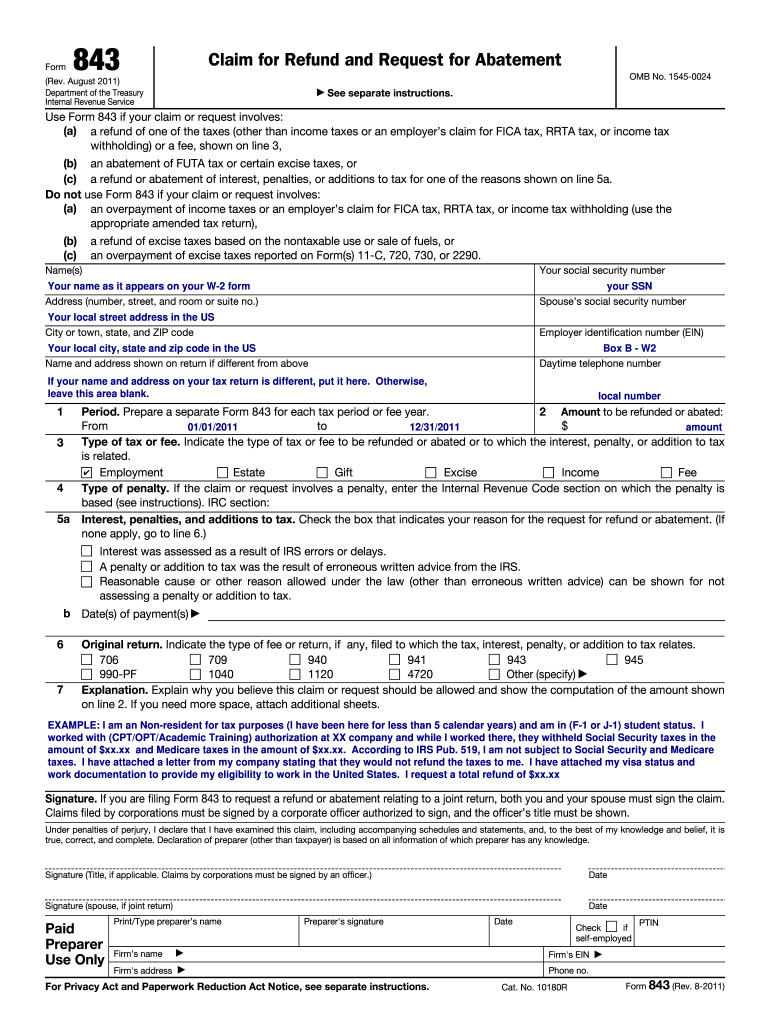

Form 843 Example

What is the Form 843?

The Form 843, officially known as the Request for Abatement, is a document used by taxpayers in the United States to request the abatement of certain penalties and interest imposed by the Internal Revenue Service (IRS). This form is particularly relevant for individuals and businesses seeking relief from penalties due to reasonable cause, such as circumstances beyond their control. It is essential for taxpayers to understand the specific situations in which this form can be utilized to ensure compliance with IRS regulations.

Steps to Complete the Form 843

Filling out the Form 843 requires careful attention to detail to ensure that all necessary information is provided. Here are the general steps to complete the form:

- Obtain the form: Download the IRS Form 843 from the official IRS website or obtain a printable version.

- Provide taxpayer information: Fill in your name, address, and taxpayer identification number (TIN) accurately.

- Specify the type of request: Indicate whether you are requesting an abatement of penalties or interest, and provide the relevant details.

- Explain the reason: Clearly state the reason for your request, providing any supporting documentation that may strengthen your case.

- Sign and date the form: Ensure that you sign and date the form before submission, as an unsigned form may be rejected.

Legal Use of the Form 843

The legal use of the Form 843 is governed by IRS regulations. Taxpayers must submit this form to request the abatement of penalties or interest that they believe were assessed incorrectly or unfairly. To ensure that the request is legally valid, it is crucial to provide a well-documented explanation of the circumstances leading to the penalty or interest. Additionally, taxpayers should be aware of the time limits for filing this form, as late submissions may not be considered.

IRS Guidelines for Form 843

The IRS provides specific guidelines for the completion and submission of Form 843. Taxpayers should refer to the IRS instructions accompanying the form for detailed information on eligibility criteria, required documentation, and filing procedures. Understanding these guidelines is essential for ensuring that the request is processed efficiently. The IRS may also require additional information or documentation to support the request, so being prepared with all necessary materials is advisable.

Form Submission Methods

Taxpayers have several options for submitting Form 843 to the IRS. The form can be sent via mail to the appropriate IRS address based on the taxpayer's location and the type of request being made. Additionally, some taxpayers may have the option to submit the form electronically through the IRS e-file system, depending on their specific circumstances. It is important to verify the submission method that applies to your situation to avoid delays in processing.

Eligibility Criteria for Form 843

To be eligible to use Form 843, taxpayers must meet specific criteria set forth by the IRS. Generally, the request for abatement must be based on reasonable cause, such as illness, natural disasters, or other unforeseen circumstances that hindered compliance with tax obligations. Taxpayers should ensure that they have sufficient documentation to support their claims, as the IRS may require evidence to substantiate the request. Understanding these eligibility criteria is crucial for a successful submission.

Quick guide on how to complete form 843 example

Complete Form 843 Example effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Form 843 Example on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric processes today.

How to modify and electronically sign Form 843 Example effortlessly

- Find Form 843 Example and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Verify all the details and click the Done button to save your changes.

- Select your preferred delivery method for the form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Form 843 Example and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 843 example

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 843 and how can airSlate SignNow help?

Form 843 is an IRS form used to claim a refund or request an abatement of certain taxes. airSlate SignNow simplifies the process by allowing you to eSign and send the form securely, ensuring your requests are submitted accurately and on time.

-

Is there a cost associated with using airSlate SignNow for form 843?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit the needs of various businesses. The cost includes all features necessary for handling documents like form 843 efficiently while ensuring a user-friendly experience.

-

What are the main features of airSlate SignNow for managing form 843?

airSlate SignNow offers seamless templates for form 843, customizable fields, and advanced eSignature capabilities. These features make it easy for users to fill out, sign, and send their forms quickly while maintaining compliance with IRS requirements.

-

Can I store my completed form 843 securely using airSlate SignNow?

Absolutely! airSlate SignNow provides secure cloud storage for all your documents, including completed form 843. This ensures that your sensitive information is safe and accessible whenever you need it.

-

Are there any integrations available with airSlate SignNow for form 843 processing?

Yes, airSlate SignNow integrates with various CRM and productivity tools to enhance your workflow. These integrations allow you to manage form 843 alongside other business processes seamlessly, improving efficiency.

-

How can I track the status of my form 843 if I use airSlate SignNow?

With airSlate SignNow, you can easily track the status of your form 843 through real-time notifications. You'll receive updates when the document is viewed, signed, or completed, ensuring you're always informed about its progress.

-

Is airSlate SignNow user-friendly for someone filling out form 843 for the first time?

Yes! airSlate SignNow is designed with user experience in mind, providing intuitive interfaces and helpful guides. Even if you're filling out form 843 for the first time, you'll find the process straightforward and easy to navigate.

Get more for Form 843 Example

- Fillable form with no auto calculations

- Per berkeley municipal code 9 form

- California hotel tax exempt form pdf

- Ca brand registration form

- Rental of real property fillable form with no auto calculations

- Instructions for completing the certificate of cagov form

- Dfpi 25061 statement of citizenship alienage and immigration status form

- Certificate of conversion form conv 1a

Find out other Form 843 Example

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement