Form C 149i Subcontractor

What is the Form C 149i Subcontractor

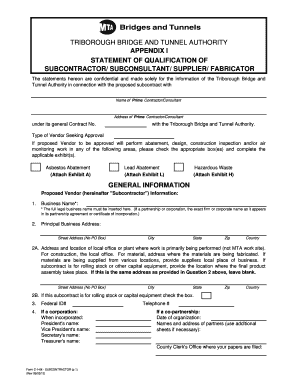

The Form C 149i Subcontractor is a specific document used in the United States for reporting payments made to subcontractors. This form is essential for businesses that engage subcontractors to ensure compliance with tax regulations. It provides necessary information about the subcontractor's identity, the nature of the work performed, and the payments made. Proper completion of this form helps maintain accurate financial records and supports the reporting requirements set forth by the Internal Revenue Service (IRS).

How to use the Form C 149i Subcontractor

Using the Form C 149i Subcontractor involves several straightforward steps. First, gather all relevant information about the subcontractor, including their legal name, address, and tax identification number. Next, accurately fill out the form, ensuring that all required fields are completed. Once the form is filled out, it should be reviewed for accuracy before submission. Depending on the specific requirements, the completed form may need to be submitted to the IRS or kept on file for your records.

Steps to complete the Form C 149i Subcontractor

Completing the Form C 149i Subcontractor requires attention to detail. Follow these steps to ensure proper completion:

- Collect the subcontractor's information, including their full name, address, and tax identification number.

- Fill in the payment details, specifying the total amount paid during the reporting period.

- Indicate the type of work performed by the subcontractor.

- Review the form for any errors or omissions.

- Submit the form according to the required guidelines, either electronically or via mail.

Key elements of the Form C 149i Subcontractor

The Form C 149i Subcontractor includes several key elements that are crucial for accurate reporting. These elements typically consist of:

- Subcontractor Information: This includes the legal name, address, and tax identification number.

- Payment Information: Details about the total payments made to the subcontractor during the reporting period.

- Description of Services: A brief description of the work performed by the subcontractor.

- Signature: The form must be signed by an authorized representative of the business.

Legal use of the Form C 149i Subcontractor

The legal use of the Form C 149i Subcontractor is vital for compliance with tax laws. When filled out correctly, it serves as an official record of payments made to subcontractors, which is necessary for tax reporting purposes. This form ensures that both the business and the subcontractor fulfill their tax obligations. It is essential to retain a copy of the completed form for your records, as it may be required for audits or other inquiries by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Form C 149i Subcontractor are critical to ensure compliance with tax regulations. Generally, the form must be submitted by January 31 of the year following the payment period. It is advisable to check for any updates or changes in deadlines, as these can vary based on specific circumstances or new IRS guidelines. Staying informed about these dates helps avoid potential penalties for late submission.

Quick guide on how to complete form c 149i subcontractor

Complete Form C 149i Subcontractor effortlessly on any gadget

Digital document management has become prevalent among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed files, as you can access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Form C 149i Subcontractor on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign Form C 149i Subcontractor effortlessly

- Find Form C 149i Subcontractor and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and eSign Form C 149i Subcontractor and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form c 149i subcontractor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form C 149I subcontractor?

Form C 149I subcontractor is a crucial document used to report information related to subcontractor activities. It is part of regulatory compliance measures and ensures that all subcontractors are properly accounted for and their contributions documented. Using airSlate SignNow simplifies the process of filling out and sending this form.

-

How can airSlate SignNow help with Form C 149I subcontractor?

airSlate SignNow provides a user-friendly platform that streamlines the creation, signing, and management of Form C 149I subcontractor. Its features allow you to easily customize the document, add signatures, and track the submission process. With this tool, you can ensure that the forms are filled out correctly and submitted on time.

-

Is there a cost associated with using airSlate SignNow for Form C 149I subcontractor?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for managing Form C 149I subcontractor documents. Each plan is designed to provide value for the features you get. It's advisable to review the pricing details on our website to find a plan that fits your budget.

-

What features does airSlate SignNow include for managing Form C 149I subcontractor?

airSlate SignNow includes several features like document templates, eSignature capabilities, and real-time tracking for Form C 149I subcontractor. You can also integrate it with other business applications, facilitating a seamless workflow. These features help to ensure compliance and efficiency in document management.

-

Can I integrate airSlate SignNow with other software for Form C 149I subcontractor?

Absolutely! airSlate SignNow supports integrations with various third-party applications, allowing you to automate workflows related to Form C 149I subcontractor. Whether you use CRM systems or project management tools, these integrations help streamline data flow and enhance productivity.

-

What are the benefits of using airSlate SignNow for Form C 149I subcontractor over traditional methods?

Using airSlate SignNow for Form C 149I subcontractor provides numerous benefits over traditional methods. It saves time with faster document turnaround, reduces paperwork, and minimizes the risk of errors. Additionally, the secure digital signature capabilities offer peace of mind regarding compliance and legitimacy.

-

How secure is airSlate SignNow when handling Form C 149I subcontractor documents?

Security is a top priority for airSlate SignNow when it comes to handling Form C 149I subcontractor documents. The platform employs advanced encryption methods and complies with industry standards to protect your information. You can trust that your sensitive data will remain safe while using our eSignature service.

Get more for Form C 149i Subcontractor

- Nypd affidavit of co habitant form

- Koordinierung der systeme der sozialen sicherheit a1 form

- Request for price quote email sample pdf form

- Wavecrest management application pdf form

- Patient profile form pdf

- Bible expositor and illuminator pdf form

- Org library volunteer application form name date address telephone home telephone cell e elpl

- 12000 gallon tank chart 320302651 form

Find out other Form C 149i Subcontractor

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors