Idaho Sales Tax Exemption Form St 104

What is the Idaho Sales Tax Exemption Form ST-104?

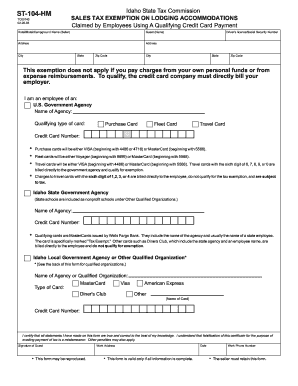

The Idaho Sales Tax Exemption Form ST-104 is a crucial document used by businesses and individuals in Idaho to claim exemptions from sales tax on certain purchases. This form is particularly important for organizations that qualify under specific categories, such as non-profit entities, government agencies, or educational institutions. By submitting this form, eligible parties can avoid paying sales tax on items that are necessary for their operations or services.

How to Use the Idaho Sales Tax Exemption Form ST-104

Using the Idaho Sales Tax Exemption Form ST-104 involves several straightforward steps. First, ensure that you qualify for a sales tax exemption based on your organization’s status. Next, download the fillable ST-104 HM form from a reliable source. Complete the form by providing accurate information regarding your organization, the nature of the purchase, and the reason for the exemption. Once filled out, present the form to the seller at the time of purchase to validate your exemption claim.

Steps to Complete the Idaho Sales Tax Exemption Form ST-104

Completing the Idaho Sales Tax Exemption Form ST-104 requires careful attention to detail. Follow these steps:

- Download the fillable ST-104 HM form.

- Fill in your organization’s name, address, and contact information.

- Indicate the type of exemption you are claiming.

- Provide a description of the items being purchased.

- Sign and date the form to certify its accuracy.

Review the completed form for any errors before submission to ensure compliance and avoid delays.

Key Elements of the Idaho Sales Tax Exemption Form ST-104

The Idaho Sales Tax Exemption Form ST-104 contains several key elements that are essential for its validity. These include:

- Organization Information: Name, address, and contact details of the entity claiming the exemption.

- Exemption Type: Specific category under which the exemption is being claimed.

- Description of Purchases: Clear details about the items for which the exemption is sought.

- Signature: An authorized representative must sign the form to validate the claim.

Legal Use of the Idaho Sales Tax Exemption Form ST-104

The legal use of the Idaho Sales Tax Exemption Form ST-104 is governed by state tax laws. It is essential that the form is used only for legitimate exemption claims. Misuse of the form can result in penalties or legal repercussions. To ensure compliance, organizations should familiarize themselves with Idaho's sales tax regulations and maintain proper documentation to support their exemption claims.

Quick guide on how to complete idaho sales tax exemption form st 104

Accomplish Idaho Sales Tax Exemption Form St 104 effortlessly on any device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the necessary form and securely retain it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle Idaho Sales Tax Exemption Form St 104 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Steps to modify and eSign Idaho Sales Tax Exemption Form St 104 with ease

- Obtain Idaho Sales Tax Exemption Form St 104 and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choice. Edit and eSign Idaho Sales Tax Exemption Form St 104 and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the idaho sales tax exemption form st 104

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fillable ST 104 HM form?

The fillable ST 104 HM form is a state tax form used for reporting sales and use tax in a specified format. It allows businesses to electronically input their sales data, making tax compliance easier and more efficient. By using a fillable ST 104 HM form, you can streamline your tax reporting and reduce the chance of errors.

-

How can airSlate SignNow help me with the fillable ST 104 HM form?

airSlate SignNow provides a user-friendly interface for filling out and signing the fillable ST 104 HM form. Our platform allows you to quickly upload, complete, and send documents securely, ensuring that your tax forms are filed correctly and timely. This simplifies the entire process, making it more efficient for your business.

-

Is there a cost associated with using the fillable ST 104 HM form feature in airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for the fillable ST 104 HM form, but we offer competitive pricing that ensures you get value for your investment. Subscription plans are available that cater to different business sizes and needs, allowing you to select one that fits your budget. You can view our pricing on our website for more details.

-

What features are included when using the fillable ST 104 HM form in airSlate SignNow?

When using the fillable ST 104 HM form in airSlate SignNow, you get features such as customizable templates, the ability to save and edit forms, electronic signatures, and secure document storage. Additionally, our platform allows for easy sharing and collaboration with team members, making the tax reporting process more streamlined. These features enhance your efficiency and accuracy.

-

Can I integrate airSlate SignNow with other applications for the fillable ST 104 HM form?

Absolutely! airSlate SignNow offers integrations with multiple applications, allowing you to pair your workflows with the fillable ST 104 HM form seamlessly. You can connect with CRM systems, document management software, and more to enhance your document handling process. This flexibility helps ensure that your workflows remain uninterrupted.

-

What benefits does using a fillable ST 104 HM form provide my business?

Using a fillable ST 104 HM form facilitates accuracy and efficiency in your tax reporting process. It reduces paperwork and minimizes the risks of errors, which can lead to fines or complications. Additionally, the ease of e-signing documents ensures that your filings are submitted promptly, saving you valuable time and resources.

-

Is it easy to learn how to fill out the fillable ST 104 HM form using airSlate SignNow?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to learn how to fill out the fillable ST 104 HM form. Our platform offers tutorials and customer support to guide you through the process. You'll be able to get started quickly and efficiently with minimal learning curve.

Get more for Idaho Sales Tax Exemption Form St 104

- Voluntary termination of parental rights n c form

- Hawaii board of nursing application form

- Hc5 optical form online

- Dsop fund withdrawal form

- Sanderson farms application form

- Dss form 2900

- Tulip online licensure application systemtexas health and human services form

- Human rights tulip nomination form es pdf studocu

Find out other Idaho Sales Tax Exemption Form St 104

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself