It4 Form

What is the It4 Form

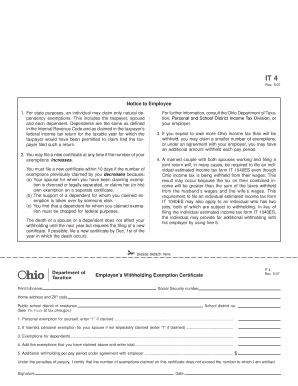

The It4 form is a tax document used in the United States, primarily for reporting income and calculating taxes owed. It is essential for individuals and businesses to accurately report their earnings, ensuring compliance with federal tax regulations. This form is particularly relevant for those who may have multiple income sources or specific deductions that need to be accounted for during tax season.

How to use the It4 Form

Using the It4 form involves several steps to ensure that all necessary information is accurately reported. Start by gathering all relevant financial documents, including W-2s, 1099s, and any receipts for deductible expenses. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is crucial to double-check all entries for accuracy before submission. Finally, decide on your submission method, whether electronically or via mail, to ensure timely processing.

Steps to complete the It4 Form

Completing the It4 form can be broken down into a series of straightforward steps:

- Gather all necessary financial documents, including income statements and expense receipts.

- Fill in your personal information, such as name, address, and Social Security number.

- Report all sources of income, ensuring to include any self-employment earnings.

- List any deductions you qualify for, such as business expenses or educational costs.

- Review the completed form for accuracy and completeness.

- Submit the form through your preferred method, ensuring it is sent before the tax deadline.

Legal use of the It4 Form

The legal use of the It4 form is governed by federal tax laws, which require accurate reporting of income and deductions. To ensure that the form is legally binding, it must be completed truthfully and submitted within the designated deadlines. Failure to comply with these regulations can result in penalties, including fines or audits by the IRS. It is advisable to keep copies of submitted forms and supporting documents for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the It4 form are crucial for compliance with tax regulations. Typically, individual tax returns are due on April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is essential to be aware of any changes to these deadlines, especially for extensions or specific state requirements, to avoid late penalties.

Required Documents

To complete the It4 form accurately, several documents are required:

- W-2 forms from employers to report wages and taxes withheld.

- 1099 forms for any freelance or contract work.

- Receipts for deductible expenses, such as business costs or educational materials.

- Any prior year tax returns for reference.

Who Issues the Form

The It4 form is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS provides guidelines and instructions for completing the form, ensuring taxpayers understand their obligations and the necessary steps for compliance. It is important to use the most current version of the form to ensure adherence to the latest tax laws.

Quick guide on how to complete it4 form

Effortlessly finalize It4 Form on any device

Digital document management has become prevalent among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with the essential tools to create, modify, and electronically sign your documents swiftly without delays. Manage It4 Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

How to adjust and electronically sign It4 Form with ease

- Obtain It4 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device you choose. Edit and electronically sign It4 Form to ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the it4 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an it4 form and how can it be used with airSlate SignNow?

The it4 form is a specific document format designed for streamlined data collection and eSignature processes. Using airSlate SignNow, you can easily create, send, and manage it4 forms, allowing for efficient workflows and quick approvals. This not only simplifies document management but also enhances productivity across your organization.

-

How does airSlate SignNow improve the efficiency of handling it4 forms?

airSlate SignNow enhances the efficiency of handling it4 forms by providing an intuitive platform for electronic signatures and document automation. With features like templating and real-time tracking, users can fill out, sign, and store it4 forms without unnecessary delays. This results in a faster turnaround time and improved collaboration among teams.

-

What is the pricing structure for using airSlate SignNow for it4 forms?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options specifically for managing it4 forms. Plans typically include a variety of features like unlimited eSigning and document storage. To find the best plan for your organization, you can explore the pricing section on our website.

-

Can I integrate airSlate SignNow with other applications for managing it4 forms?

Yes, airSlate SignNow seamlessly integrates with numerous applications, enabling you to manage it4 forms alongside other business tools. Common integrations include CRM systems, document storage platforms, and project management software. This connectivity helps streamline your workflow and ensures that all your tools work harmoniously.

-

What security measures does airSlate SignNow have for it4 forms?

Security is a top priority at airSlate SignNow when handling it4 forms. Our platform utilizes advanced encryption to safeguard your documents and eSignatures. Additionally, we comply with industry standards and regulations to ensure your data remains confidential and protected at all times.

-

Are there any templates available for it4 forms on airSlate SignNow?

Yes, airSlate SignNow provides various templates for it4 forms to help users get started quickly. These templates can be customized to fit your specific requirements, allowing you to create professional-looking documents with minimal effort. Explore our library to find the most suitable templates for your needs.

-

How can I track the status of my it4 forms in airSlate SignNow?

Tracking the status of your it4 forms in airSlate SignNow is easy and transparent. The platform provides a dashboard that allows you to monitor the progress of your documents in real-time. You will receive notifications whenever there are updates, ensuring that you're always informed about your submissions.

Get more for It4 Form

Find out other It4 Form

- Request Electronic signature Word Online

- How To Request Electronic signature Word

- Request Electronic signature Document Free

- Request Electronic signature Form Easy

- Add Electronic signature PDF Online

- Request Electronic signature Presentation Free

- Add Electronic signature PDF Free

- Add Electronic signature PDF Mac

- How To Add Electronic signature PDF

- How Do I Add Electronic signature PDF

- Add Electronic signature Document Online

- How To Add Electronic signature Document

- Add Electronic signature Word Mac

- How Do I Add Electronic signature Document

- How To Add Electronic signature Form

- How To Add Electronic signature Word

- How Do I Add Electronic signature Word

- Add Electronic signature Document iOS

- How To Remove Electronic signature PDF

- How Do I Remove Electronic signature PDF