Form 1040 Schedule a Internal Revenue Service

What is the Form 1040 Schedule A Internal Revenue Service

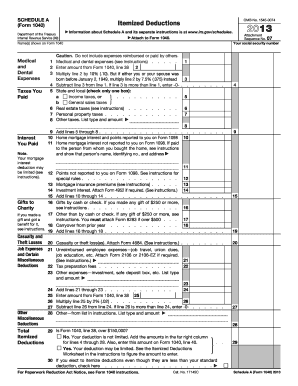

The Form 1040 Schedule A is a crucial document used by taxpayers in the United States to itemize deductions on their federal income tax returns. This form allows individuals to report various deductible expenses, such as medical expenses, mortgage interest, charitable contributions, and state and local taxes. By itemizing deductions, taxpayers may reduce their taxable income, potentially leading to a lower tax liability. The Schedule A must be attached to the Form 1040 when filing, providing detailed information about each deduction claimed.

How to use the Form 1040 Schedule A Internal Revenue Service

Using the Form 1040 Schedule A involves several steps to ensure accurate reporting of itemized deductions. Taxpayers should first gather all necessary documentation, including receipts and statements for deductible expenses. Next, complete the form by entering the amounts for each category of deduction. It is essential to follow the instructions provided by the Internal Revenue Service (IRS) carefully. After filling out the form, attach it to the main Form 1040 when submitting your tax return. Ensure that all information is accurate to avoid potential issues with the IRS.

Steps to complete the Form 1040 Schedule A Internal Revenue Service

Completing the Form 1040 Schedule A involves a systematic approach:

- Gather documentation for all deductible expenses, such as medical bills, mortgage statements, and charitable donation receipts.

- Begin filling out the form by entering your total medical expenses, followed by the applicable thresholds for deductibility.

- Continue with other sections, including taxes paid, interest paid, gifts to charity, and other itemized deductions.

- Calculate the total of all itemized deductions and ensure that the total is accurately reflected on your Form 1040.

- Review the completed form for accuracy and completeness before submitting it with your tax return.

Legal use of the Form 1040 Schedule A Internal Revenue Service

The legal use of the Form 1040 Schedule A requires compliance with IRS guidelines and regulations. Taxpayers must ensure that all claimed deductions are legitimate and supported by appropriate documentation. Misrepresentation or fraudulent claims can lead to penalties, including fines or audits. It is important to maintain accurate records of all expenses reported on the Schedule A, as these may be requested by the IRS during an audit. Utilizing a reliable electronic signature solution can help ensure that the form is completed and submitted in a legally binding manner.

Key elements of the Form 1040 Schedule A Internal Revenue Service

The key elements of the Form 1040 Schedule A include various categories of deductions that taxpayers can claim. These categories typically include:

- Medical and dental expenses: Costs incurred for medical care that exceed a certain percentage of adjusted gross income.

- Taxes paid: State and local income taxes, real estate taxes, and personal property taxes.

- Interest paid: Mortgage interest and investment interest expenses.

- Gifts to charity: Donations made to qualified charitable organizations.

- Other itemized deductions: Miscellaneous deductions such as unreimbursed employee expenses and certain legal fees.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule A align with the annual tax return deadlines set by the IRS. Typically, individual tax returns must be filed by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers may also request an extension to file their returns, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is crucial to stay informed about any changes in deadlines or regulations that may affect your filing obligations.

Quick guide on how to complete form 1040 schedule a internal revenue service

Effortlessly Prepare Form 1040 Schedule A Internal Revenue Service on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect sustainable alternative to traditional printed and signed documents, allowing you to easily find the right form and securely keep it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents quickly without any delays. Handle Form 1040 Schedule A Internal Revenue Service on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest method to alter and electronically sign Form 1040 Schedule A Internal Revenue Service with minimal effort

- Find Form 1040 Schedule A Internal Revenue Service and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or black out sensitive information using the tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign option, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks, from any device you prefer. Modify and electronically sign Form 1040 Schedule A Internal Revenue Service while ensuring effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule a internal revenue service

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1040 Schedule A Internal Revenue Service used for?

The Form 1040 Schedule A Internal Revenue Service is utilized for itemizing deductions on your federal tax return. This allows taxpayers to potentially reduce their taxable income by listing eligible expenses, such as mortgage interest, medical expenses, and charitable contributions.

-

How can airSlate SignNow assist me with the Form 1040 Schedule A Internal Revenue Service?

airSlate SignNow provides an efficient way to complete and eSign documents like the Form 1040 Schedule A Internal Revenue Service. Our platform ensures that your forms are filled out correctly, signed in compliance with regulations, and securely stored for easy access during tax season.

-

Is there a cost associated with using airSlate SignNow for Form 1040 Schedule A Internal Revenue Service?

airSlate SignNow offers a cost-effective solution for managing your documents, including the Form 1040 Schedule A Internal Revenue Service. We provide various pricing plans to accommodate different business needs, including features that streamline the signing process and enhance document security.

-

What features does airSlate SignNow offer for the Form 1040 Schedule A Internal Revenue Service?

Our features for handling the Form 1040 Schedule A Internal Revenue Service include easy document creation, eSigning capabilities, and customizable templates. These tools help ensure that your tax documents are completed accurately and efficiently, making tax season less stressful.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax preparation software, allowing you to manage the Form 1040 Schedule A Internal Revenue Service more effectively. This integration enhances your workflow, making it simple to import and export necessary documents without hassle.

-

What are the benefits of using airSlate SignNow for the Form 1040 Schedule A Internal Revenue Service?

Using airSlate SignNow for the Form 1040 Schedule A Internal Revenue Service offers numerous benefits, including time savings, enhanced accuracy, and secure document handling. Our platform streamlines the entire process, enabling you to focus on maximizing your deductions.

-

How secure is my data when using airSlate SignNow for Form 1040 Schedule A Internal Revenue Service?

Data security is a top priority for airSlate SignNow. When handling the Form 1040 Schedule A Internal Revenue Service, we employ industry-leading encryption and compliance measures to safeguard your sensitive information, ensuring that your data remains private and secure.

Get more for Form 1040 Schedule A Internal Revenue Service

- Wi modification form

- Petition for review of conduct of guardian wisconsin form

- Order on petition for review of conduct of guardian wisconsin form

- Wisconsin transfer property form

- Receipt form guardian or conservator wisconsin

- Order of discharge or conservator wisconsin form

- Wisconsin foreign form

- Wisconsin notice to form

Find out other Form 1040 Schedule A Internal Revenue Service

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document