless of their technical expertise, can quickly produce professional-looking documents.

-

Are CR forms secure on airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. CR forms utilize advanced encryption, secure sign-in options, and compliance with industry standards to ensure that your sensitive information is protected throughout the signing process.

Get more for Cr Form

- Note registrations for all assemblies except those located in health care facilities along with all test reports can be done form

- License application form nvcontractorsboardcom

- Dc 100b demand for possession damagehealth hazard to property landlord tenant form

- First name middle name last name of veteran veterans affairs form

- Connecticuts juvenile justice system university of new haven form

- Fw 001 gc request to waive court fees ward or form

- In the superior court for the state of alaska at form

- Domestic violence victim notice form

Find out other Cr Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document