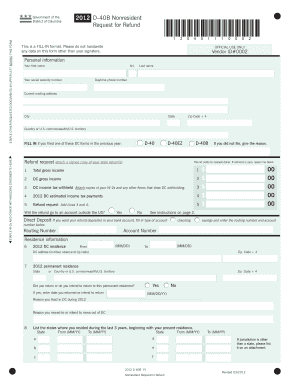

D 40B Nonresident Request for RefundFill in Office of Tax Otr Cfo Dc Form

What is the D-40B Nonresident Request for Refund?

The D-40B Nonresident Request for Refund is a tax form used by nonresident individuals who have overpaid their taxes in Washington, D.C. This form allows eligible taxpayers to request a refund for excess withholding or estimated tax payments. It is specifically designed for nonresidents who earn income in D.C. but do not reside there. Understanding the purpose of this form is essential for ensuring compliance and securing any potential refunds owed.

Steps to Complete the D-40B Nonresident Request for Refund

Completing the D-40B Nonresident Request for Refund involves several key steps:

- Gather necessary documentation, including W-2 forms and any other proof of income earned in D.C.

- Fill out the D-40B form accurately, ensuring all personal information and tax details are correct.

- Calculate the refund amount by reviewing your total income and any taxes withheld.

- Sign and date the form, as an unsigned form may delay the processing of your request.

- Submit the completed form to the Office of Tax and Revenue, either online or via mail.

Required Documents for the D-40B Nonresident Request for Refund

When submitting the D-40B Nonresident Request for Refund, certain documents are required to support your claim:

- W-2 forms from all employers that withheld D.C. taxes.

- Any 1099 forms that report income earned in D.C.

- Proof of residency in another state, if applicable.

- Any additional documentation that verifies your income and tax payments.

Legal Use of the D-40B Nonresident Request for Refund

The D-40B Nonresident Request for Refund is legally binding when filled out correctly and submitted according to the guidelines set by the Office of Tax and Revenue. Electronic signatures are accepted, provided they comply with the legal standards for eSignatures in the U.S. This ensures that the form is recognized as valid and enforceable in tax matters.

Filing Deadlines for the D-40B Nonresident Request for Refund

It is important to be aware of the filing deadlines for the D-40B Nonresident Request for Refund. Typically, the form must be submitted within a specific timeframe following the tax year in which the overpayment occurred. Missing the deadline may result in the forfeiture of your refund. Keeping track of these dates ensures that you can claim your refund without unnecessary delays.

Eligibility Criteria for the D-40B Nonresident Request for Refund

To qualify for a refund using the D-40B form, you must meet certain eligibility criteria:

- You must be a nonresident of D.C. who earned income in the district.

- Your income must have had D.C. taxes withheld.

- You must have overpaid your taxes based on your income and withholding.

Meeting these criteria is essential for a successful refund request.

Quick guide on how to complete d 40b nonresident request for refundfill in office of tax otr cfo dc

Easily Prepare D 40B Nonresident Request For RefundFill in Office Of Tax Otr Cfo Dc on Any Device

Managing documents online has gained traction among companies and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the resources you require to create, alter, and electronically sign your documents quickly and without delays. Handle D 40B Nonresident Request For RefundFill in Office Of Tax Otr Cfo Dc on any platform using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Modify and Electronically Sign D 40B Nonresident Request For RefundFill in Office Of Tax Otr Cfo Dc Effortlessly

- Locate D 40B Nonresident Request For RefundFill in Office Of Tax Otr Cfo Dc and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Choose your preferred method for sending your form—via email, SMS, or invite link—or download it to your computer.

Eliminate worries about missing or lost files, tedious document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign D 40B Nonresident Request For RefundFill in Office Of Tax Otr Cfo Dc to ensure smooth communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the d 40b nonresident request for refundfill in office of tax otr cfo dc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a D 40B nonresident request for refund?

The D 40B nonresident request for refund is a form that allows nonresident individuals to claim a refund for overpaid Virginia state taxes. This process is essential for ensuring that nonresidents are not penalized for tax amounts that exceed their actual liabilities. Proper submission of this request ensures compliance with state regulations.

-

How can airSlate SignNow help with submitting a D 40B nonresident request for refund?

airSlate SignNow simplifies the signing and submission of the D 40B nonresident request for refund by offering an easy-to-use digital platform. Users can quickly create, sign, and send these forms electronically, saving time and ensuring accuracy in their submissions. Our platform streamlines the entire workflow, making it user-friendly for nonresidents.

-

Is there a cost associated with using airSlate SignNow for D 40B nonresident requests?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs when filing a D 40B nonresident request for refund. Depending on your usage and features required, you can choose a plan that best suits your budget. We strive to provide an affordable and cost-effective solution for all customers.

-

What features does airSlate SignNow offer for signing documents like the D 40B nonresident request for refund?

Our platform provides several features that benefit users completing a D 40B nonresident request for refund. Users can add electronic signatures, set signing orders, and even integrate with other tools to enhance efficiency. These features ensure that your documentation process is both secure and compliant.

-

Can I track the status of my D 40B nonresident request for refund with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the entire signing process for your D 40B nonresident request for refund in real-time. You will receive notifications at each step, ensuring that you are informed when the document is signed and submitted. This transparency is vital for peace of mind.

-

What integrations does airSlate SignNow offer that can assist with the D 40B nonresident request for refund?

airSlate SignNow integrates seamlessly with popular applications to enhance your experience when submitting a D 40B nonresident request for refund. You can connect with cloud storage services, CRMs, and more to easily manage your documents. These integrations help streamline your overall workflow.

-

Is airSlate SignNow compliant with legal standards for the D 40B nonresident request for refund?

Yes, airSlate SignNow is compliant with legal standards and regulations when it comes to signing documents like the D 40B nonresident request for refund. Our platform adheres to industry standards to ensure secure electronic signatures that are legally binding. You can trust us to maintain the integrity of your documents.

Get more for D 40B Nonresident Request For RefundFill in Office Of Tax Otr Cfo Dc

- Product classification form

- Defensive driving school workbook answers form

- Lymphedema measurement chart pdf form

- Ross root feeder parts 381465582 form

- 120120 ccg 0613 anotice of filingin the circui form

- Pastor evaluation form

- Veterinary new client form template

- Construction company contract template form

Find out other D 40B Nonresident Request For RefundFill in Office Of Tax Otr Cfo Dc

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free