Aurora Occupational Privilege Tax Return Form

What is the Aurora Occupational Privilege Tax Return

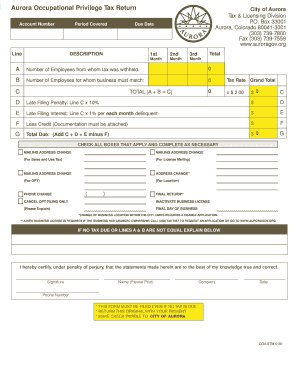

The Aurora Occupational Privilege Tax Return is a form required by the city of Aurora for individuals engaged in business activities within its jurisdiction. This tax is levied on employees and self-employed individuals who earn income from work performed in Aurora. The purpose of this tax is to generate revenue for local services and infrastructure. Understanding this form is essential for compliance with local tax regulations and to avoid potential penalties.

Steps to Complete the Aurora Occupational Privilege Tax Return

Completing the Aurora Occupational Privilege Tax Return involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and identification. Next, accurately fill out the form, providing your personal information, business details, and income figures. Ensure that all calculations are correct, particularly the tax amount owed. After completing the form, review it for any errors before submission. Finally, submit the form according to the specified method, whether online, by mail, or in person.

Legal Use of the Aurora Occupational Privilege Tax Return

The legal use of the Aurora Occupational Privilege Tax Return is governed by local tax laws. It is essential to file this return accurately and on time to comply with municipal regulations. Failure to submit the return can result in penalties, including fines and interest on unpaid taxes. The return serves as a legal document that verifies your compliance with the tax obligations of the city, making it crucial for both individuals and businesses operating within Aurora.

Filing Deadlines / Important Dates

Filing deadlines for the Aurora Occupational Privilege Tax Return are typically set by the city of Aurora and may vary each year. It is important to be aware of these dates to avoid late fees or penalties. Generally, the return is due annually, and specific dates are announced by the city. Keeping track of these deadlines ensures timely compliance and helps maintain good standing with local tax authorities.

Required Documents

To complete the Aurora Occupational Privilege Tax Return, several documents are required. These typically include proof of income, such as W-2 forms for employees or 1099 forms for self-employed individuals. Additionally, identification documents may be necessary to verify your identity and residency. Having these documents ready will streamline the process and help ensure that the return is filled out accurately.

Form Submission Methods (Online / Mail / In-Person)

The Aurora Occupational Privilege Tax Return can be submitted through various methods, providing flexibility for taxpayers. Individuals may choose to file online using the city’s designated portal, which often offers a streamlined process. Alternatively, the form can be mailed to the appropriate city department or submitted in person at designated locations. Each method has its advantages, and selecting the right one can depend on personal preference and convenience.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Aurora Occupational Privilege Tax Return can lead to significant penalties. These may include financial fines, interest on unpaid taxes, and potential legal action for persistent non-filers. It is crucial to understand the implications of not submitting the return on time and to take proactive measures to ensure compliance, such as setting reminders for filing deadlines.

Quick guide on how to complete aurora occupational privilege tax return

Complete Aurora Occupational Privilege Tax Return effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage Aurora Occupational Privilege Tax Return on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to edit and eSign Aurora Occupational Privilege Tax Return effortlessly

- Obtain Aurora Occupational Privilege Tax Return and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, time-consuming searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Aurora Occupational Privilege Tax Return and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the aurora occupational privilege tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the aurora occupational privilege tax return?

The aurora occupational privilege tax return is a tax form required for certain businesses operating within Aurora, Colorado. It helps ensure compliance with local regulations and allows the city to collect revenue from businesses benefiting from its resources. Understanding and accurately completing this form is vital for avoiding penalties.

-

How can airSlate SignNow assist with submitting the aurora occupational privilege tax return?

airSlate SignNow simplifies the process of submitting the aurora occupational privilege tax return by allowing businesses to create and eSign documents digitally. This ensures timely submission without the hassle of paperwork. Our platform also provides tracking capabilities to confirm that your return has been processed.

-

What are the pricing options for using airSlate SignNow for the aurora occupational privilege tax return?

airSlate SignNow offers various pricing plans to suit the needs of different businesses handling the aurora occupational privilege tax return. Each plan provides essential features like unlimited eSignatures, document storage, and integrations with accounting software. Choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the aurora occupational privilege tax return?

airSlate SignNow provides a range of features tailored for the aurora occupational privilege tax return, including customizable templates, secure cloud storage, and real-time collaboration tools. These features streamline document preparation and ensure that every step of the tax return filing is accurate and efficient.

-

Is airSlate SignNow secure for submitting sensitive documents like the aurora occupational privilege tax return?

Yes, airSlate SignNow prioritizes the security of your documents. Our platform uses bank-level encryption and complies with industry standards to protect sensitive information, including your aurora occupational privilege tax return. You can trust us to keep your data safe throughout the entire process.

-

Does airSlate SignNow integrate with other accounting software for the aurora occupational privilege tax return?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage the aurora occupational privilege tax return and other financial documents. This integration allows for smooth data transfer and helps ensure that your records are always up to date.

-

What are the benefits of using airSlate SignNow for my aurora occupational privilege tax return?

Using airSlate SignNow for your aurora occupational privilege tax return offers numerous benefits, such as increased efficiency, reduced errors, and improved compliance rates. The intuitive interface makes it easy to prepare and sign documents, ultimately saving you time and minimizing stress during tax season.

Get more for Aurora Occupational Privilege Tax Return

- Format of notice of egm for strike off company

- Cartea mea de gramatica clasa 6 pdf form

- Aanc lease form

- Jrotc marksmanship test answer key form

- Lesson 2 homework practice powers and exponents form

- 5d steakhouse port oconnor 2683 west adams avenue form

- Children s ministries registration form ucumctx

- Alteration addition description form

Find out other Aurora Occupational Privilege Tax Return

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free