Certificate of Exemption Streamlined Sales and Use FormuPack

Understanding the streamlined tax exempt form

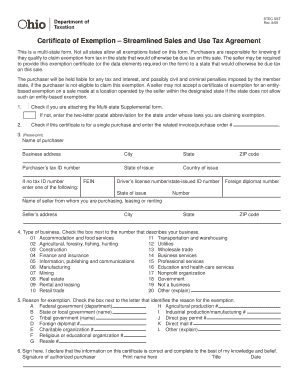

The streamlined tax exempt form is a crucial document for businesses seeking to make tax-exempt purchases. This form allows eligible entities to purchase goods and services without incurring sales tax, provided they meet specific criteria. Typically, this form is utilized by organizations such as non-profits, government agencies, and certain educational institutions. By completing the streamlined sales tax exemption certificate, businesses can ensure compliance with state tax regulations while benefiting from potential cost savings on purchases.

Steps to complete the streamlined tax exempt form

Completing the streamlined tax exempt form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the purchaser's name, address, and tax identification number. Next, specify the type of exemption being claimed, such as non-profit status or government agency. After filling in the required fields, review the form for any errors or omissions. Finally, ensure that the form is signed by an authorized representative of the purchasing entity to validate the exemption claim.

Legal use of the streamlined tax exempt form

The legal use of the streamlined tax exempt form is governed by state tax laws, which dictate the conditions under which the form can be utilized. To be legally binding, the form must be completed accurately and signed by an authorized individual. Additionally, it is essential to maintain proper records of the exemption claims for audit purposes. Failure to comply with state regulations can result in penalties, including back taxes and fines. Therefore, understanding the legal implications of using this form is vital for businesses seeking to benefit from tax exemptions.

Eligibility criteria for the streamlined tax exempt form

Eligibility for using the streamlined tax exempt form varies by state but generally includes specific criteria that must be met. Commonly eligible entities include non-profit organizations, government agencies, and educational institutions. These entities must provide documentation proving their tax-exempt status, such as a federal tax exemption letter. It is important for businesses to verify their eligibility before using the form to avoid potential compliance issues.

State-specific rules for the streamlined tax exempt form

Each state has its own rules and regulations regarding the use of the streamlined tax exempt form. These rules may dictate the types of purchases that qualify for tax exemption, the documentation required, and the process for submitting the form. Businesses should familiarize themselves with their state’s specific requirements to ensure compliance and avoid complications during audits. Consulting with a tax professional can also provide valuable insights into state-specific regulations.

Examples of using the streamlined tax exempt form

There are various scenarios in which the streamlined tax exempt form can be effectively utilized. For instance, a non-profit organization purchasing office supplies for its operations may use the form to avoid sales tax. Similarly, a government agency procuring equipment for public service can present the form to vendors to exempt the purchase from tax. These examples illustrate how the form can facilitate cost savings while ensuring compliance with tax regulations.

Quick guide on how to complete certificate of exemption streamlined sales and use formupack

Effortlessly prepare Certificate Of Exemption Streamlined Sales And Use FormuPack on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Certificate Of Exemption Streamlined Sales And Use FormuPack on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Certificate Of Exemption Streamlined Sales And Use FormuPack with ease

- Locate Certificate Of Exemption Streamlined Sales And Use FormuPack and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to share your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Adjust and eSign Certificate Of Exemption Streamlined Sales And Use FormuPack and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of exemption streamlined sales and use formupack

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a streamlined tax exempt form, and how does it work?

A streamlined tax exempt form is a digital document designed to simplify the process of applying for tax exemption. With airSlate SignNow, users can easily fill out and eSign this form, ensuring a quick turnaround. The process eliminates the need for paper forms, making it more efficient and environmentally friendly.

-

How can airSlate SignNow help my business with tax exempt forms?

airSlate SignNow provides a straightforward platform for managing streamlined tax exempt forms. Businesses can create, send, and eSign these forms securely, reducing turnaround time and enhancing productivity. The solution also keeps all documents organized, ensuring easy access for future reference.

-

Is there a cost associated with using the streamlined tax exempt form feature?

Yes, airSlate SignNow offers various pricing plans that include features for creating and managing streamlined tax exempt forms. The cost is competitive and provides great value considering the time saved and improved workflow efficiency. You can choose a plan that best fits your business needs.

-

What benefits do I gain by using airSlate SignNow for tax exemption?

By using airSlate SignNow, businesses gain several benefits, including increased efficiency and reduced processing times for their streamlined tax exempt forms. The solution is designed to enhance collaboration among team members and provides robust security features. This ensures that sensitive tax information is protected throughout the entire process.

-

Can I integrate airSlate SignNow with my existing software?

Yes, airSlate SignNow integrates seamlessly with a variety of applications to enhance your workflow when handling streamlined tax exempt forms. This includes CRM systems, cloud storage services, and productivity tools. The integrations help in streamlining processes and ensuring all your systems work harmoniously.

-

Is the user interface of airSlate SignNow intuitive for new users?

Absolutely! airSlate SignNow features an intuitive user interface designed for ease of use, making it simple for new users to navigate and manage their streamlined tax exempt forms. With just a few clicks, users can create, eSign, and send documents. Comprehensive tutorials and customer support also help users get started.

-

How secure is airSlate SignNow when handling tax exempt forms?

airSlate SignNow prioritizes security by implementing robust encryption and data protection protocols for all streamlined tax exempt forms. Your documents are stored securely in the cloud, and access is controlled through advanced authentication methods. This ensures that sensitive information remains confidential and protected from unauthorized access.

Get more for Certificate Of Exemption Streamlined Sales And Use FormuPack

Find out other Certificate Of Exemption Streamlined Sales And Use FormuPack

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free