Metlife Loan Request Form

What is the Metlife Loan Request Form

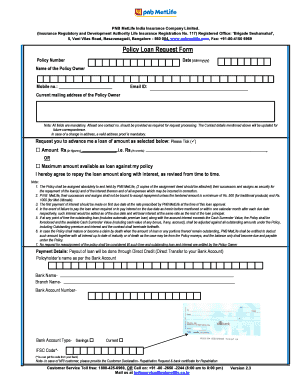

The Metlife loan request form is a crucial document for policyholders seeking to borrow against the cash value of their Metlife life insurance policy. This form allows individuals to formally request a loan, detailing the amount desired and acknowledging the terms associated with the loan. It is essential for policyholders to understand that borrowing against their policy may affect its death benefit and cash value. Proper completion of this form ensures that the loan is processed efficiently and in accordance with Metlife's policies.

How to Use the Metlife Loan Request Form

Utilizing the Metlife loan request form involves several straightforward steps. Begin by downloading or accessing the form through Metlife’s official channels. Fill in your personal information, including your policy number and the amount you wish to borrow. It is important to review the terms and conditions outlined in the form, as these will inform you of any implications related to the loan. Once completed, you can submit the form electronically or via traditional mail, depending on your preference and Metlife's submission guidelines.

Steps to Complete the Metlife Loan Request Form

Completing the Metlife loan request form requires careful attention to detail. Follow these steps for a successful submission:

- Access the form through Metlife’s website or customer service.

- Enter your personal information accurately, including your full name, address, and policy number.

- Specify the loan amount you are requesting, ensuring it does not exceed your policy's cash value.

- Review the loan terms and conditions to understand the implications of borrowing.

- Sign and date the form to validate your request.

- Submit the form as per the instructions provided, either online or by mail.

Legal Use of the Metlife Loan Request Form

The legal use of the Metlife loan request form is governed by various regulations that ensure the validity of the loan agreement. By signing the form, you are entering into a legally binding contract with Metlife. It is essential to ensure that all information provided is accurate and truthful to avoid any legal complications. The form must comply with relevant laws, including those surrounding eSignatures, which are recognized under the ESIGN Act and UETA in the United States, ensuring that your digital submission is as valid as a paper document.

Required Documents

When submitting the Metlife loan request form, certain documents may be required to support your application. Typically, you will need to provide:

- A copy of your Metlife life insurance policy for reference.

- Identification documents, such as a driver's license or Social Security number, to verify your identity.

- Any additional documentation requested by Metlife, which may include proof of income or financial statements.

Having these documents ready will facilitate a smoother application process and help expedite the approval of your loan request.

Form Submission Methods

The Metlife loan request form can be submitted through various methods, allowing flexibility based on your preference. The available submission methods typically include:

- Online submission through Metlife's secure portal, which allows for immediate processing.

- Mailing the completed form to the address specified on the form, which may take longer for processing.

- In-person submission at a local Metlife office, if available, which allows for direct interaction with a representative.

Choosing the right submission method can impact the speed at which your loan request is processed.

Quick guide on how to complete metlife loan request form

Accomplish Metlife Loan Request Form seamlessly on any device

Digital document administration has gained signNow traction among businesses and individuals. It provides an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Metlife Loan Request Form on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to alter and eSign Metlife Loan Request Form effortlessly

- Obtain Metlife Loan Request Form and click on Get Form to initiate.

- Utilize the tools we offer to complete your form.

- Emphasize signNow portions of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your adjustments.

- Select how you prefer to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Alter and eSign Metlife Loan Request Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the metlife loan request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MetLife loan request form and how can it be accessed?

The MetLife loan request form is a document that borrowers use to apply for loans through MetLife. You can access this form easily online and fill it out using airSlate SignNow's electronic signing feature, ensuring a seamless application process.

-

How does airSlate SignNow enhance the MetLife loan request form process?

airSlate SignNow streamlines the MetLife loan request form process by allowing users to complete, sign, and send documents from any device. This ease of use helps ensure that your loan application is processed quickly and efficiently.

-

Are there any costs associated with using airSlate SignNow for the MetLife loan request form?

airSlate SignNow offers competitive pricing for its services, which includes using the MetLife loan request form. The cost-effectiveness of this solution is designed to empower users while providing high-quality document management.

-

What features does airSlate SignNow offer for completing the MetLife loan request form?

airSlate SignNow provides features such as eSignature, document templates, and real-time tracking, all of which enhance the experience of filling out the MetLife loan request form. These features ensure that your documents are completed accurately and promptly.

-

Is it easy to integrate airSlate SignNow with other tools for the MetLife loan request form?

Yes, airSlate SignNow offers easy integrations with various platforms, making it convenient to use alongside your existing software tools when working on the MetLife loan request form. This flexibility allows you to enhance your workflow and save time.

-

What are the security measures in place when using airSlate SignNow for the MetLife loan request form?

airSlate SignNow employs robust security measures, including encryption and secure cloud storage, to protect sensitive information in the MetLife loan request form. This ensures that your data remains confidential and safe throughout the signing process.

-

Can multiple users collaborate on the MetLife loan request form using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the MetLife loan request form seamlessly. This collaborative feature makes it easier for teams to work together, ensuring all necessary information is accurately filled out.

Get more for Metlife Loan Request Form

- Sellers inspection response form

- Petsmart store list by state store number account name address form

- Safety amp health self assessment checklists virginia ship bb osha osha form

- Appendix e research evidence appraisal tool form

- Missouri intra club guest player form

- 2017 instructions 4562 form

- Adding a joint owner instructions amp authorization form

- Swiftwater pa 18370 0200 form

Find out other Metlife Loan Request Form

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast