Pa 1000 Property Tax Rent Rebate Form

What is the PA 1000 Property Tax Rent Rebate Form?

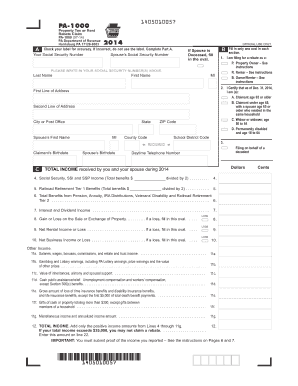

The PA 1000 Property Tax Rent Rebate Form is an official document used by eligible Pennsylvania residents to apply for a rebate on property taxes or rent paid during the previous year. This program is designed to provide financial relief to low-income seniors and individuals with disabilities. The form collects essential information about the applicant's income, residency, and the amount of rent or property taxes paid, which is necessary for determining eligibility and calculating the rebate amount.

How to Obtain the PA 1000 Property Tax Rent Rebate Form

To obtain the PA 1000 Property Tax Rent Rebate Form, individuals can visit the Pennsylvania Department of Revenue's website, where the form is available for download. Additionally, physical copies can be requested through local government offices, such as county treasurers or senior centers. It is important to ensure that the correct version for the applicable tax year is used, as forms may vary from year to year.

Steps to Complete the PA 1000 Property Tax Rent Rebate Form

Completing the PA 1000 Property Tax Rent Rebate Form involves several key steps:

- Gather required documentation, including proof of income and records of rent or property taxes paid.

- Fill out the personal information section, ensuring accuracy in names, addresses, and Social Security numbers.

- Provide details regarding income sources, including wages, pensions, and any other financial support.

- Indicate the amount of rent or property taxes paid during the previous year.

- Review the completed form for any errors or missing information before submission.

Eligibility Criteria

Eligibility for the PA 1000 Property Tax Rent Rebate Form is primarily based on income and age. Applicants must meet the following criteria:

- Be a Pennsylvania resident for the entire tax year.

- Be at least sixty-five years old, or be a widow/widower aged fifty-one or older, or be permanently disabled.

- Have a total income below the specified limits set by the state, which may vary annually.

Form Submission Methods

The completed PA 1000 Property Tax Rent Rebate Form can be submitted through various methods:

- Online submission via the Pennsylvania Department of Revenue's e-filing system.

- Mailing the completed form to the appropriate regional office.

- In-person submission at designated government offices, where assistance may be available.

Key Elements of the PA 1000 Property Tax Rent Rebate Form

Understanding the key elements of the PA 1000 Property Tax Rent Rebate Form is crucial for successful completion. Important sections include:

- Personal Information: Name, address, and Social Security number.

- Income Details: Comprehensive listing of all income sources.

- Rent or Property Tax Information: Amount paid, including supporting documentation.

- Signature: Required to certify the accuracy of the information provided.

Quick guide on how to complete pa 1000 property tax rent rebate form

Complete Pa 1000 Property Tax Rent Rebate Form effortlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, as you can obtain the correct format and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Pa 1000 Property Tax Rent Rebate Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Pa 1000 Property Tax Rent Rebate Form with ease

- Find Pa 1000 Property Tax Rent Rebate Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form navigation, or mistakes that require printing additional document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Alter and eSign Pa 1000 Property Tax Rent Rebate Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pa 1000 property tax rent rebate form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PA 1000 property tax rent rebate form 2020?

The PA 1000 property tax rent rebate form 2020 is a state-specific document used by Pennsylvania residents to claim a rebate on property taxes or rent paid during the previous year. This form is essential for qualifying individuals to receive financial assistance from the Pennsylvania government.

-

How can I obtain the PA 1000 property tax rent rebate form 2020?

You can obtain the PA 1000 property tax rent rebate form 2020 from the Pennsylvania Department of Revenue's website or at local government offices. It's advisable to download the form directly online for convenience and ensure you have the most current version.

-

Who is eligible to file the PA 1000 property tax rent rebate form 2020?

Eligibility for the PA 1000 property tax rent rebate form 2020 typically includes individuals who are 65 years or older, widows or widowers aged 50 or older, or individuals with disabilities. Income limits apply, so it's essential to review the criteria before applying.

-

What documents do I need to complete the PA 1000 property tax rent rebate form 2020?

To complete the PA 1000 property tax rent rebate form 2020, you will need your Social Security number, income information, and records of property tax or rent payments made throughout the year. Keeping these documents organized will help streamline the application process.

-

What is the deadline for submitting the PA 1000 property tax rent rebate form 2020?

The deadline for submitting the PA 1000 property tax rent rebate form 2020 is typically set by the Pennsylvania Department of Revenue. It is crucial to submit your application by the date indicated on their website to ensure that you receive your rebate in a timely manner.

-

Can I eSign the PA 1000 property tax rent rebate form 2020 using airSlate SignNow?

Yes, you can eSign the PA 1000 property tax rent rebate form 2020 using airSlate SignNow. Our platform provides a user-friendly, cost-effective solution for electronically signing documents, ensuring your form is completed quickly and securely.

-

What are the benefits of using airSlate SignNow for the PA 1000 property tax rent rebate form 2020?

Using airSlate SignNow for the PA 1000 property tax rent rebate form 2020 offers numerous benefits, including increased efficiency, reduced paperwork, and a secure way to manage your documents. Our service ensures that your submissions are both legally compliant and easy to track.

Get more for Pa 1000 Property Tax Rent Rebate Form

Find out other Pa 1000 Property Tax Rent Rebate Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT