Verification of Deposit Form

What is the Verification of Deposit Form

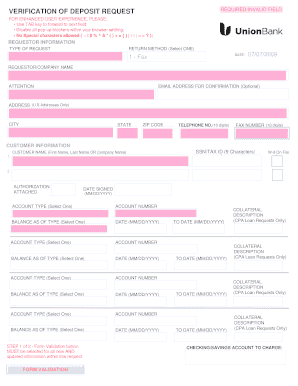

The verification of deposit form serves as an official document that confirms an individual's or business's account balance and transaction history with a financial institution. This form is commonly requested by lenders, landlords, or other entities requiring proof of financial stability. It typically includes details such as the account holder's name, account number, balance, and the bank's contact information. The form plays a crucial role in various financial transactions, including loan applications and rental agreements.

How to Use the Verification of Deposit Form

Using the verification of deposit form involves several steps to ensure that it meets the requirements of the requesting party. First, the account holder must request the form from their bank or financial institution. Once obtained, the form should be filled out accurately, providing all necessary information. After completing the form, it may need to be signed by both the account holder and a bank representative to verify its authenticity. Finally, the completed form is submitted to the requesting entity, such as a lender or landlord, as proof of the account holder's financial status.

Steps to Complete the Verification of Deposit Form

Completing the verification of deposit form requires attention to detail to ensure accuracy. Here are the steps to follow:

- Request the form from your bank or financial institution.

- Fill in your personal information, including your name and account number.

- Provide the current balance and any relevant transaction history if required.

- Sign the form to authorize its release to the requesting party.

- Have a bank representative review and sign the form to confirm its validity.

- Submit the completed form to the entity that requested it.

Key Elements of the Verification of Deposit Form

The verification of deposit form must include several key elements to be considered valid. These elements typically consist of:

- Account holder's full name and address.

- Account number associated with the deposit.

- Current balance of the account.

- Transaction history, if applicable.

- Bank's name, address, and contact information.

- Signature of the account holder and a bank representative.

Legal Use of the Verification of Deposit Form

The verification of deposit form is legally recognized as a binding document when completed correctly. It serves as proof of an individual's or business's financial status, which can be critical in various legal and financial situations. Proper execution of the form, including signatures and accurate information, ensures its acceptance by lenders, landlords, and other entities. Additionally, compliance with state and federal regulations regarding financial documentation is essential to uphold the form's legal standing.

Examples of Using the Verification of Deposit Form

There are numerous scenarios where the verification of deposit form is utilized. Common examples include:

- Applying for a mortgage or personal loan, where lenders require proof of income and financial stability.

- Renting a property, where landlords may request the form to assess the tenant's ability to pay rent.

- Opening a new bank account, where financial institutions may need verification of existing funds.

Quick guide on how to complete verification of deposit form 195748

Complete Verification Of Deposit Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources you require to create, edit, and electronically sign your paperwork quickly without interruptions. Manage Verification Of Deposit Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Verification Of Deposit Form with ease

- Locate Verification Of Deposit Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize critical sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and electronically sign Verification Of Deposit Form and ensure effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the verification of deposit form 195748

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a verification of deposit form?

A verification of deposit form is a document used by financial institutions to confirm the account balance and transaction history of an individual or business. This form is crucial for lending processes, as it provides lenders with the necessary information to assess a borrower's financial status.

-

How does airSlate SignNow streamline the verification of deposit form process?

airSlate SignNow streamlines the verification of deposit form process by allowing users to electronically sign and send documents quickly and securely. Our platform simplifies document management, ensuring that all parties can collaborate efficiently while maintaining compliance with industry standards.

-

What are the benefits of using airSlate SignNow for verification of deposit forms?

Using airSlate SignNow for verification of deposit forms offers several benefits, including reduced processing time, improved accuracy, and enhanced security. It allows you to access documents anytime, anywhere, which increases productivity and accelerates the loan approval process.

-

Is airSlate SignNow cost-effective for managing verification of deposit forms?

Yes, airSlate SignNow provides a cost-effective solution for managing verification of deposit forms. Our competitive pricing plans are designed to accommodate businesses of all sizes, ensuring you receive maximum value for your investment while simplifying document workflows.

-

Can I integrate airSlate SignNow with other applications for verification of deposit forms?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications, enhancing the management of your verification of deposit forms. This connectivity enables you to automate workflows, improve data accuracy, and save time on administrative tasks.

-

What features does airSlate SignNow offer for verification of deposit forms?

airSlate SignNow offers several features tailored for verification of deposit forms, including secure eSignatures, customizable templates, and advanced tracking options. These features ensure that you can manage your documents efficiently while maintaining compliance with legal standards.

-

How secure is airSlate SignNow when handling verification of deposit forms?

Security is a top priority for airSlate SignNow. We implement advanced encryption and strict compliance with data protection regulations to ensure that your verification of deposit forms and sensitive information are handled safely and securely.

Get more for Verification Of Deposit Form

- Fill in blank turabian bibliography worksheets form

- Moda appeal form

- Hysa player status form hawaii youth soccer association

- Akc additional signature form

- Suffolk county pistol license bureau form

- Mold addendum massachusetts form

- Bdeceased claim formatb baroda gujarat gramin bank

- Request for tender rft for the provision of tourism australia form

Find out other Verification Of Deposit Form

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now