Tax Return Transcriptt Sample Veri Tax Form

What is the Tax Return Transcript Sample?

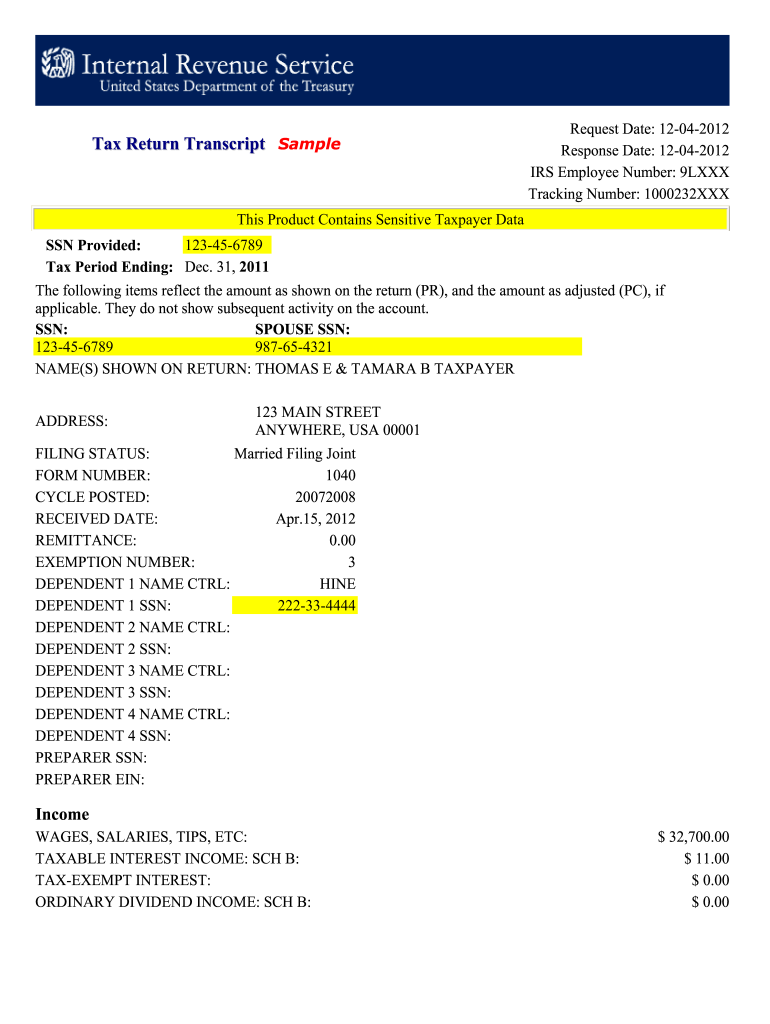

The Tax Return Transcript Sample is a document provided by the IRS that summarizes your tax return information. It includes details such as your adjusted gross income (AGI), filing status, and the types of income reported. This document is essential for various purposes, including applying for loans, verifying income, and fulfilling tax obligations. Unlike a full tax return, the transcript offers a concise overview, making it easier for users to access relevant information quickly.

How to Obtain the Tax Return Transcript Sample

To obtain a Tax Return Transcript Sample, individuals can request it directly from the IRS. This can be done online through the IRS website, where users can create an account or log in to access their transcripts. Alternatively, transcripts can be requested via mail by completing Form 4506-T, which allows for the selection of the specific type of transcript needed. It is important to provide accurate information to ensure timely processing and delivery.

Steps to Complete the Tax Return Transcript Sample

Completing the Tax Return Transcript Sample involves several key steps:

- Gather necessary information, including your Social Security number, filing status, and the tax year for which you need the transcript.

- Visit the IRS website or access Form 4506-T to initiate the request.

- Follow the prompts to select the type of transcript you need, ensuring you choose the correct year.

- Submit your request, either electronically or by mailing the completed form to the appropriate address.

Legal Use of the Tax Return Transcript Sample

The Tax Return Transcript Sample holds legal significance in various contexts. It is often used to verify income for loan applications, government assistance programs, and other financial assessments. The document is recognized by lenders and institutions as a legitimate source of income verification, provided that it is obtained directly from the IRS. Understanding its legal implications can help individuals ensure compliance with financial and tax-related requirements.

Key Elements of the Tax Return Transcript Sample

Key elements of the Tax Return Transcript Sample include:

- Adjusted Gross Income (AGI): This figure reflects your total income after adjustments and is crucial for determining tax liability.

- Filing Status: Indicates whether you filed as single, married, or head of household.

- Types of Income: Summarizes various income sources, such as wages, interest, and dividends.

- Tax Year: Specifies the year for which the transcript is applicable, ensuring relevance for the request.

IRS Guidelines

The IRS provides specific guidelines regarding the use and request of tax transcripts. Individuals are encouraged to use the IRS online portal for immediate access, which is the fastest method. The IRS also emphasizes the importance of safeguarding personal information when requesting transcripts, as this document contains sensitive data. Following these guidelines ensures a smooth process and helps maintain compliance with IRS regulations.

Quick guide on how to complete tax return transcriptt sample veri tax

Easily Set Up Tax Return Transcriptt Sample Veri Tax on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage Tax Return Transcriptt Sample Veri Tax on any device with the airSlate SignNow applications for Android or iOS and enhance any document-related task today.

How to Modify and Electronically Sign Tax Return Transcriptt Sample Veri Tax Effortlessly

- Locate Tax Return Transcriptt Sample Veri Tax and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you want to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searching, or errors that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Tax Return Transcriptt Sample Veri Tax and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax return transcriptt sample veri tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Veritax Accounting and how can it benefit my business?

Veritax Accounting is a comprehensive accounting and financial management solution that streamlines budgeting, reporting, and compliance tasks. By integrating with airSlate SignNow, businesses can efficiently manage their financial documents while ensuring secure eSignatures, enhancing productivity and accuracy in financial operations.

-

How does airSlate SignNow integrate with Veritax Accounting?

airSlate SignNow seamlessly integrates with Veritax Accounting, allowing users to send, sign, and manage documents directly within the accounting platform. This integration improves workflow efficiency, enabling businesses to handle their financial documentation and eSigning processes without switching between multiple applications.

-

What are the pricing options for Veritax Accounting?

Veritax Accounting offers various pricing plans that cater to different business sizes and needs. airSlate SignNow provides flexible pricing that can be combined with Veritax Accounting, making it cost-effective for businesses looking to streamline their financial and documentation processes.

-

What features does Veritax Accounting offer?

Veritax Accounting is equipped with features such as automated bookkeeping, real-time financial reporting, and compliance management. When paired with airSlate SignNow, users can further automate their document handling, ensuring that all financial agreements are swiftly signed and securely stored.

-

Are there benefits to using airSlate SignNow with Veritax Accounting?

Using airSlate SignNow alongside Veritax Accounting enhances document management by simplifying the eSigning process. Businesses benefit from faster transactions and improved compliance, as all signed documents can be easily tracked and stored, thus improving overall operational efficiency.

-

Is Veritax Accounting suitable for small businesses?

Yes, Veritax Accounting is designed to accommodate businesses of all sizes, including small businesses. Its features, combined with airSlate SignNow’s user-friendly interface, make it an ideal solution for small businesses looking to manage their accounting tasks efficiently without the complexity of larger systems.

-

Can Veritax Accounting handle multiple users?

Absolutely! Veritax Accounting allows multiple user access, enabling team collaboration on financial documentation. This feature works hand-in-hand with airSlate SignNow, facilitating efficient signing processes where team members can review and approve documents in real time.

Get more for Tax Return Transcriptt Sample Veri Tax

- Sample osha respiratory program evaluation form

- Mc 020 form

- Cubbies appleseed teaching plans pdf form

- Open the file excellus bluecross blueshield form

- Allenstown new hampshire zobrio fund accounting rfp response version 1 form

- Tehillim online pdf form

- Application for refund pennsylvania realty transfer tax rev 1651 application for refund pennsylvania realty transfer tax rev form

- Application for refund pennsylvania realty transfer tax rev 1651 form

Find out other Tax Return Transcriptt Sample Veri Tax

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT