Micr Specification Sheet Form

What is the Micr Specification Sheet

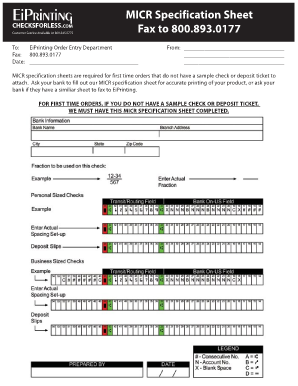

The MICR specification sheet is a crucial document that outlines the specific requirements for Magnetic Ink Character Recognition (MICR) printing. This sheet details the placement, format, and content of MICR characters, which are essential for the processing of checks and other financial documents. The primary purpose of the MICR specification sheet is to ensure that checks can be read accurately by automated systems used by banks and financial institutions. Understanding what a bank specification sheet entails is vital for businesses that handle checks, as it helps maintain compliance with banking standards.

How to Use the Micr Specification Sheet

Using the MICR specification sheet involves following the guidelines provided to ensure that checks are printed correctly. Start by reviewing the layout specified in the sheet, which includes the positioning of the MICR line at the bottom of the check. This line typically contains the bank routing number, account number, and check number, all printed in a specific font using magnetic ink. It is essential to adhere to the dimensions and spacing outlined in the specification sheet to avoid processing errors. Businesses should also ensure that their printing equipment is compatible with MICR ink to produce legible and compliant checks.

Steps to Complete the Micr Specification Sheet

Completing the MICR specification sheet requires careful attention to detail. Follow these steps:

- Gather the necessary information, including the bank's routing number, account number, and check number.

- Refer to the MICR specification sheet for the correct format and placement of each element.

- Use compatible software or templates that allow for the proper formatting of MICR characters.

- Print a test check to verify that all information is correctly positioned and readable by MICR readers.

- Make any necessary adjustments based on the test print before finalizing the checks.

Legal Use of the Micr Specification Sheet

The legal use of the MICR specification sheet is governed by banking regulations that ensure checks are processed efficiently and securely. Compliance with these regulations is critical for businesses to avoid penalties and ensure that their checks are accepted by financial institutions. The MICR specification sheet must be followed precisely to maintain the legal validity of checks. Additionally, businesses should stay informed about any updates to banking regulations that may affect MICR requirements.

Key Elements of the Micr Specification Sheet

Key elements of the MICR specification sheet include:

- Routing Number: A nine-digit number that identifies the bank.

- Account Number: The number associated with the account from which funds will be drawn.

- Check Number: A unique identifier for each check issued.

- Font Specifications: Details on the required font and size for MICR characters.

- Placement Guidelines: Instructions on where each element should be positioned on the check.

How to Obtain the Micr Specification Sheet

Obtaining the MICR specification sheet typically involves contacting your bank or financial institution. Most banks provide this information to their business clients to ensure compliance with their check processing requirements. Additionally, many banks have downloadable resources available on their websites. It is advisable to request the most current version of the specification sheet to ensure that all guidelines are up to date.

Quick guide on how to complete micr specification sheet

Prepare Micr Specification Sheet seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly without delays. Manage Micr Specification Sheet on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Micr Specification Sheet effortlessly

- Find Micr Specification Sheet and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Micr Specification Sheet and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the micr specification sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a bank specification sheet?

A bank specification sheet is a document detailing specific requirements and standards related to banking operations. It helps ensure that businesses provide the necessary information in a structured format that banks can easily understand. Utilizing a bank specification sheet can streamline communication and reduce errors in transaction processing.

-

How does airSlate SignNow facilitate the creation of a bank specification sheet?

airSlate SignNow allows users to create customizable templates for a bank specification sheet, making it easy to tailor documents according to specific bank requirements. With a user-friendly interface, you can quickly add necessary fields and signatures, ensuring your sheet meets all relevant guidelines. This efficiency saves time and enhances accuracy in documentation.

-

What are the benefits of using airSlate SignNow for my bank specification sheet?

Using airSlate SignNow for your bank specification sheet offers numerous benefits, including ease of use, cost-effectiveness, and quick electronic signing capabilities. The platform ensures that your documents are secure and legally binding, giving you peace of mind while handling sensitive banking information. Additionally, it speeds up the approval process when collaborating with banks and stakeholders.

-

Can I integrate airSlate SignNow with other applications for managing bank specification sheets?

Yes, airSlate SignNow seamlessly integrates with various applications, enhancing how you manage your bank specification sheet. You can connect with platforms like Google Drive, Zapier, and CRM systems to streamline workflows. This integration capability means you can automate document handling and improve efficiency in your banking operations.

-

What security features does airSlate SignNow offer for my bank specification sheet?

airSlate SignNow prioritizes the security of your documents, including bank specification sheets. The platform offers bank-level encryption, multi-factor authentication, and secure cloud storage to protect sensitive information from unauthorized access. These features ensure that your documents are safe throughout the signing and storage process.

-

Is airSlate SignNow suitable for small businesses needing a bank specification sheet?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly, making it ideal for small businesses needing a bank specification sheet. The platform's flexible pricing plans cater to various business sizes, enabling even startups to access powerful document management tools. This accessibility allows small businesses to efficiently handle their banking needs.

-

How can I ensure compliance when using a bank specification sheet with airSlate SignNow?

To ensure compliance when using a bank specification sheet with airSlate SignNow, it’s essential to stay informed about local and federal regulations pertaining to banking documentation. The platform offers compliant templates that meet industry standards, helping you create documents that adhere to legal requirements. Additionally, always review and update your bank specification sheet as regulations change.

Get more for Micr Specification Sheet

- Quest lab supply order form

- Holland america shareholder benefit request form 2022

- Veterinary certificate for domestic amp international airline travel form

- 7x7 grid form

- Tax declaration sample 2022 form

- Village care max prior authorization form

- Village of east hills offices 209 harbor hill rd roslyn ny form

- Fold and seal or use an envelopeinstructionswashi form

Find out other Micr Specification Sheet

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now