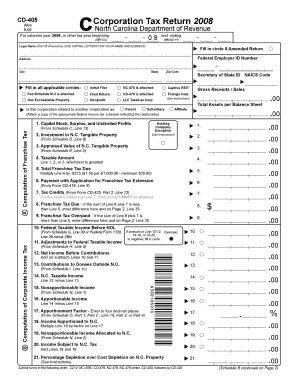

CD 405 Corporation Tax Return Form

What is the CD 405 Corporation Tax Return

The CD 405 Corporation Tax Return is a tax form used by corporations operating in North Carolina to report their income, deductions, and tax liability. This form is essential for ensuring compliance with state tax regulations. Corporations must accurately complete the CD 405 to determine their tax obligations and maintain good standing with the North Carolina Department of Revenue.

Steps to complete the CD 405 Corporation Tax Return

Completing the CD 405 Corporation Tax Return involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and receipts for deductions.

- Fill out the form with accurate financial information, ensuring all income and expenses are reported.

- Calculate the total tax liability based on the income reported and applicable tax rates.

- Review the completed form for accuracy and completeness before submission.

- Submit the form by the designated deadline to avoid penalties.

Legal use of the CD 405 Corporation Tax Return

The CD 405 Corporation Tax Return must be filed in accordance with North Carolina tax laws. Legally, the form serves as the official record of a corporation's financial activity for the tax year. Corporations must ensure that all information provided is truthful and complete, as any discrepancies may lead to audits or penalties. Utilizing a reliable eSignature solution can help ensure that the submission is secure and compliant with electronic signature laws.

Filing Deadlines / Important Dates

Corporations must be aware of specific deadlines for filing the CD 405 Corporation Tax Return to avoid late fees. Generally, the return is due on the fifteenth day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due on April 15. It is important to keep track of these dates and plan accordingly to ensure timely submission.

Form Submission Methods (Online / Mail / In-Person)

The CD 405 Corporation Tax Return can be submitted through various methods. Corporations have the option to file online through the North Carolina Department of Revenue's website, which is often the fastest method. Alternatively, the form can be mailed to the appropriate address provided by the Department of Revenue or submitted in person at local offices. Each method has its advantages, and corporations should choose the one that best suits their needs.

Key elements of the CD 405 Corporation Tax Return

Key elements of the CD 405 Corporation Tax Return include:

- Identification information, including the corporation's name, address, and tax identification number.

- Income details, including gross receipts and any other sources of income.

- Deductions that the corporation is eligible to claim, which can significantly affect the tax liability.

- Calculation of the total tax owed based on the reported income and applicable tax rates.

Quick guide on how to complete cd 405 corporation tax return

Set up CD 405 Corporation Tax Return effortlessly on any gadget

Managing documents online has become increasingly popular with both businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to find the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle CD 405 Corporation Tax Return on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign CD 405 Corporation Tax Return without hassle

- Find CD 405 Corporation Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or obscure sensitive information using tools that airSlate SignNow features specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign CD 405 Corporation Tax Return and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cd 405 corporation tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the CD 405 instructions 2022?

The CD 405 instructions 2022 provide a detailed guide on how to effectively complete and submit the necessary documentation. This ensures compliance with current regulations and facilitates a smooth signing process. Understanding these instructions is crucial for efficient document management.

-

How does airSlate SignNow assist with CD 405 instructions 2022?

AirSlate SignNow simplifies the process of managing CD 405 instructions 2022 by providing an intuitive eSigning platform. Users can easily upload, send, and sign documents while ensuring they follow the necessary guidelines. This empowers businesses to maintain compliance and efficiency.

-

What pricing plans are available for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans designed to meet various business needs. Whether you're a small business or a large enterprise, you'll find a suitable plan that fits your budget and requirements. Each plan supports documentation processes including those involving CD 405 instructions 2022.

-

What features does airSlate SignNow offer for eSigning?

AirSlate SignNow includes a range of features such as document templates, workflow automation, and secure cloud storage. These features facilitate the signing process, especially for documents related to CD 405 instructions 2022. Users can benefit from an efficient, easy-to-use platform.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow integrates seamlessly with various applications including Google Drive, Salesforce, and Dropbox. This allows users to manage their documents effectively and reference CD 405 instructions 2022 without switching platforms. Integrations enhance workflow efficiency and data management.

-

What benefits can businesses expect from using airSlate SignNow?

Businesses using airSlate SignNow can expect to minimize errors and expedite the signing process through its user-friendly interface. The platform helps ensure that documents adhere to CD 405 instructions 2022, allowing for compliance and smooth operations. This ultimately contributes to improved productivity.

-

Is airSlate SignNow suitable for remote teams?

Absolutely, airSlate SignNow is ideal for remote teams, offering robust cloud capabilities that allow access from anywhere. The platform ensures that team members can collaborate and eSign documents that require adherence to CD 405 instructions 2022, facilitating a seamless remote workflow. Flexibility and collaboration are prioritized.

Get more for CD 405 Corporation Tax Return

Find out other CD 405 Corporation Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors