Cupping Release Form

What is the cupping release form

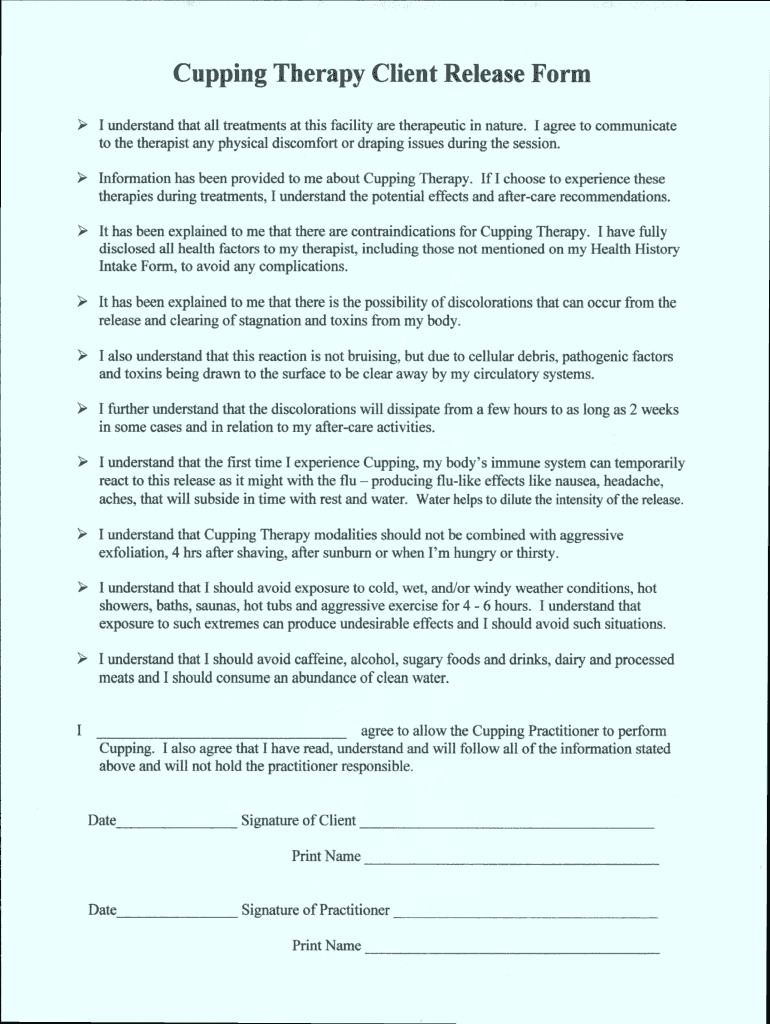

The cupping release form is a crucial document used in massage cupping therapy. It serves as a legal agreement between the practitioner and the client, ensuring that both parties understand the nature of the therapy and any associated risks. This form typically includes details about the client’s health history, consent for treatment, and acknowledgment of potential side effects. By signing the cupping release form, clients affirm their understanding and acceptance of the therapy, which helps protect practitioners from liability.

How to use the cupping release form

Using the cupping release form involves several steps. First, the practitioner should provide the form to the client prior to the session. Clients need to fill out their personal information, health history, and any specific concerns they may have regarding the therapy. After completing the form, clients must review the information and sign it to indicate their consent. Practitioners should retain a copy of the signed form for their records, ensuring compliance with legal and ethical standards.

Steps to complete the cupping release form

Completing the cupping release form involves a straightforward process:

- Begin by entering your personal information, including your name, contact information, and date of birth.

- Provide details about your health history, including any medical conditions, allergies, or medications you are currently taking.

- Read through the consent section carefully, which outlines the risks and benefits of massage cupping therapy.

- Sign and date the form to indicate your understanding and acceptance of the treatment.

- Submit the completed form to your practitioner before the therapy session begins.

Key elements of the cupping release form

The cupping release form contains several key elements that ensure clarity and legal protection. These include:

- Client Information: Personal details such as name, address, and contact information.

- Health History: A section for clients to disclose any relevant medical conditions or treatments.

- Informed Consent: A statement outlining the nature of the therapy, potential risks, and benefits.

- Signature Line: A space for clients to sign and date the form, indicating their consent.

Legal use of the cupping release form

The legal use of the cupping release form is essential for both practitioners and clients. By having clients sign this document, practitioners establish a record of informed consent, which can be crucial in case of disputes or misunderstandings. The form should comply with relevant state laws and regulations governing massage therapy practices. It is advisable for practitioners to consult legal counsel to ensure that their forms meet all necessary legal requirements.

Digital vs. paper version

Both digital and paper versions of the cupping release form have their advantages. Digital forms offer convenience, allowing clients to fill them out online and submit them electronically. This can streamline the process and reduce paperwork for practitioners. On the other hand, paper forms may be preferred in certain settings where digital access is limited. Regardless of the format, it is important that the form retains its legal validity and complies with applicable regulations.

Quick guide on how to complete cupping therapy client release form just massage llc

The optimal method to locate and authorize Cupping Release Form

On a company-wide scale, ineffective procedures related to document endorsement can take up considerable working hours. Authorizing documents such as Cupping Release Form is an inherent aspect of operations in any organization, which is why the productivity of each agreement’s lifecycle signNowly impacts the firm's overall efficiency. With airSlate SignNow, approving your Cupping Release Form is as straightforward and quick as possible. This platform provides you with the latest iteration of virtually any form. Even better, you can authorize it immediately without the requirement of installing external software on your computer or printing any hard copies.

Steps to obtain and authorize your Cupping Release Form

- Browse our collection by category or utilize the search bar to find the form you require.

- Check the form preview by clicking Learn more to confirm it’s the correct one.

- Hit Get form to start editing immediately.

- Fill out your form and enter any necessary information using the toolbar.

- Once finished, click the Sign tool to authorize your Cupping Release Form.

- Select the signing option that is most convenient for you: Draw, Create initials, or upload a picture of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing choices as required.

With airSlate SignNow, you have everything necessary to manage your documents efficiently. You can find, complete, edit, and even send your Cupping Release Form all in a single tab with minimal effort. Optimize your workflows by utilizing a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What do you need from your partners in order to fill out a k1-form? We all used LLC's to split our partnership up, so do I just need thier EINs or do I need their personal SSN as well?

Assuming each LLC is a single member disregarded entity, then you need the individual's SSN not the EIN of the LLC. You also put the individual's name on the K1 not the name of the LLC. If the LLC's are any other type of entity, then use the EIN and name of the LLC.You also need each partner's address and capital, loss and profit percentage.

-

Whats the cheapest & best way to start an LLC for a dropshipping business in the US, legalZoom or just fill out the forms and send to the gov't center?

You have a choice either use a service company or directly file article to the Secretary of State to start an LLC in the USA.The service companies have the experience, knowledge of the state requirement to write and file articles which saves time and errors in the articles.It is always recommended to hire a professional who has a reasonable experience of the industry to write and file the articles to incorporate company as per the requirement which avoids future uncertain issues.

-

Are health clubs, gyms and other public businesses that require customers and clients to fill out health and/or medical forms or releases required to protect that information under HIPAA?

This does not fall under HIPAA. Under the HIPAA regulations, the entities that must comply with the rules are defined as "covered entities" which are: health care plans, health care providers, and health care clearinghouses. So health clubs or gyms do not meet this definition and are therefore not subject to HIPAA. However, depending on your state, there may be laws which protect the sharing of this type of information.

-

How do I create a authentication code system with WordPress (no coding)? Clients can enter the code and then be shown a form to fill out. Also have a client side setup to create access codes.

Yes, what I understand is that you need a plugin order to create an authentication code system various free plugins are available on WordPress plugin directory list but here are some of best authentication code plugin that I would recommend:Authentication Code By MitchTwo Factor AuthenticationGoogle Authenticator By Henrik SchackRublon Two-Factor AuthenticationTry It and Tell me how these plugins work for you… All The Best

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

I just Incorporated a WY LLC as a non resident alien and saw there is a mandatory Form 5472 to be filled. how an when should this be submitted if I don't live in the states?

This is a relatively new filing requirement that has just been added for tax years beginning with 2017. As of this writing it appears that the IRS is going to slightly modify the Form 5472 to allow you to file just that form by itself, if you have no other US federal tax reporting obligation. You should expect the due date to be the same as a non-resident US tax return which will be either April 15 or June 15, depending on your specific filing requirements to report transactions for the previous calendar year.

-

How can we track our visitors conversion/drop off when the visitor actually fills out fields on a form page outside of our site domain (Visitor finds listing in SERPS, hits our site, jumps to client site to complete form)?

The short answer: You can't unless the client site allows you to do so. A typical way to accomplish measuring external conversions is to use a postback pixels. You can easily google how they work - in short you would require your client to send a http request to your tracking software on the form submit. A good way to do this in practice is to provide an embedable form to your clients that already includes this feature and sends along a clientID with the request, so that you can easily see which client generates how many filled out forms.

Create this form in 5 minutes!

How to create an eSignature for the cupping therapy client release form just massage llc

How to create an electronic signature for your Cupping Therapy Client Release Form Just Massage Llc online

How to generate an eSignature for the Cupping Therapy Client Release Form Just Massage Llc in Google Chrome

How to make an eSignature for signing the Cupping Therapy Client Release Form Just Massage Llc in Gmail

How to create an eSignature for the Cupping Therapy Client Release Form Just Massage Llc right from your mobile device

How to create an eSignature for the Cupping Therapy Client Release Form Just Massage Llc on iOS

How to generate an electronic signature for the Cupping Therapy Client Release Form Just Massage Llc on Android OS

People also ask

-

What is a Cupping Release Form and why is it important?

A Cupping Release Form is a legal document that ensures clients understand the procedures and potential risks associated with cupping therapy. It protects practitioners by obtaining informed consent from patients, making it an essential part of offering cupping services.

-

How can I create a Cupping Release Form using airSlate SignNow?

Creating a Cupping Release Form with airSlate SignNow is simple and efficient. You can use customizable templates to tailor the document to your specific requirements, ensuring all necessary information and consent clauses are included.

-

Is there a cost associated with using the Cupping Release Form on airSlate SignNow?

AirSlate SignNow offers various pricing plans that include access to the Cupping Release Form and other document management features. The plans are designed to be cost-effective, allowing businesses of all sizes to utilize electronic signatures without breaking the bank.

-

What features does the airSlate SignNow platform offer for managing Cupping Release Forms?

AirSlate SignNow provides features such as customizable templates, secure e-signatures, and document tracking for Cupping Release Forms. Additionally, you can automate workflows, ensuring that the forms are sent, signed, and stored efficiently.

-

Can I integrate the Cupping Release Form with other software tools?

Yes, airSlate SignNow allows seamless integration with various software applications, enabling you to connect your Cupping Release Form process with tools like CRM systems, payment processors, and more. This integration enhances workflow efficiency and data management.

-

How does using a digital Cupping Release Form improve customer experience?

Utilizing a digital Cupping Release Form through airSlate SignNow streamlines the consent process, allowing clients to sign documents from anywhere at any time. This convenience enhances customer satisfaction and encourages more clients to engage with your services.

-

What security measures does airSlate SignNow have for Cupping Release Forms?

AirSlate SignNow employs advanced security protocols, including encryption and secure cloud storage, to protect your Cupping Release Forms. This ensures that client information remains confidential and compliant with relevant regulations.

Get more for Cupping Release Form

- Rcs delhigovt nic form

- Tax return transcriptt sample veri tax form

- Nick will eat spaghetti and meatballs for dinner tonight form

- Mental health screening form 46387974

- Hrd lion air form

- How to fill requiistion form for supplyof energy

- Name change application signature date university federal ufcu form

- Conquering wees and poos form

Find out other Cupping Release Form

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile