Income Tax Customer Information Form Stanley & Associates

What is the Income Tax Customer Information Form Stanley & Associates

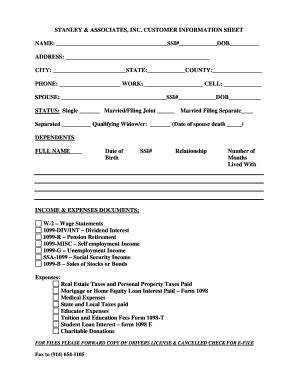

The Income Tax Customer Information Form Stanley & Associates is a document designed to collect essential information from clients for tax preparation purposes. This form typically includes personal details such as name, address, Social Security number, and income sources. It is crucial for ensuring accurate tax filing and compliance with IRS regulations. The information gathered helps tax professionals provide tailored advice and services to clients, facilitating a smoother tax preparation process.

Steps to complete the Income Tax Customer Information Form Stanley & Associates

Completing the Income Tax Customer Information Form Stanley & Associates involves several straightforward steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and previous tax returns.

- Fill in personal information: Enter your full name, address, and Social Security number accurately to avoid delays.

- Provide income details: List all sources of income, including wages, dividends, and any additional earnings.

- Review the form: Double-check all entries for accuracy and completeness to prevent errors.

- Sign and date: Ensure that you sign and date the form, as this is necessary for its validity.

Legal use of the Income Tax Customer Information Form Stanley & Associates

The legal use of the Income Tax Customer Information Form Stanley & Associates is governed by various regulations, including compliance with the IRS guidelines. This form must be filled out truthfully and accurately, as any discrepancies can lead to penalties or audits. Additionally, the form must be securely stored and handled to protect sensitive personal information, ensuring compliance with privacy laws such as the CCPA and HIPAA.

Key elements of the Income Tax Customer Information Form Stanley & Associates

Key elements of the Income Tax Customer Information Form Stanley & Associates include:

- Personal Information: This section captures the client's name, address, and Social Security number.

- Income Sources: Clients must disclose various income sources, which are vital for accurate tax calculations.

- Deductions and Credits: Information regarding applicable deductions and credits can also be included to optimize tax outcomes.

- Signature: A signature is required to validate the form and confirm that the information provided is correct.

How to obtain the Income Tax Customer Information Form Stanley & Associates

The Income Tax Customer Information Form Stanley & Associates can typically be obtained through several channels. Clients may receive the form directly from their tax consultant or accountant. Additionally, it may be available for download from the Stanley & Associates website or provided in physical format at their office. Ensuring that you have the most current version of the form is essential for compliance and accuracy in tax preparation.

Filing Deadlines / Important Dates

Filing deadlines for the Income Tax Customer Information Form Stanley & Associates align with the overall tax filing schedule established by the IRS. Generally, individual tax returns must be filed by April fifteenth of each year. However, if additional time is needed, clients can file for an extension, typically extending the deadline to October fifteenth. It is crucial to keep these dates in mind to avoid penalties and ensure timely processing of tax returns.

Quick guide on how to complete income tax customer information form stanley ampamp associates

Complete Income Tax Customer Information Form Stanley & Associates effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Income Tax Customer Information Form Stanley & Associates on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and eSign Income Tax Customer Information Form Stanley & Associates with ease

- Obtain Income Tax Customer Information Form Stanley & Associates and then click Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Income Tax Customer Information Form Stanley & Associates and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax customer information form stanley ampamp associates

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Income Tax Customer Information Form Stanley & Associates?

The Income Tax Customer Information Form Stanley & Associates is a document designed to collect necessary data from clients for tax preparation. This form ensures that all essential information is gathered efficiently, simplifying the tax filing process. By utilizing this form, our clients can easily provide the required details essential for accurate tax submissions.

-

How can I access the Income Tax Customer Information Form Stanley & Associates?

You can access the Income Tax Customer Information Form Stanley & Associates directly through our website. After signing up for airSlate SignNow, you will have immediate access to this form along with other essential templates. Simply log in, navigate to the forms section, and start filling out the required information.

-

Is the Income Tax Customer Information Form Stanley & Associates customizable?

Yes, the Income Tax Customer Information Form Stanley & Associates is fully customizable. You can tailor the form to suit the specific needs of your clients, adding or removing fields as necessary. This customization ensures that you collect all relevant information as per your requirements.

-

What are the pricing options for using the Income Tax Customer Information Form Stanley & Associates?

airSlate SignNow offers various pricing plans to accommodate different business needs, including flexible options for the Income Tax Customer Information Form Stanley & Associates. You can choose from monthly or annual plans that provide access to a variety of features and unlimited document signing. Visit our pricing page for more details on plans and features.

-

What features does airSlate SignNow provide for the Income Tax Customer Information Form Stanley & Associates?

airSlate SignNow provides a wide range of features for the Income Tax Customer Information Form Stanley & Associates including eSignature capabilities, document sharing, and automatic reminders. These features enhance the overall efficiency of collecting, signing, and managing tax documents. Moreover, our user-friendly interface ensures easy navigation and usage.

-

How does the Income Tax Customer Information Form Stanley & Associates benefit my business?

Using the Income Tax Customer Information Form Stanley & Associates can signNowly streamline your tax preparation process. It minimizes errors and omissions by gathering all necessary client information in one place. Additionally, the electronic signature feature improves client satisfaction as it allows for quick sign-offs without needing physical meetings.

-

Can the Income Tax Customer Information Form Stanley & Associates be integrated with other software?

Yes, the Income Tax Customer Information Form Stanley & Associates can be seamlessly integrated with various accounting and tax software platforms. This integration helps in automatic data transfer, reducing manual input. Our commitment to compatibility allows you to enhance your workflow and increase efficiency.

Get more for Income Tax Customer Information Form Stanley & Associates

Find out other Income Tax Customer Information Form Stanley & Associates

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement