US 1120S Form

What is the US 1120S

The US 1120S form is a tax return specifically designed for S corporations in the United States. This form allows S corporations to report income, deductions, and credits to the Internal Revenue Service (IRS). Unlike traditional corporations, S corporations pass their income directly to shareholders, who then report it on their personal tax returns. This unique structure helps avoid double taxation, making it a popular choice for small businesses and startups.

How to use the US 1120S

Using the US 1120S form involves several steps to ensure accurate reporting of your S corporation's financial activities. First, gather all necessary financial documents, including income statements, balance sheets, and records of deductions. Next, complete the form by providing information about the corporation, such as its name, address, and Employer Identification Number (EIN). Be sure to accurately report all income and expenses, as this will affect the tax liability of shareholders.

Steps to complete the US 1120S

Completing the US 1120S form requires careful attention to detail. Follow these steps:

- Start by entering your corporation's basic information, including the name, address, and EIN.

- Report the corporation's income by listing all revenue sources, including sales and interest income.

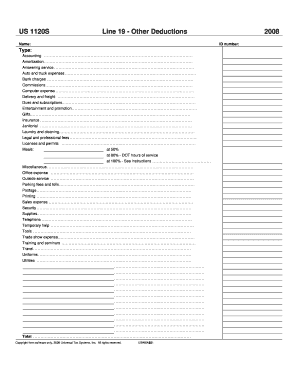

- Detail all deductions, such as salaries, rent, and utilities, to determine the taxable income.

- Calculate the tax credits the corporation is eligible for, which can reduce the overall tax burden.

- Ensure all information is accurate and complete before submitting the form.

Filing Deadlines / Important Dates

Filing the US 1120S form is subject to specific deadlines that must be adhered to avoid penalties. Generally, the form is due on the fifteenth day of the third month after the end of the corporation's tax year. For corporations that operate on a calendar year, this typically falls on March 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is essential to keep track of these dates to ensure timely submission.

Legal use of the US 1120S

The legal use of the US 1120S form is governed by IRS regulations. It is crucial for S corporations to file this form annually to maintain their status. Failure to file can result in the loss of S corporation status, leading to potential double taxation. Additionally, the information reported on the form must be accurate and truthful, as discrepancies can lead to audits or penalties from the IRS.

Required Documents

To successfully complete the US 1120S form, certain documents are required. These include:

- Financial statements, including profit and loss statements and balance sheets.

- Records of all income sources and expenses incurred during the tax year.

- Documentation supporting any deductions or credits claimed.

- Shareholder information, including their ownership percentages and Social Security numbers.

Who Issues the Form

The US 1120S form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and tax law enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that S corporations can accurately report their financial activities and comply with federal tax laws.

Quick guide on how to complete us 1120s

Complete US 1120S seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers a splendid eco-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage US 1120S on any platform with airSlate SignNow Android or iOS applications and enhance any document-based task today.

The most effective way to edit and eSign US 1120S effortlessly

- Find US 1120S and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign US 1120S and ensure outstanding communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the us 1120s

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the US 1120S form and who needs to file it?

The US 1120S form is a tax document used by S corporations to report income, deductions, and credits to the IRS. Any corporation that has chosen S corp status must file this form annually, ensuring compliance with federal tax regulations and avoiding potential penalties.

-

How can airSlate SignNow assist with the US 1120S filing process?

airSlate SignNow simplifies the US 1120S filing process by enabling businesses to easily prepare and eSign necessary documents securely. Our solution streamlines collaboration among stakeholders, ensuring that all required signatures are obtained promptly, making tax season less stressful.

-

What features does airSlate SignNow provide that are relevant to US 1120S?

airSlate SignNow offers user-friendly features such as document templates, eSignature workflows, and secure storage, all of which are beneficial for managing US 1120S filings. These capabilities maximize efficiency and reduce the likelihood of errors during the filing process.

-

Is airSlate SignNow cost-effective for businesses filing the US 1120S?

Yes, airSlate SignNow is a cost-effective solution for businesses, particularly when it comes to filing the US 1120S. With competitive pricing, organizations can manage their document signing needs without breaking the bank while ensuring compliance and accuracy in their tax filings.

-

Can airSlate SignNow integrate with accounting software for US 1120S preparation?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, enhancing the efficiency of preparing the US 1120S. This integration allows businesses to pull data directly from their accounting systems, reducing manual input and the associated risk of errors.

-

What are the main benefits of using airSlate SignNow for US 1120S documentation?

Using airSlate SignNow for US 1120S documentation provides several key benefits, including increased speed in obtaining signatures and enhanced security for sensitive information. Additionally, it allows for easy tracking of document status, ensuring that your tax documents are always in order and filed on time.

-

Is it easy to use airSlate SignNow for someone unfamiliar with e-signatures?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals unfamiliar with e-signatures. Our intuitive interface and easy-to-follow guides assist users in navigating the process of preparing and signing documents, including the US 1120S, without any technical expertise.

Get more for US 1120S

- Hsa trustee or custodian form

- Tobii pro glasses 2 software development kit and api form

- Pdf download graphic design the new basics second edition revised and expanded by ellen lupton jennifer cole phillips full form

- 2018 form 593 v payment voucher for real franchise tax

- Elements of an informativeexplanatory paragraph htc mpc

- Broker examination application pennsylvania form

- Tax ny form

- Jumping zaxx waiver rosenbergdocx form

Find out other US 1120S

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT