Minnesota Form M71

What is the Minnesota Form M71

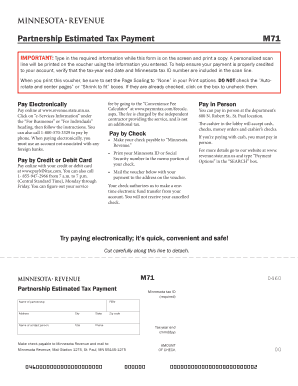

The Minnesota Form M71 is a specific document used in the state of Minnesota for various administrative purposes. It is typically associated with tax filings or other official state requirements. Understanding its purpose is crucial for individuals and businesses to ensure compliance with state regulations. The form serves as a means to collect necessary information that may be required by state authorities.

How to use the Minnesota Form M71

Using the Minnesota Form M71 involves several key steps. First, ensure you have the correct version of the form, which can be obtained from the Minnesota Department of Revenue or relevant state agency. Next, fill out the form accurately, providing all required information. It’s essential to review the completed form for any errors before submission. Finally, submit the form according to the guidelines provided, whether online, by mail, or in person, depending on the specific requirements associated with the form.

Steps to complete the Minnesota Form M71

Completing the Minnesota Form M71 requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Download the latest version of the form from the official Minnesota state website.

- Read the instructions carefully to understand the information required.

- Gather all necessary documentation that supports the information you will provide.

- Fill out the form completely, ensuring all fields are addressed.

- Double-check the information for accuracy and completeness.

- Submit the form through the designated method as outlined in the instructions.

Legal use of the Minnesota Form M71

The legal use of the Minnesota Form M71 is governed by state laws and regulations. To ensure the form is legally binding, it must be completed accurately and submitted in accordance with the specified guidelines. The form may require signatures or additional documentation to validate its contents. Compliance with these legal requirements is essential for the form to be accepted by state authorities.

Key elements of the Minnesota Form M71

The Minnesota Form M71 includes several key elements that must be addressed for proper completion. These elements typically consist of:

- Identification information of the individual or business submitting the form.

- Details regarding the specific purpose of the form.

- Any relevant financial or operational data required by the state.

- Signature lines for necessary approvals or attestations.

Form Submission Methods

Submitting the Minnesota Form M71 can be done through various methods, depending on the preferences of the filer and the requirements set forth by the state. Common submission methods include:

- Online submission through the Minnesota Department of Revenue's website.

- Mailing the completed form to the appropriate state office.

- Delivering the form in person at designated state agency locations.

Quick guide on how to complete minnesota form m71

Prepare Minnesota Form M71 effortlessly on any gadget

Digital document management has become popular among organizations and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without complications. Manage Minnesota Form M71 on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign Minnesota Form M71 effortlessly

- Locate Minnesota Form M71 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Minnesota Form M71 and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota form m71

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Minnesota form M71 and why do I need it?

The Minnesota form M71 is a specific document used for various legal and administrative purposes in Minnesota. Understanding this form is essential for compliance with state regulations. airSlate SignNow allows you to easily eSign and submit the Minnesota form M71, streamlining your workflow and ensuring that your documents are properly managed.

-

How does airSlate SignNow simplify the process of completing the Minnesota form M71?

AirSlate SignNow provides a user-friendly platform that simplifies the filling and signing of the Minnesota form M71. With its intuitive interface, you can quickly input necessary information and electronically sign the document. This eliminates the need for paper forms and enhances the efficiency of your document management process.

-

What are the pricing options for using airSlate SignNow services?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs, including options suitable for individuals and large organizations. Whether you’re dealing with the Minnesota form M71 or other documents, you’ll find a plan that fits your budget. You can start with a free trial to evaluate the features before committing.

-

Can I integrate airSlate SignNow with other software I use?

Yes, airSlate SignNow integrates seamlessly with various applications including CRM systems, email platforms, and cloud storage services. This allows you to automate workflows related to the Minnesota form M71 and other documents, saving you time and improving efficiency. By integrating your tools, you can enhance your overall productivity.

-

What security measures are in place for signing the Minnesota form M71?

Security is a top priority at airSlate SignNow. When signing the Minnesota form M71, your documents are protected using industry-standard encryption. Additionally, all signatures are legally binding and comply with electronic signature laws, giving you peace of mind that your documents are secure.

-

Is there customer support available for issues related to the Minnesota form M71?

Absolutely! airSlate SignNow provides comprehensive customer support to assist you with any queries related to the Minnesota form M71. Whether you need help navigating the platform or require guidance on document signing, our support team is ready to help you resolve issues quickly and efficiently.

-

Can I use airSlate SignNow for both personal and business purposes with the Minnesota form M71?

Yes, airSlate SignNow is versatile enough for both personal and business use. Whether you’re completing the Minnesota form M71 for a personal matter or a business transaction, the platform caters to all your signing needs. It streamlines the process, making document management easier for everyone.

Get more for Minnesota Form M71

Find out other Minnesota Form M71

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney