Nj St 51 Form

What is the Nj St 51

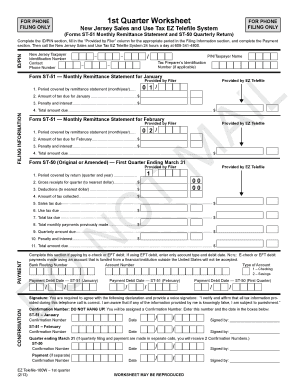

The Nj St 51 form is a document used in New Jersey for specific legal and administrative purposes. It is often required for various transactions and processes, including tax filings and compliance with state regulations. Understanding the function and requirements of the Nj St 51 is essential for individuals and businesses operating within New Jersey.

How to use the Nj St 51

Using the Nj St 51 involves filling out the form accurately and submitting it to the appropriate state agency. The form typically requires detailed information about the individual or entity submitting it, including identification details and the purpose of the submission. It is crucial to follow the instructions carefully to ensure compliance with state laws.

Steps to complete the Nj St 51

Completing the Nj St 51 form involves several steps:

- Gather necessary information, such as identification numbers and relevant documentation.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the form online, by mail, or in person, depending on the requirements.

Legal use of the Nj St 51

The Nj St 51 is legally binding when completed and submitted according to the state’s regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal consequences. Compliance with the legal requirements surrounding the Nj St 51 helps protect individuals and businesses from potential penalties.

Key elements of the Nj St 51

Key elements of the Nj St 51 form include:

- Identification information of the individual or business submitting the form.

- Specific purpose for which the form is being submitted.

- Signature of the individual or authorized representative.

- Date of submission.

Who Issues the Form

The Nj St 51 form is issued by the New Jersey Division of Taxation or other relevant state agencies, depending on its specific use. It is important to ensure that the correct version of the form is obtained from official sources to avoid any issues during submission.

Quick guide on how to complete nj st 51

Effortlessly Prepare Nj St 51 on Any Device

Online document management has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Nj St 51 on any device with airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The Easiest Way to Edit and Electronically Sign Nj St 51 Effortlessly

- Obtain Nj St 51 and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to send your form, by email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Nj St 51 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nj st 51

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the st 51 feature in airSlate SignNow?

The st 51 feature in airSlate SignNow allows users to streamline the document signing process. It offers an intuitive interface for quick eSigning, ensuring that important documents are handled efficiently. This feature can signNowly reduce turnaround times for signatures.

-

How much does the st 51 service cost?

The st 51 service pricing varies based on the chosen plan within airSlate SignNow. There are flexible pricing options suitable for businesses of all sizes, providing great value for the features offered. You can explore our pricing page for detailed information about each plan.

-

What are the main benefits of using st 51?

Using the st 51 feature enhances productivity by simplifying document workflows and reducing paper usage. Businesses experience increased efficiency as documents can be sent for signing instantly. Additionally, the legal compliance provided by airSlate SignNow ensures that your signed documents are secure and valid.

-

Does airSlate SignNow with st 51 integrate with other applications?

Yes, airSlate SignNow with st 51 integrates seamlessly with various applications, including CRM systems, cloud storage platforms, and productivity tools. This facilitates a smooth workflow by allowing you to manage your documents from your favorite apps. Integration enhances the overall user experience and boosts operational efficiency.

-

Is there a free trial available for st 51?

Yes, airSlate SignNow offers a free trial for users interested in the st 51 feature. This allows you to explore all the capabilities and benefits of the platform without any commitment. You can assess how st 51 fits your business needs during the trial period.

-

How secure is the st 51 eSigning process?

The st 51 eSigning process in airSlate SignNow is highly secure, employing advanced encryption measures to protect your data. AirSlate SignNow complies with legal regulations, ensuring that your documents are protected throughout the signing process. You can sign with confidence knowing your information is safeguarded.

-

Can st 51 be used for international document signing?

Absolutely, st 51 is designed for international document signing, making it suitable for businesses with a global presence. The airSlate SignNow platform is compliant with international eSignature laws, providing assurance that your signed documents are valid across borders. This feature is perfect for companies engaging with clients or partners globally.

Get more for Nj St 51

Find out other Nj St 51

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF