Form 84ag Refund Table

What is the Form 84ag Refund Table

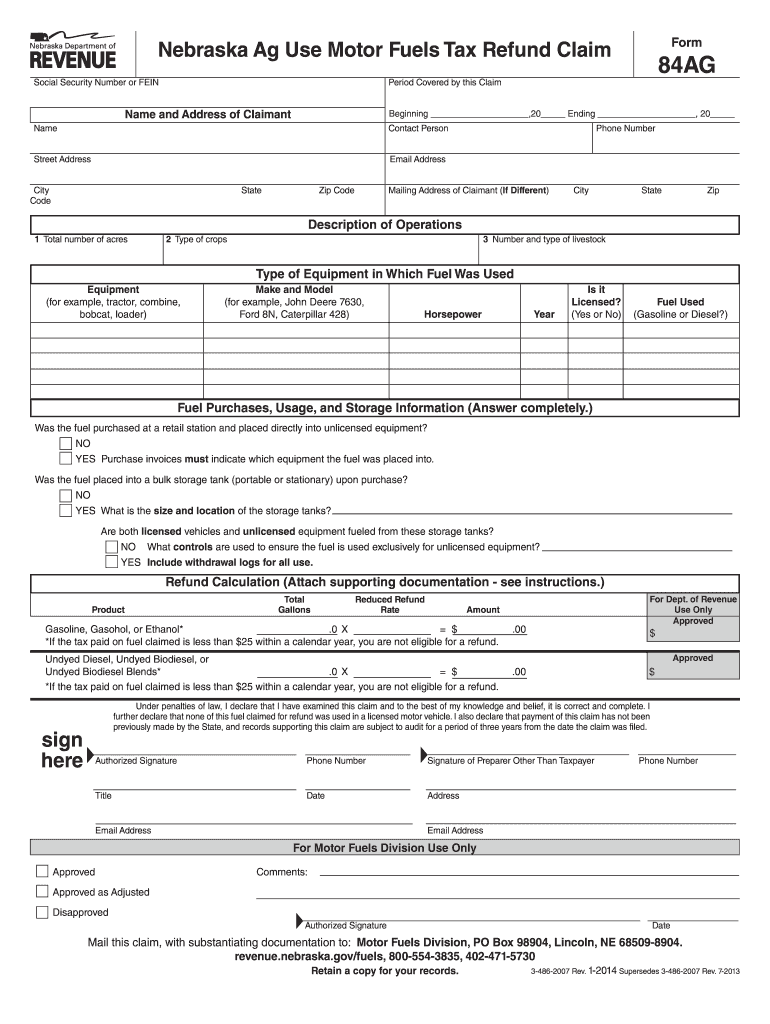

The Form 84ag Refund Table is a specific document used in the context of tax refunds in the United States. It serves as a structured method for taxpayers to claim refunds for overpayments or adjustments related to their tax filings. This form is particularly relevant for individuals and businesses that need to reconcile their tax obligations and ensure they receive any due refunds in a timely manner. Understanding the details and requirements of this form is essential for accurate tax reporting and compliance.

How to use the Form 84ag Refund Table

Using the Form 84ag Refund Table involves a few straightforward steps. First, gather all necessary financial documents, including previous tax returns and any relevant payment records. Next, fill out the form with accurate information regarding your tax situation, including the amounts you are claiming for refund. It is crucial to double-check all entries for accuracy before submission. Once completed, the form can be submitted either electronically or via traditional mail, depending on your preference and the specific instructions provided for the form.

Steps to complete the Form 84ag Refund Table

Completing the Form 84ag Refund Table requires careful attention to detail. Follow these steps for accurate completion:

- Obtain the latest version of the Form 84ag Refund Table from the appropriate source.

- Review the instructions carefully to understand the information required.

- Fill in your personal and financial information accurately.

- Calculate the refund amount based on your tax records.

- Sign and date the form to validate your submission.

- Submit the completed form according to the provided guidelines.

Legal use of the Form 84ag Refund Table

The legal use of the Form 84ag Refund Table is governed by various tax laws and regulations in the United States. To ensure that your submission is legally binding, it is important to comply with the guidelines set forth by the Internal Revenue Service (IRS). This includes providing accurate information, adhering to filing deadlines, and maintaining proper documentation to support your claims. Failure to follow these legal requirements may result in penalties or delays in receiving your refund.

Required Documents

When completing the Form 84ag Refund Table, certain documents are necessary to support your claim. These may include:

- Previous tax returns

- Proof of payments made

- Any correspondence with the IRS regarding your tax status

- Documentation of deductions or credits claimed

Having these documents on hand will facilitate a smoother completion process and help substantiate your refund request.

Filing Deadlines / Important Dates

Filing deadlines for the Form 84ag Refund Table are critical to ensure timely processing of your refund. Typically, taxpayers must submit this form by the tax filing deadline, which is usually April 15 for individual taxpayers. However, specific circumstances may alter these dates, such as extensions granted by the IRS. It is essential to stay informed about any changes to filing deadlines to avoid penalties or delays in receiving your refund.

Quick guide on how to complete form 84ag refund table

Complete Form 84ag Refund Table seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed papers, as you can find the necessary form and securely preserve it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents swiftly without any holdups. Handle Form 84ag Refund Table on any device with the airSlate SignNow Android or iOS applications and streamline any document-based workflow today.

The easiest way to modify and eSign Form 84ag Refund Table effortlessly

- Find Form 84ag Refund Table and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and bears the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and eSign Form 84ag Refund Table and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 84ag refund table

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 84ag and how can airSlate SignNow help?

Form 84ag is a document used for certain legal or organizational purposes. airSlate SignNow provides a seamless platform for clients to fill out, send, and eSign the form 84ag efficiently, ensuring that all required information is accurately captured.

-

What are the key features of airSlate SignNow for managing form 84ag?

AirSlate SignNow offers features like auto-fill, document templates, and custom workflows specifically designed for form 84ag. These features streamline the process, making it easy for users to manage their documents without hassle.

-

Is there a cost associated with using airSlate SignNow for form 84ag?

Yes, airSlate SignNow provides various pricing plans that cater to businesses of all sizes. Users can choose a plan that fits their budget while leveraging the cost-effective solution to manage form 84ag and other documentation needs.

-

Can I integrate airSlate SignNow with other applications for form 84ag?

Absolutely! airSlate SignNow offers integrations with popular applications, allowing you to connect your workflow and enhance the efficiency of handling form 84ag. This ensures a more streamlined experience across platforms.

-

What are the benefits of using airSlate SignNow for form 84ag?

Using airSlate SignNow for form 84ag offers several benefits, including time savings and increased accuracy. The platform reduces the risk of errors and accelerates the signing process, enabling businesses to focus more on their core activities.

-

How secure is airSlate SignNow when handling form 84ag?

Security is a top priority at airSlate SignNow. When dealing with form 84ag, our platform employs advanced encryption and compliance measures to ensure your documents are safe and secure from unauthorized access.

-

Can I track the status of form 84ag in airSlate SignNow?

Yes, airSlate SignNow allows you to easily track the status of your form 84ag. You can see when it has been sent, viewed, and signed, giving you complete visibility and control over your document workflow.

Get more for Form 84ag Refund Table

- Argos application form

- New employee set upmaintenance form

- Cigna 360 exam incentive form

- The ebola wars case study answer key form

- Angeles city building permit forms

- Ontario youth apprenticeship program oyap placement card form

- Download 911 pamphlet lghealth form

- Best ontario site map best ontario inc nuans amp business form

Find out other Form 84ag Refund Table

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now