1040 Fillable Form

What is the 1040 Fillable Form

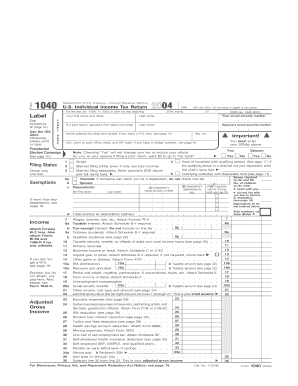

The 1040 Fillable Form is a crucial tax document used by individuals in the United States to report their annual income to the Internal Revenue Service (IRS). This form allows taxpayers to detail their income, claim deductions, and calculate their tax liability. The fillable version provides an interactive format that enables users to enter information directly into the form electronically, making the process more efficient and user-friendly. It is particularly beneficial for those who prefer to complete their taxes digitally, as it can be saved and edited as needed.

How to use the 1040 Fillable Form

Using the 1040 Fillable Form involves several straightforward steps. First, access the form through a reliable source, ensuring it is the most current version. Next, gather necessary documents such as W-2s, 1099s, and any other income statements. Begin filling out the form by entering personal information, including your name, address, and Social Security number. Carefully input your income details, deductions, and credits. Review the information for accuracy before submitting. The digital format allows for easy corrections, ensuring that your submission is precise and complete.

Steps to complete the 1040 Fillable Form

Completing the 1040 Fillable Form can be broken down into clear steps:

- Access the form from a trusted source.

- Gather all relevant financial documents.

- Fill in your personal information accurately.

- Report all sources of income, including wages and interest.

- Claim deductions and tax credits applicable to your situation.

- Review all entries for accuracy and completeness.

- Submit the form electronically or print it for mailing.

Legal use of the 1040 Fillable Form

The 1040 Fillable Form is legally recognized as a valid tax document when completed and submitted according to IRS guidelines. To ensure its legality, taxpayers must provide accurate information and adhere to filing deadlines. Electronic submissions through secure platforms are considered valid, provided they meet the requirements set forth by federal law. Utilizing a trusted eSignature solution can further enhance the legal standing of the completed form, ensuring compliance with regulations such as the ESIGN Act.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 Fillable Form are critical for taxpayers to observe. Typically, the deadline for submitting individual tax returns is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can file for an extension, which grants an additional six months to submit the form, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting the 1040 Fillable Form. Taxpayers can file online using IRS-approved e-filing services, which often provide a streamlined process. Alternatively, the form can be printed and mailed to the appropriate IRS address, depending on the taxpayer's location and whether a refund is expected. Some individuals may choose to file in person at designated IRS offices, although this option is less common. Each method has its own advantages, such as speed and convenience with online filing versus the traditional approach of mailing a physical form.

Required Documents

To successfully complete the 1040 Fillable Form, several documents are typically required. These include:

- W-2 forms from employers, detailing annual wages.

- 1099 forms for any freelance or contract work.

- Records of other income, such as interest or dividends.

- Documentation for deductions, such as mortgage interest statements or medical expenses.

- Social Security numbers for dependents.

Having these documents ready will facilitate a smoother completion process and help ensure accuracy in reporting income and claiming deductions.

Quick guide on how to complete 1040 fillable form

Complete 1040 Fillable Form effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the resources you need to craft, modify, and electronically sign your documents quickly and without complications. Manage 1040 Fillable Form on any gadget using airSlate SignNow applications for Android or iOS and enhance any document-oriented task today.

How to modify and electronically sign 1040 Fillable Form with ease

- Find 1040 Fillable Form and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose how you want to send your form, via email, SMS, share link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign 1040 Fillable Form and ensure superior communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1040 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 1040 Fillable Form and how can airSlate SignNow help?

The 1040 Fillable Form is an electronic version of the IRS Form 1040, which allows taxpayers to fill out their tax return online. airSlate SignNow simplifies this process by enabling you to eSign and securely share your completed forms, making tax filing more efficient.

-

Are there any costs associated with using the 1040 Fillable Form on airSlate SignNow?

Using airSlate SignNow for the 1040 Fillable Form requires a subscription, but the pricing is competitive and tailored to fit various budgets. We offer several plans that provide different levels of access and functionality, ensuring you get the best value for your needs.

-

Can I use the 1040 Fillable Form on mobile devices?

Yes, airSlate SignNow provides a seamless experience across all devices, including mobile phones and tablets. This means you can access, complete, and eSign your 1040 Fillable Form from anywhere, at any time.

-

What features make airSlate SignNow ideal for completing the 1040 Fillable Form?

airSlate SignNow offers a user-friendly interface, enabling easy navigation through the 1040 Fillable Form. Additionally, features like eSigning, document sharing, and real-time tracking enhance your filing experience, making it faster and more secure.

-

How does airSlate SignNow ensure the security of my 1040 Fillable Form?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and comply with industry standards to protect your sensitive information while you fill out the 1040 Fillable Form, ensuring your data remains confidential.

-

Are there any integrations available to enhance my experience with the 1040 Fillable Form?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office, enhancing your productivity. This means you can easily access and manage your 1040 Fillable Form within your preferred workflow.

-

What benefits can I expect from using the 1040 Fillable Form through airSlate SignNow?

Using the 1040 Fillable Form via airSlate SignNow provides numerous benefits such as a streamlined filing process, reduced paperwork, and faster tax submissions. Moreover, eSigning capabilities save you time and reduce the stress associated with tax season.

Get more for 1040 Fillable Form

Find out other 1040 Fillable Form

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template

- Electronic signature Wyoming Indemnity Agreement Template Free

- Electronic signature Iowa Bookkeeping Contract Safe

- Electronic signature New York Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Computer

- Electronic signature South Carolina Bookkeeping Contract Myself

- Electronic signature South Carolina Bookkeeping Contract Easy

- How To Electronic signature South Carolina Bookkeeping Contract

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later