Form 500d Maryland

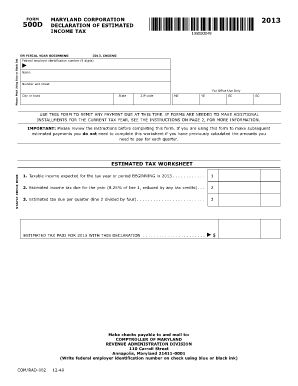

What is the Maryland Form 500D?

The Maryland Form 500D is a tax document used by individuals and businesses in Maryland to report income and calculate their tax liability. This form is specifically designed for non-residents and part-year residents who have earned income in Maryland. It is important for ensuring compliance with state tax laws and accurately reporting income earned within the state.

How to Use the Maryland Form 500D

Using the Maryland Form 500D involves several steps. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, fill out the form by providing your personal information, including your name, address, and Social Security number. Report your income earned in Maryland and calculate your tax liability based on the provided tax tables. Finally, review the form for accuracy before submitting it to the Maryland Comptroller's office.

Steps to Complete the Maryland Form 500D

Completing the Maryland Form 500D requires careful attention to detail. Follow these steps:

- Collect all relevant income documents.

- Fill in your personal information accurately.

- Report all income earned in Maryland.

- Calculate your deductions and credits, if applicable.

- Determine your tax liability using the tax tables provided.

- Sign and date the form before submission.

Legal Use of the Maryland Form 500D

The Maryland Form 500D is legally binding when completed and submitted according to state regulations. To ensure its validity, it must be signed and dated by the taxpayer. Additionally, the form should be submitted by the established filing deadline to avoid penalties. Compliance with all state tax laws is essential for the legal use of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland Form 500D are crucial for compliance. Typically, the form must be submitted by April fifteenth of the year following the tax year. If this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be aware of any extensions that may apply and ensure they file on time to avoid penalties.

Form Submission Methods

The Maryland Form 500D can be submitted through various methods. Taxpayers have the option to file online through the Maryland Comptroller's website, which offers a secure and efficient way to submit forms. Alternatively, the form can be mailed to the appropriate address listed on the form or submitted in person at designated offices. Each method has its own processing times and requirements.

Quick guide on how to complete form 500d maryland

Prepare Form 500d Maryland effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Form 500d Maryland on any platform with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

The simplest way to modify and eSign Form 500d Maryland with ease

- Locate Form 500d Maryland and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your selected device. Modify and eSign Form 500d Maryland and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 500d maryland

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Maryland Form 500D 2024, and who needs it?

The Maryland Form 500D 2024 is a document used for reporting income and deductions for businesses within Maryland. It is essential for businesses that are required to file a Maryland tax return. By understanding this form, you can ensure compliance and maximize your tax benefits.

-

How can airSlate SignNow help with Maryland Form 500D 2024?

airSlate SignNow streamlines the signing and management process for documents like the Maryland Form 500D 2024. With its user-friendly interface, businesses can easily send, sign, and store their tax documents securely online, saving time and reducing the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Maryland Form 500D 2024?

Yes, airSlate SignNow offers various pricing plans to suit different business needs when managing documents like the Maryland Form 500D 2024. These plans are designed to be cost-effective, ensuring you get the features necessary without overspending.

-

What features does airSlate SignNow offer for managing the Maryland Form 500D 2024?

airSlate SignNow provides several features tailored for documents like the Maryland Form 500D 2024, including e-signatures, templates, and document tracking. These features ensure that your forms are completed efficiently and securely, enhancing your overall workflow.

-

Can I integrate airSlate SignNow with other tools for filing Maryland Form 500D 2024?

Absolutely! airSlate SignNow integrates with various business applications and software, making it easy to incorporate it into your existing systems when dealing with the Maryland Form 500D 2024. This ensures a seamless experience for managing your documents.

-

What are the benefits of e-signing the Maryland Form 500D 2024?

E-signing the Maryland Form 500D 2024 with airSlate SignNow offers numerous benefits, including faster processing times, enhanced security, and lower administrative costs. These features help businesses streamline their tax filing process, ensuring compliance while improving efficiency.

-

How secure is airSlate SignNow when handling sensitive documents like the Maryland Form 500D 2024?

Security is a top priority for airSlate SignNow. When handling critical documents such as the Maryland Form 500D 2024, the platform employs advanced encryption and data protection measures, ensuring your information remains confidential and secure.

Get more for Form 500d Maryland

- Loi nuskin form

- Aro form 99

- Patient responsibility letter template form

- Virginia 529 intent to enroll form

- Mdcf form

- Boarding contract for horses form

- Unofficial consolidation form 45 106f12 risk acknowledgement form for family friend and business associate investors

- Site form indd ministry of forests for gov bc

Find out other Form 500d Maryland

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free