Sales Tax Lake Charles La Form

What is the Calcasieu Parish Sales Tax?

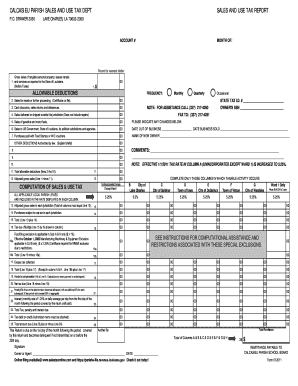

The Calcasieu Parish sales tax is a local tax imposed on the sale of goods and services within Calcasieu Parish, Louisiana. This tax is collected by businesses at the point of sale and is an essential source of revenue for local government services, including education, infrastructure, and public safety. The sales tax rate can vary based on specific jurisdictions within the parish, and it is important for businesses and consumers to be aware of these rates when making purchases.

Steps to Complete the Calcasieu Parish Sales Tax Form

Completing the Calcasieu Parish sales tax form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including sales records and any relevant invoices. Next, accurately fill out the form, ensuring that all sales and tax amounts are correctly reported. It is crucial to review the form for any errors before submission. Finally, submit the completed form by the specified deadline, which can vary based on the reporting period.

Legal Use of the Calcasieu Parish Sales Tax Form

The Calcasieu Parish sales tax form must be completed and submitted in accordance with local laws and regulations. This form serves as a legal document that outlines the sales tax collected by businesses and ensures compliance with state and local tax laws. Proper use of the form is essential for avoiding penalties and ensuring that tax obligations are met. Businesses should keep copies of submitted forms for their records, as these may be required for future audits or inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Calcasieu Parish sales tax form are critical for businesses to note. Typically, forms are due on a monthly or quarterly basis, depending on the volume of sales. It is important to check the specific deadlines for each reporting period to avoid late fees or penalties. Additionally, businesses should be aware of any changes to these deadlines that may occur due to holidays or other circumstances.

Required Documents for the Calcasieu Parish Sales Tax Form

To successfully complete the Calcasieu Parish sales tax form, businesses must prepare several required documents. These typically include sales records, invoices, and any previous tax returns that may be relevant. Accurate documentation is essential for substantiating reported sales and ensuring compliance with tax regulations. Maintaining organized records will facilitate the completion of the form and help in case of audits.

Who Issues the Calcasieu Parish Sales Tax Form?

The Calcasieu Parish sales tax form is issued by the Calcasieu Parish School Board and the Calcasieu Parish Police Jury. These entities are responsible for collecting sales tax and ensuring compliance with local tax laws. Businesses operating within the parish must obtain the form from these official sources to ensure they are using the correct version and adhering to all legal requirements.

Penalties for Non-Compliance with the Calcasieu Parish Sales Tax

Non-compliance with the Calcasieu Parish sales tax regulations can result in significant penalties for businesses. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to understand their obligations and ensure timely and accurate filing of the sales tax form to avoid these consequences. Regular training and updates on tax regulations can help businesses stay compliant.

Quick guide on how to complete sales tax lake charles la

Effortlessly Prepare Sales Tax Lake Charles La on Any Device

Managing documents online has gained popularity among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the required form and safely store it online. airSlate SignNow provides all the features necessary to create, edit, and eSign your documents swiftly without delays. Handle Sales Tax Lake Charles La on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Easiest Way to Modify and eSign Sales Tax Lake Charles La Seamlessly

- Acquire Sales Tax Lake Charles La and click on Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of your documents or mask sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or by downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Edit and eSign Sales Tax Lake Charles La and ensure seamless communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales tax lake charles la

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the calcasieu parish sales tax rate?

The calcasieu parish sales tax rate varies depending on the type of purchase and specific location within the parish. Typically, the combined sales tax rate includes state, local, and additional district taxes. For the most accurate rate, it's advisable to check the Calcasieu Parish tax authority website.

-

How does airSlate SignNow assist with calcasieu parish sales tax compliance?

airSlate SignNow offers features that help businesses manage their documentation related to calcasieu parish sales tax efficiently. By eSigning tax forms and invoices, businesses can ensure compliance and maintain accurate records. Our solution integrates with popular accounting software, making it easier to prepare and file tax documents.

-

What are the benefits of using airSlate SignNow for calcasieu parish sales tax documents?

Using airSlate SignNow streamlines the process of preparing and signing calcasieu parish sales tax documents. The platform saves time and reduces paper usage, allowing businesses to eSign and send documents quickly. This efficiency enhances compliance while providing secure storage for all tax-related documents.

-

Is there a pricing plan tailored for small businesses dealing with calcasieu parish sales tax?

Yes, airSlate SignNow offers pricing plans that cater specifically to small businesses handling calcasieu parish sales tax. Our cost-effective solutions allow organizations to manage their documentation without breaking the bank. You can choose from various plans based on the number of users and features needed.

-

Can I integrate airSlate SignNow with my existing accounting software for calcasieu parish sales tax?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, which enhances your ability to manage calcasieu parish sales tax documentation. This integration ensures that your signed documents sync automatically with your bookkeeping, simplifying tax preparation and filing.

-

What features does airSlate SignNow offer for eSigning calcasieu parish sales tax forms?

airSlate SignNow provides a user-friendly platform for eSigning calcasieu parish sales tax forms. Features include customizable templates, bulk sending, and mobile access for signing documents on-the-go. These features make it easier to handle various tax forms timely and efficiently.

-

How secure is airSlate SignNow for handling calcasieu parish sales tax documents?

Security is a top priority for airSlate SignNow, especially when handling sensitive calcasieu parish sales tax documents. Our platform employs industry-standard encryption and compliance with data protection regulations to ensure the safety of your information. You can trust that your documents are secure throughout their lifecycle.

Get more for Sales Tax Lake Charles La

Find out other Sales Tax Lake Charles La

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors