Amazon W 9 Form

What is the Amazon W-9?

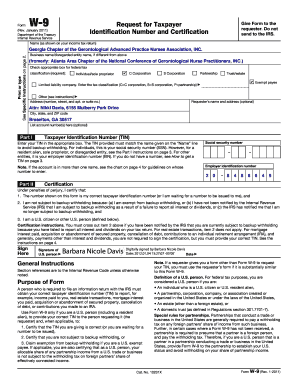

The Amazon W-9 form is a tax document that businesses, including Amazon, use to collect taxpayer identification information from independent contractors and vendors. This form is essential for reporting income paid to these individuals to the Internal Revenue Service (IRS). The W-9 provides necessary details such as the name, business name (if applicable), address, and taxpayer identification number (TIN) of the contractor or vendor. It is crucial for ensuring compliance with U.S. tax laws and for accurate reporting of income.

How to Obtain the Amazon W-9

To obtain the Amazon W-9 form, individuals can typically request it directly from Amazon or download it from their official website. If you are working with Amazon as a vendor or contractor, you may receive the form via email or through your Amazon account. Ensure that you are accessing the most current version of the W-9 to avoid any issues with tax reporting.

Steps to Complete the Amazon W-9

Completing the Amazon W-9 form involves several straightforward steps:

- Provide your full name as it appears on your tax return.

- If applicable, enter your business name or disregarded entity name.

- Fill in your address, including city, state, and ZIP code.

- Enter your taxpayer identification number (TIN), which can be your Social Security number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to certify that the information provided is accurate.

Once completed, the form can be submitted according to the instructions provided by Amazon.

Legal Use of the Amazon W-9

The Amazon W-9 form is legally binding once it is signed and dated by the individual providing the information. This form is used to ensure that the IRS has accurate records of income paid to contractors and vendors. It is important to complete the form accurately to avoid penalties or issues with tax compliance. The use of electronic signatures is permitted under U.S. law, making it easier to complete and submit the form digitally.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the W-9 form. These guidelines include ensuring that the information provided is correct and up to date. The IRS may require this form to be submitted before any payments are made to contractors or vendors. It is advisable to review the IRS instructions related to the W-9 to ensure compliance with all requirements.

Filing Deadlines / Important Dates

While the W-9 form itself does not have a specific filing deadline, it is essential to submit it to Amazon or any other requesting entity before the end of the tax year. This ensures that the income reported to the IRS is accurate and reflects the payments made to contractors. Keeping track of deadlines for submitting other related forms, such as the 1099, is also important for compliance.

Quick guide on how to complete amazon w 9

Effortlessly Prepare Amazon W 9 on Any Device

The management of documents online has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to obtain the correct document and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and seamlessly. Handle Amazon W 9 on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric procedures today.

The Easiest Method to Edit and Electronically Sign Amazon W 9 with Ease

- Locate Amazon W 9 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to store your adjustments.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget the hassle of lost or misplaced documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Amazon W 9 to maintain excellent communication at every stage of your document preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the amazon w 9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the amazon capital services w9 form and why do I need it?

The amazon capital services w9 form is a tax document required for independent contractors and freelancers working with Amazon. It contains important information needed for tax reporting. Completing this form ensures compliance with IRS regulations and helps facilitate proper tax withholding.

-

How can airSlate SignNow help me manage the amazon capital services w9 form?

airSlate SignNow provides a seamless platform for sending and eSigning the amazon capital services w9 form. With user-friendly features, you can easily upload, fill out, and electronically sign the document. This not only saves time but also enhances document security and accessibility.

-

Is there a pricing plan for using airSlate SignNow for the amazon capital services w9?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. You can choose from multiple subscription tiers, each designed to provide value based on your volume of documents and features needed, including the handling of the amazon capital services w9 form.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSignature capabilities that make managing documents like the amazon capital services w9 form efficient. Additionally, you can track document status in real-time, ensuring a streamlined process from start to finish.

-

Can I integrate airSlate SignNow with other applications for handling the amazon capital services w9?

Absolutely! airSlate SignNow offers integrations with various applications, making it easy to manage the amazon capital services w9 form alongside other systems you use. Simplifying workflows across platforms helps enhance efficiency and ensures you have all necessary documents organized in one place.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides many benefits, including increased efficiency and reduced paperwork. For handling forms like the amazon capital services w9, it allows your team to sign and send documents electronically, thus speeding up the overall process and improving customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents like the amazon capital services w9?

Yes, airSlate SignNow prioritizes security. It ensures that sensitive documents like the amazon capital services w9 are encrypted and stored securely. You can trust our platform to protect your data and maintain compliance with industry standards.

Get more for Amazon W 9

- Parallel lines cut by transversal coloring activity answer key form

- Direction to pay form contractor

- America the story of us worksheets pdf form

- Reg 101 28270116 form

- Load test certificate template form

- Fha purchase agreement addendum pdf 100326780 form

- Extended abstract template form

- Mshda forms 120336

Find out other Amazon W 9

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile