Form Wt 7

What is the Form Wt 7

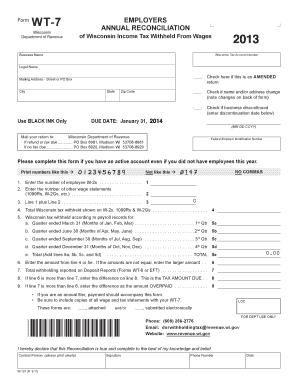

The Form Wt 7 is a Wisconsin-specific document used primarily for annual reconciliation of withholding taxes. This form is essential for employers who need to report the amount of state income tax withheld from employees' wages. It helps ensure compliance with state tax regulations and provides a summary of the withholding amounts for the year.

How to use the Form Wt 7

To effectively use the Form Wt 7, employers must first gather all relevant payroll information for the year. This includes total wages paid, the amount of state income tax withheld, and any adjustments that may apply. After compiling this data, complete the form accurately, ensuring that all figures are correct. Once completed, the form can be submitted to the Wisconsin Department of Revenue as part of the annual tax filing process.

Steps to complete the Form Wt 7

Completing the Form Wt 7 involves several key steps:

- Gather all necessary payroll records, including total wages and withholding amounts.

- Fill in the employer's information, including name, address, and identification number.

- Input the total wages paid and the total amount of Wisconsin income tax withheld.

- Review the form for accuracy, ensuring all calculations are correct.

- Sign and date the form before submission.

Legal use of the Form Wt 7

The legal use of the Form Wt 7 is crucial for employers in Wisconsin. It serves as an official record of the state income tax withheld from employees, which is necessary for compliance with state tax laws. Failing to file this form or submitting inaccurate information can lead to penalties or audits by the Wisconsin Department of Revenue.

Filing Deadlines / Important Dates

Employers must be aware of specific deadlines when submitting the Form Wt 7. Typically, the form is due by January 31 of the following year for the previous calendar year’s withholding. It is important to mark this date on the calendar to avoid late penalties. Additionally, employers should keep track of any changes in state regulations that may affect filing deadlines.

Form Submission Methods (Online / Mail / In-Person)

The Form Wt 7 can be submitted through multiple methods, providing flexibility for employers. Options include:

- Online: Employers can file electronically through the Wisconsin Department of Revenue's e-filing system.

- Mail: The completed form can be printed and mailed to the appropriate state office.

- In-Person: Employers may also choose to deliver the form directly to a local Department of Revenue office.

Quick guide on how to complete form wt 7

Complete Form Wt 7 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow offers all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Form Wt 7 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to alter and eSign Form Wt 7 effortlessly

- Obtain Form Wt 7 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your needs in document management with just a few clicks from any device of your choosing. Edit and eSign Form Wt 7 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form wt 7

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the wi form wt 7 and how can airSlate SignNow help with it?

The wi form wt 7 is a tax document used for reporting withholdings in Wisconsin. airSlate SignNow simplifies the process of signing and submitting this form, ensuring you can easily manage all your tax documents electronically. With digitized workflows, you can efficiently fill out, sign, and share your wi form wt 7 without delays.

-

What features does airSlate SignNow offer for managing the wi form wt 7?

airSlate SignNow includes features such as templates, document sharing, and real-time collaboration specifically designed to streamline the completion of the wi form wt 7. Users can create reusable templates for the form to save time and ensure accuracy in their submissions. The platform provides scalability for businesses of all sizes needing to manage tax documents effectively.

-

How much does it cost to use airSlate SignNow for the wi form wt 7?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains a cost-effective solution for managing the wi form wt 7 and other documents. Potential users can take advantage of a free trial to explore its features and understand how it can benefit their tax management needs before committing to a subscription.

-

Can I integrate airSlate SignNow with other software for managing the wi form wt 7?

Yes, airSlate SignNow offers various integrations with software platforms such as CRM systems and cloud storage services, allowing you to manage the wi form wt 7 alongside your existing workflows. These integrations can help streamline the process of document management by connecting all tools your team already uses.

-

What are the benefits of using airSlate SignNow for the wi form wt 7 compared to traditional methods?

Using airSlate SignNow for the wi form wt 7 eliminates the need for paper documentation, reducing waste and the potential for errors associated with manual entry. Additionally, the platform provides secure electronic signatures and the ability to track the status of documents, ensuring a more efficient and reliable submission process compared to traditional methods.

-

Is airSlate SignNow user-friendly for completing the wi form wt 7?

Absolutely! airSlate SignNow is designed with an intuitive interface, making it easy for users of all skill levels to complete the wi form wt 7. The step-by-step guidance and user-friendly features enhance the overall experience, allowing anyone to navigate the platform comfortably.

-

What types of businesses benefit from using airSlate SignNow for the wi form wt 7?

Businesses of all sizes can benefit from using airSlate SignNow for the wi form wt 7, especially those that handle numerous tax-related documents and transactions. Whether you're a small business just starting or a large corporation managing complex compliance issues, airSlate SignNow offers the tools needed for effective document handling.

Get more for Form Wt 7

Find out other Form Wt 7

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF