Tax Declaration Sample Form

Understanding the Tax Declaration Sample

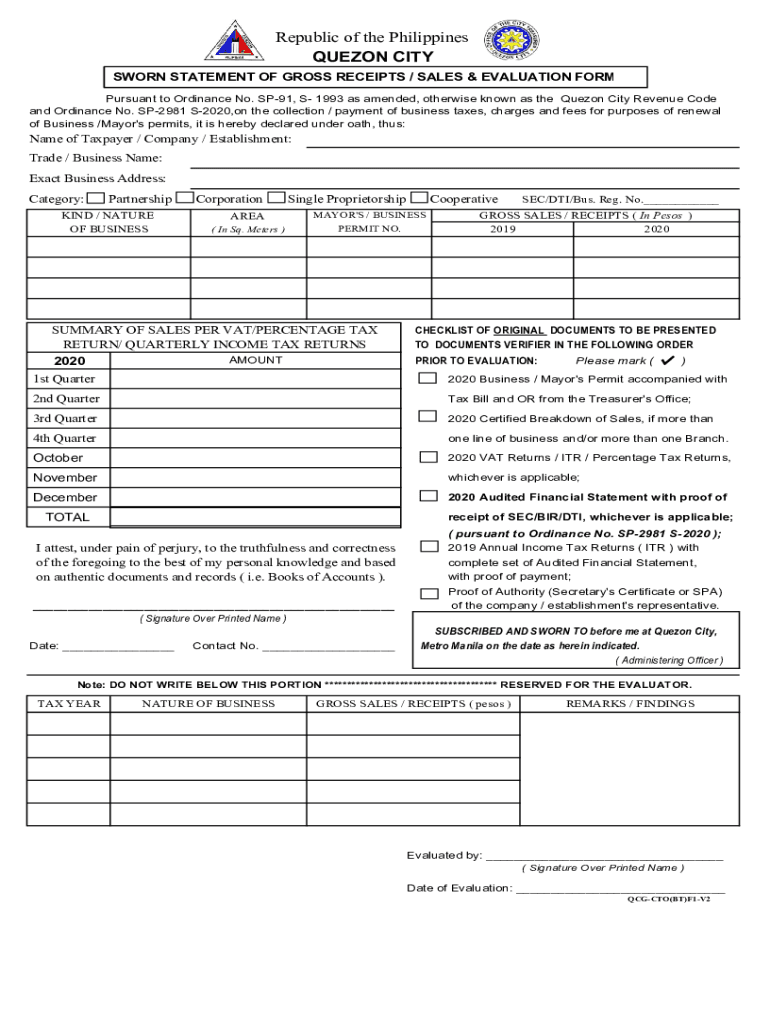

The Tax Declaration Sample serves as a formal document that outlines an individual's or business's gross receipts for a specific period. This declaration is essential for tax purposes, as it provides the necessary information to determine tax liabilities. The sworn statement of gross receipts Quezon City is a specific version of this form, tailored to meet local regulations. It includes details such as total sales, revenue sources, and any applicable deductions. Understanding this sample is crucial for ensuring compliance with local tax laws and regulations.

Steps to Complete the Tax Declaration Sample

Completing the Tax Declaration Sample involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including sales records and receipts. Next, fill out the form by entering your gross receipts accurately, ensuring that all figures are supported by documentation. It's important to double-check all entries for errors before submission. Finally, sign and date the form to validate it. Using a digital solution can streamline this process, allowing for easy corrections and secure submission.

Legal Use of the Tax Declaration Sample

The Tax Declaration Sample is legally binding when completed correctly. It serves as a declaration of income and is often required by local tax authorities. To ensure its legal standing, it must be signed by the individual or authorized representative. Digital signatures can also be used, provided they comply with relevant eSignature laws. This form is crucial for maintaining transparency and accountability in financial reporting, and it can be used in legal proceedings if necessary.

Required Documents for the Tax Declaration Sample

To complete the Tax Declaration Sample, several documents are typically required. These include:

- Sales records and receipts for the reporting period

- Bank statements to verify income

- Invoices issued to clients or customers

- Any previous tax returns that may provide context for current filings

Having these documents ready will facilitate a smoother completion process and ensure that all reported figures are accurate and substantiated.

Filing Deadlines for the Tax Declaration Sample

Filing deadlines for the Tax Declaration Sample vary by jurisdiction but are typically set by local tax authorities. It is essential to be aware of these deadlines to avoid penalties. Generally, businesses must file their declarations annually, with specific due dates often falling at the end of the fiscal year. Keeping track of these dates can help ensure timely submissions and compliance with tax regulations.

Examples of Using the Tax Declaration Sample

The Tax Declaration Sample can be utilized in various scenarios, including:

- Self-employed individuals reporting their annual income

- Small businesses declaring their gross receipts for tax purposes

- Non-profit organizations providing transparency in financial reporting

These examples highlight the versatility of the form and its importance across different sectors, reinforcing the need for accurate and timely submissions.

Quick guide on how to complete tax declaration sample 2022

Manage Tax Declaration Sample effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Handle Tax Declaration Sample on any device using the airSlate SignNow Android or iOS applications and streamline any document-focused task today.

How to modify and eSign Tax Declaration Sample with ease

- Locate Tax Declaration Sample and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes only a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Tax Declaration Sample and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax declaration sample 2022

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Quezon City sworn statement of gross receipts?

A Quezon City sworn statement of gross receipts is a legal document that outlines the total revenue generated by a business over a specific period. This statement is often required for tax purposes and helps ensure transparency in financial reporting. Using airSlate SignNow, you can easily create and eSign your sworn statement of gross receipts.

-

How does airSlate SignNow help with the Quezon City sworn statement of gross receipts?

airSlate SignNow provides a streamlined platform for businesses to create, sign, and manage their Quezon City sworn statement of gross receipts efficiently. Our user-friendly interface allows you to customize your document as needed and ensures that all signatures are legally binding. This simplifies the filing process signNowly.

-

What are the costs associated with using airSlate SignNow for my Quezon City sworn statement of gross receipts?

airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the features you choose, you can enjoy cost-effective solutions for signing documents, including the creation of your Quezon City sworn statement of gross receipts. Check our website for detailed pricing options to find the best plan for you.

-

Is airSlate SignNow legally compliant for Quezon City sworn statements?

Yes, airSlate SignNow is designed to comply with legal standards for electronic signatures, making it a reliable choice for your Quezon City sworn statement of gross receipts. Our platform ensures that all eSigned documents adhere to applicable laws, providing peace of mind for businesses in compliance with regulations.

-

Can I integrate airSlate SignNow with other software for my Quezon City sworn statement of gross receipts?

Absolutely! airSlate SignNow offers integrations with various popular software applications, making it easy to manage your Quezon City sworn statement of gross receipts alongside your existing workflows. Integrate with tools like Google Drive, Dropbox, and CRM systems to enhance efficiency in document management.

-

What features does airSlate SignNow offer for creating a Quezon City sworn statement of gross receipts?

airSlate SignNow includes features like document templates, customizable fields, and real-time tracking for your Quezon City sworn statement of gross receipts. These tools make it simple to fill out required information and send it for signatures quickly. Additionally, you can store and access your completed documents securely in the cloud.

-

How can I track the status of my Quezon City sworn statement of gross receipts with airSlate SignNow?

With airSlate SignNow, you can easily track the status of your Quezon City sworn statement of gross receipts through our intuitive dashboard. You will receive notifications when documents are opened, signed, or completed, allowing you to stay informed throughout the signing process. This feature enhances communication and efficiency.

Get more for Tax Declaration Sample

Find out other Tax Declaration Sample

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF