Application for Refund of Franking Credits for Individuals Form

Understanding the Application for Refund of Franking Credits for Individuals

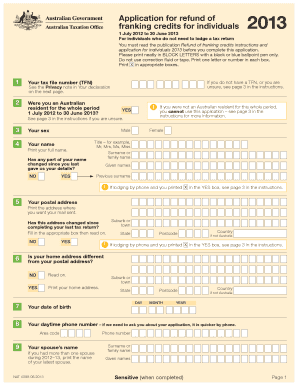

The application for refund of franking credits for individuals is a crucial document for taxpayers who have received franking credits from dividends. Franking credits are a tax credit that shareholders receive when they receive dividends that have already been taxed at the corporate level. This form allows individuals to claim a refund for any excess franking credits that exceed their tax liability. Understanding the purpose and significance of this application is essential for maximizing potential refunds.

Steps to Complete the Application for Refund of Franking Credits for Individuals

Completing the application for refund of franking credits involves several important steps. First, gather all necessary documentation, including your tax return and any statements showing franking credits received. Next, accurately fill out the application form, ensuring that all personal information and financial details are correct. After completing the form, review it for any errors before submitting. Finally, choose your preferred submission method, whether online or by mail, and keep a copy for your records.

Eligibility Criteria for the Application for Refund of Franking Credits for Individuals

To be eligible for a refund of franking credits, individuals must meet specific criteria. You must be an Australian resident for tax purposes and have received dividends that include franking credits. Additionally, your total taxable income must be below a certain threshold to qualify for a full refund. It is important to review the eligibility requirements carefully to ensure that you can successfully claim your refund.

Required Documents for the Application for Refund of Franking Credits for Individuals

When preparing to submit the application for refund of franking credits, several documents are required. These typically include:

- Your completed application form.

- Tax return for the relevant financial year.

- Dividend statements showing the franking credits received.

- Any additional documentation that supports your claim, such as bank statements.

Having these documents ready will streamline the application process and help ensure a successful claim.

Form Submission Methods for the Application for Refund of Franking Credits for Individuals

The application for refund of franking credits can be submitted through various methods. Individuals may choose to file online through designated portals or submit a paper form via mail. Each method has its advantages, such as faster processing times for online submissions. It is important to select the method that best suits your needs and ensure that all necessary documents are included with your submission.

Legal Use of the Application for Refund of Franking Credits for Individuals

The application for refund of franking credits is legally binding when completed correctly. To ensure compliance with relevant laws, it is essential to provide accurate information and adhere to submission guidelines. The application must be signed and dated, and any false information can lead to penalties. Understanding the legal implications of this form is vital for protecting your rights as a taxpayer.

Quick guide on how to complete application for refund of franking credits for individuals

Prepare Application For Refund Of Franking Credits For Individuals effortlessly on any device

Web-based document management has become popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can access the correct version and safely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents rapidly without delays. Manage Application For Refund Of Franking Credits For Individuals on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign Application For Refund Of Franking Credits For Individuals with ease

- Obtain Application For Refund Of Franking Credits For Individuals and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or inaccuracies that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Modify and eSign Application For Refund Of Franking Credits For Individuals and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for refund of franking credits for individuals

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a franking credit form?

A franking credit form is a document that allows shareholders to claim tax credits on dividends received from shares. It provides essential information necessary for the tax return process, making it easier for investors to manage their tax obligations efficiently.

-

How can I create a franking credit form using airSlate SignNow?

Creating a franking credit form with airSlate SignNow is quick and straightforward. Simply upload your document, customize it with the necessary fields, and then use our eSignature feature to securely send it for signing, ensuring a seamless experience from start to finish.

-

Are there any costs associated with the franking credit form on airSlate SignNow?

airSlate SignNow offers a cost-effective solution for managing your franking credit forms. We provide various pricing plans that cater to different business sizes and needs, ensuring you get the best value for your document signing and management requirements.

-

What features does airSlate SignNow offer for managing franking credit forms?

airSlate SignNow includes a range of powerful features for managing franking credit forms, such as customizable templates, secure eSignatures, and real-time tracking. These tools ensure you can efficiently manage your documents while maintaining compliance and security.

-

Can I integrate airSlate SignNow with other applications for managing franking credit forms?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to enhance your workflow when managing franking credit forms. You can connect it with CRM systems, cloud storage solutions, and more, ensuring your documents are always accessible and organized.

-

What are the benefits of using airSlate SignNow for franking credit forms?

Using airSlate SignNow for your franking credit forms offers signNow benefits, including improved efficiency, reduced paperwork, and enhanced security for your sensitive documents. Our platform is designed to simplify the signing process and help you stay organized.

-

Is airSlate SignNow compliant with legal regulations for franking credit forms?

Yes, airSlate SignNow complies with industry standards and legal regulations for electronic signatures, making it a reliable choice for your franking credit forms. We prioritize security and compliance to ensure that your documents are legally binding and protected.

Get more for Application For Refund Of Franking Credits For Individuals

- Uplb sticker pre registration google form

- Fill in the blank resume worksheet pdf form

- Reliance motor claim form

- Skin tag removal consent form

- Vampire the masquerade 20th anniversary edition character sheet fillable form

- One and same certificate format

- Cigna synagis prior authorization form

- Form ca request for transcript fill online

Find out other Application For Refund Of Franking Credits For Individuals

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement