Ny State Tax Return Form

What is the NY State Tax Return Form

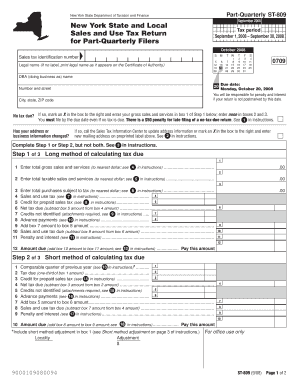

The NY State Tax Return Form is an essential document that residents of New York must complete to report their income and calculate their state tax obligations. This form is used by individuals and businesses to declare earnings, claim deductions, and determine the amount of tax owed or the refund due. The form varies depending on the taxpayer's status, such as whether they are single, married, or head of household, and it includes specific sections tailored to different income types and deductions.

How to Obtain the NY State Tax Return Form

To obtain the NY State Tax Return Form, taxpayers can visit the New York State Department of Taxation and Finance website, where the forms are available for download in PDF format. Additionally, physical copies can often be found at public libraries, post offices, and local tax offices. It is important to ensure that you are using the correct version of the form for the tax year you are filing.

Steps to Complete the NY State Tax Return Form

Completing the NY State Tax Return Form involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring accuracy to avoid discrepancies.

- Claim any eligible deductions and credits, which can significantly reduce your tax liability.

- Calculate your total tax owed or refund due, following the instructions provided on the form.

- Review the completed form for accuracy before submission.

Legal Use of the NY State Tax Return Form

The NY State Tax Return Form must be filled out accurately and submitted by the designated deadlines to comply with state tax laws. The information provided on this form is legally binding, and any false statements or omissions can lead to penalties, including fines or audits. It is crucial to ensure that all information is truthful and complete to avoid legal repercussions.

Filing Deadlines / Important Dates

Taxpayers should be aware of important filing deadlines for the NY State Tax Return Form. Generally, the deadline for submitting the form is April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check the New York State Department of Taxation and Finance website for any updates or changes to these dates.

Form Submission Methods

The NY State Tax Return Form can be submitted in several ways:

- Online: Taxpayers can file electronically using approved e-filing software, which often streamlines the process and ensures accuracy.

- By Mail: Completed forms can be printed and mailed to the appropriate address as specified in the form instructions.

- In-Person: Some taxpayers may choose to submit their forms in person at local tax offices, especially if they require assistance.

Penalties for Non-Compliance

Failure to file the NY State Tax Return Form on time can result in significant penalties. The state may impose late filing fees, interest on unpaid taxes, and potential legal action for continued non-compliance. It is essential to file the form by the deadline and to pay any taxes owed to avoid these consequences.

Quick guide on how to complete ny state tax return form

Complete Ny State Tax Return Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can access the necessary form and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Ny State Tax Return Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and eSign Ny State Tax Return Form with ease

- Find Ny State Tax Return Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you prefer to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign Ny State Tax Return Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ny state tax return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are NY state tax forms and how can they be accessed?

NY state tax forms are official documents required for filing taxes in New York. You can access these forms online through the New York State Department of Taxation and Finance website, or by using platforms like airSlate SignNow to efficiently manage and eSign your necessary documents.

-

Can airSlate SignNow help with NY state tax forms preparation?

Yes, airSlate SignNow offers features that simplify the preparation of NY state tax forms. By providing templates and easy document management, it allows users to fill out and eSign forms seamlessly, ensuring compliance and accuracy in tax filing.

-

Is there a cost associated with using airSlate SignNow for NY state tax forms?

airSlate SignNow offers various pricing plans suitable for individuals and businesses. While basic features for managing NY state tax forms may be available for free, more advanced options and integrations might require a subscription.

-

What features does airSlate SignNow provide for handling NY state tax forms?

airSlate SignNow provides a range of features such as customizable templates, secure electronic signatures, and document tracking specifically designed for NY state tax forms. These tools help streamline the tax preparation process, ensuring that users can manage their forms efficiently.

-

Are electronic signatures on NY state tax forms legally binding?

Yes, electronic signatures on NY state tax forms are legally binding in New York, provided they adhere to the state's electronic signature laws. Using airSlate SignNow guarantees that your eSignatures are compliant and secure, making the submission process hassle-free.

-

How does airSlate SignNow integrate with tax software for NY state tax forms?

airSlate SignNow offers integrations with various tax preparation software that can facilitate the management of NY state tax forms. This means you can import, fill out, and eSign your forms directly within your preferred tax software, enhancing workflow efficiency.

-

What are the benefits of using airSlate SignNow for NY state tax forms?

Using airSlate SignNow for NY state tax forms provides numerous benefits, including a streamlined document workflow, improved collaboration, and secure handling of sensitive tax information. These advantages ensure that your tax filing process is smoother and more efficient.

Get more for Ny State Tax Return Form

- Assignment interest estate 497330565 form

- Assignment interest estate 497330566 form

- Metal detecting agreement form

- Assignment order form

- Secrecy confidentiality form

- Confidentiality agreement form pdf

- Secrecy nondisclosure and confidentiality agreement by employee or consultant to owner form

- Money estate form

Find out other Ny State Tax Return Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document