940 V Form

What is the 940 V

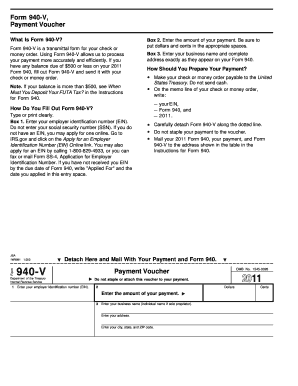

The 940 V form is a payment voucher used by employers to submit their annual Federal Unemployment Tax Act (FUTA) tax payments. This form serves as a means to ensure that the correct amount of FUTA tax is paid to the Internal Revenue Service (IRS) and is crucial for maintaining compliance with federal tax regulations. The 940 V is typically filed alongside the annual Form 940, which reports the employer's total FUTA tax liability for the year. Understanding the purpose and requirements of the 940 V is essential for any business that employs workers and is subject to unemployment taxes.

How to use the 940 V

Using the 940 V form involves a few straightforward steps. First, employers need to calculate their FUTA tax liability based on the wages paid to employees. Once the amount is determined, the employer can fill out the 940 V form, indicating the payment amount and relevant information such as the employer's identification number. After completing the form, it must be submitted to the IRS along with the payment. This can be done electronically or via mail, depending on the employer's preference. Ensuring accuracy in this process is vital to avoid penalties and interest charges.

Steps to complete the 940 V

Completing the 940 V form requires careful attention to detail. Here are the essential steps:

- Calculate the total FUTA tax liability for the year based on employee wages.

- Obtain the 940 V form from the IRS website or through other authorized sources.

- Fill out the form with the employer's information, including the Employer Identification Number (EIN).

- Enter the payment amount clearly on the form.

- Review the form for accuracy to avoid errors that could lead to penalties.

- Submit the completed 940 V form along with the payment to the IRS.

Legal use of the 940 V

The legal use of the 940 V form is governed by IRS regulations. It is essential for employers to use this form correctly to ensure compliance with federal unemployment tax laws. The 940 V serves as a record of payment and must be retained for tax purposes. Failure to use the form properly can result in penalties, including interest on unpaid taxes and potential legal action from the IRS. Employers should stay informed about any changes to tax laws that may affect their use of the 940 V.

Filing Deadlines / Important Dates

Timely filing of the 940 V is crucial for compliance. Employers must submit their payment and the 940 V form by January 31 of the following year for the previous tax year. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, employers should be aware of any interim deadlines for quarterly payments if applicable. Keeping track of these dates helps avoid late fees and ensures that the employer remains in good standing with the IRS.

Required Documents

To complete the 940 V form, employers need specific documents and information, including:

- Employer Identification Number (EIN).

- Total wages paid to employees subject to FUTA tax.

- Any previous payments made towards FUTA tax for the year.

- Records of employee classifications and their eligibility for unemployment benefits.

Having these documents readily available simplifies the completion of the 940 V and ensures accuracy in reporting.

Quick guide on how to complete 940 v

Effortlessly Prepare 940 V on Any Device

Digital document management has gained traction among organizations and individuals alike. It serves as an ideal environmentally-conscious alternative to traditional printed and signed materials, allowing you to acquire the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without any holdups. Manage 940 V on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-centric workflow today.

How to Adjust and Electronically Sign 940 V With Ease

- Find 940 V and click on Get Form to initiate the process.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive data with tools specifically designed for that by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Adjust and electronically sign 940 V and ensure excellent communication throughout your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 940 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 940 V document type, and how can airSlate SignNow help?

The 940 V document type is essential for employers reporting unemployment tax. airSlate SignNow ensures that you can easily send and eSign your 940 V forms, streamlining your document workflow and saving time.

-

How does airSlate SignNow ensure security for my 940 V documents?

Security is a top priority for airSlate SignNow. We employ advanced encryption and authentication protocols to protect your sensitive 940 V documents, ensuring that your data remains safe throughout the eSignature process.

-

What are the pricing options for using airSlate SignNow for 940 V documents?

airSlate SignNow offers flexible pricing plans suitable for all business sizes. You can choose from monthly or annual subscriptions, allowing you to manage your costs effectively while eSigning 940 V documents with ease.

-

Can I integrate airSlate SignNow with other tools I use for managing 940 V documents?

Absolutely! airSlate SignNow seamlessly integrates with various platforms like Google Drive, Salesforce, and Dropbox. This makes it easy for you to manage and eSign your 940 V documents within your existing workflow.

-

What features does airSlate SignNow offer for processing 940 V forms?

airSlate SignNow includes features like templates, bulk sending, and automated reminders, which simplify the management of 940 V forms. These tools enhance efficiency and help you stay organized while ensuring compliance with required timelines.

-

Is it easy to invite others to eSign my 940 V documents with airSlate SignNow?

Yes, inviting others to eSign your 940 V documents is very straightforward. You can send documents directly via email or share a link, allowing multiple parties to sign quickly and securely, thereby speeding up the overall process.

-

Can I track the status of my 940 V documents in airSlate SignNow?

Definitely! airSlate SignNow provides real-time tracking for all your documents, including 940 V forms. You can monitor who has signed and who still needs to sign, ensuring that your documentation progresses smoothly.

Get more for 940 V

Find out other 940 V

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template