Credit Card Authorization Form Marriott AFT Aft

What is the Marriott Credit Card Authorization Form?

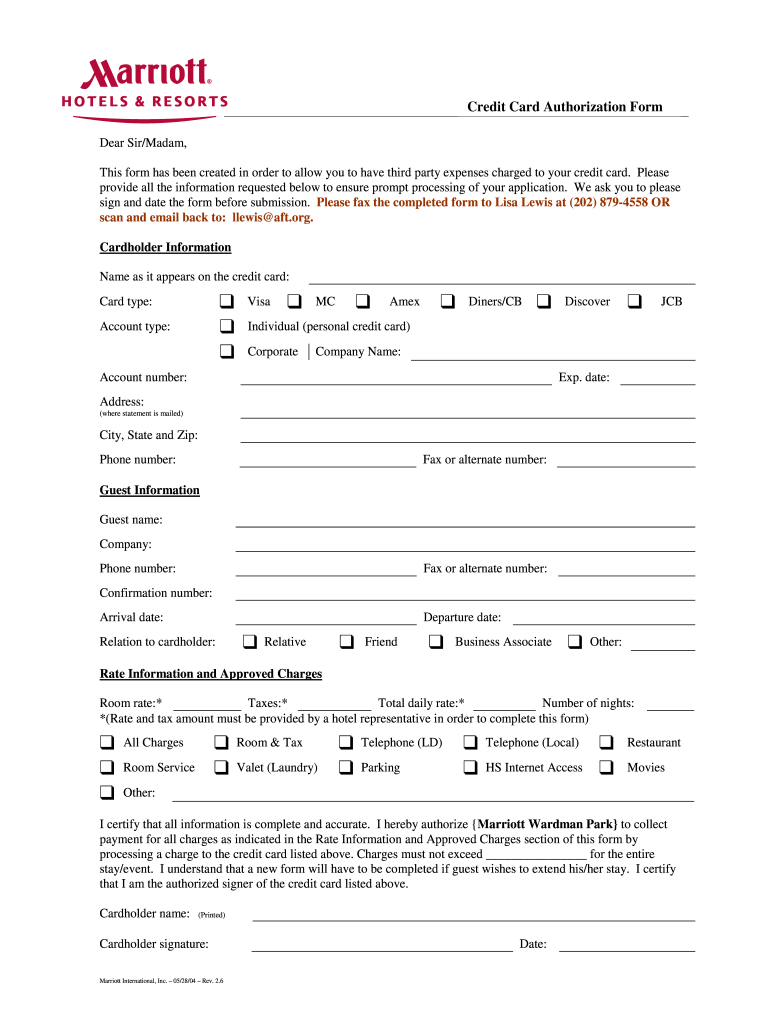

The Marriott credit card authorization form is a document that allows a cardholder to authorize a hotel to charge their credit card for specific expenses. This form is often used in the hospitality industry to ensure that charges related to a guest's stay, such as room service or incidentals, can be processed smoothly. The form typically includes important information such as the guest's name, reservation details, and the credit card information being authorized for use.

Key Elements of the Marriott Credit Card Authorization Form

Understanding the key elements of the Marriott credit card authorization form is essential for proper completion. The primary components include:

- Guest Information: This section requires the guest's full name, contact information, and reservation number.

- Credit Card Details: The form must include the credit card number, expiration date, and the cardholder's name as it appears on the card.

- Authorization Statement: The cardholder must provide a statement authorizing the hotel to charge the specified amounts to the credit card.

- Signature: A signature is required to validate the authorization, confirming that the cardholder agrees to the terms outlined in the form.

Steps to Complete the Marriott Credit Card Authorization Form

Filling out the Marriott credit card authorization form involves several straightforward steps:

- Gather necessary information, including your reservation details and credit card information.

- Fill in your personal details in the designated sections of the form.

- Enter the credit card information accurately, ensuring all numbers and dates are correct.

- Review the authorization statement and ensure you understand the terms.

- Sign and date the form to confirm your authorization.

- Submit the completed form to the hotel, either electronically or via fax, based on their submission guidelines.

How to Obtain the Marriott Credit Card Authorization Form

The Marriott credit card authorization form can typically be obtained through the following methods:

- Hotel Website: Many Marriott hotels provide downloadable versions of the form on their official websites.

- Contacting the Hotel: You can request the form directly from the hotel where you have a reservation.

- Email Request: Some hotels may allow you to request the form via email, which they can send to you as a PDF.

Legal Use of the Marriott Credit Card Authorization Form

The legal use of the Marriott credit card authorization form is governed by federal and state laws regarding electronic signatures and consumer protection. To ensure that the form is legally binding, it is important to use a reliable digital signature platform that complies with the ESIGN Act and UETA. This compliance guarantees that the authorization is recognized as valid in legal contexts, protecting both the cardholder and the hotel.

Digital vs. Paper Version of the Marriott Credit Card Authorization Form

Both digital and paper versions of the Marriott credit card authorization form serve the same purpose but differ in their execution. The digital version allows for quicker processing and easier submission, especially for remote transactions. It often includes features such as electronic signatures and secure data handling. In contrast, the paper version may require mailing or faxing, which can take additional time. Choosing between the two often depends on personal preference and the specific requirements of the hotel.

Quick guide on how to complete credit card authorization form marriott aft aft

Effortlessly Prepare Credit Card Authorization Form Marriott AFT Aft on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary forms and securely archive them online. airSlate SignNow equips you with all the tools required to create, amend, and electronically sign your documents swiftly without delays. Handle Credit Card Authorization Form Marriott AFT Aft on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric workflow today.

How to Alter and Electronically Sign Credit Card Authorization Form Marriott AFT Aft with Ease

- Obtain Credit Card Authorization Form Marriott AFT Aft and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which only takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether via email, SMS, invitation link, or download it to your computer.

Forget about misplaced or lost documents, tedious form searches, or errors that require printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Credit Card Authorization Form Marriott AFT Aft to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Is it safe to give all my details: name, address, credit card number and CVV, when filling in a credit card authorization form?

Safety is relative.Ecommerce is safe as long as you know what to look for. If the site doesn't feel safe, go with your gut. Here are reasons why you have to fill out all of the information requested like name, address, CVV and full card number.1. When you are purchasing goods from a merchant, that merchant needs certain information to verify you are the valid cardholder. The merchant is assuming the real risk in assuming you aren't a fraudster using a stolen card. Put yourself in the merchant's position. Would you just take a card number and expiration date from some random cardholder and hope it's not a stolen card?2. Information such as Address and ZIP and CVV/CVC (Visa/MC) or CID (Amex/Disc) are tools to verify the card is valid. They mitigate risk for the merchant. Address and ZIP in a Card Not Present (CNP) situation also allow the merchant to get the best possible processing rates for that transaction. 3. A legitimate merchant will have a secure website (if this is the scenario to which you're referring). Look for 2 things when entering your payment information on the site.Secure Connection in the URL Address denoted by HTTPS:A Privacy and Security Statement that includes their Compliance and Security Assessor:4. Credit card numbers are created by a sophisticated algorithm which is why you can't simply input the last 4 digits into a form. There are sites that will allow you to enter the lat 4 digits once you have already registered with them to verify the choice of card, but this is after they have your card on file. There are billions of debit/credit cards in the world with different expiration dates, CVV values and different 11/12 beginning digits so the chances that your card is the only one with a unique 4 digit ending are pretty slim.What is not safe 1. Filling out a paper form with this same data and mailing it to someone. Imagine if it got lost and someone got this info. Shopping spree on the internet for them. It still amazes me that my water bill allows this info to be paid in this manner. I would never fill out a form with my credit card data an mail or fax it. A big no-no. 2. Never email you credit card data to anyone. This communication can be easily intercepted and go into the wrong hands. Email is a safe mode of transmitting sensitive card data..

-

Why is Ikea requiring me to email them my credit card information in order to make a lousy appointment to see a kitchen planner? They’re requiring me to fill out forms, scan them, and email back.

The reason they are requiring your credit card information is because Ikea’s kitchen planning service isn’t free. In some cases, a portion of the planning and/or measuring fees may be reimbursed when you place your kitchen purchase, but the details may vary from store to store.

-

When you apply for a credit card on the phone, does the operator simply fill out a web form the way you would if you applied online? Or do you get to explain situations if you are denied at first?

Don't waste your time calling in, just fill it out online yourself. Your financial details and credit score are put through an automated system. Your credit history does all of the explaining for you unfortunately. Also, ditto to what Bryan said about higher end cards, they will actually take the time to verify your income and personal assets in some cases to offset tarnished credit.

-

I am trying to get my first credit card but no company will accept my application. How can I fill out the application differently to get accepted?

Look no farther than AmazonIf you are a frequent Amazon customer, as I was, you will have seen many prompts trying to get you to sign up for their rewards card. I didn’t really have a need for a credit card but I figured I might as well get the $70 or so as well as the cash back for signing up for a rewards card.I’m only 18 so I figured there was a high chance of being denied. I entered my information and was promptly denied. For some reason the prompts kept being displayed on my checkout pages, so after a month or so I applied again. Denied.Oh well… I thought.But one day I saw a new rewards card pop up. Rather than being through Synchrony Financial, this one was through Chase. Since I have no credit, it was reasonable that I was getting rejected. However, I currently have a Chase College Student Checking account and have had a Business and Savings account with them in the past. Because I was a current account holder I figured I would have a better chance.I applied one last time only to get waitlisted…? (I read too many college application questions)Waitlisted in this setting meant they needed to further review my application. I wasn’t very optimistic about the outcome but a few days later I found out I had been approved!My very first credit card: An Amazon Rewards Visa..How times have changed.Note: This only works with Chase, at least to my knowledge. You also do not need a cosigner for this method.

-

Have you added your teens to your credit card as authorized users so they can establish some credit? How did it turn out?

My understanding is that being added to a credit card account as an authorized user does nothing for the authorized user’s credit. The authorized user is not obligated in any way. My son could max out my credit card and ride off into the sun with no effect on his credit. Or he could pay off the card, my debits as well as his and it would just help my credit.I added my son as an authorized user as a convenience. It should not do anything for his \credit standing because I am the one who is liable for payment. Even if I were to die he would not be responsible for the bills.

Create this form in 5 minutes!

How to create an eSignature for the credit card authorization form marriott aft aft

How to make an electronic signature for your Credit Card Authorization Form Marriott Aft Aft in the online mode

How to generate an eSignature for your Credit Card Authorization Form Marriott Aft Aft in Google Chrome

How to create an electronic signature for signing the Credit Card Authorization Form Marriott Aft Aft in Gmail

How to create an electronic signature for the Credit Card Authorization Form Marriott Aft Aft straight from your mobile device

How to make an electronic signature for the Credit Card Authorization Form Marriott Aft Aft on iOS devices

How to generate an eSignature for the Credit Card Authorization Form Marriott Aft Aft on Android

People also ask

-

What is the Marriott credit card authorization form?

The Marriott credit card authorization form is a document used by hotels to obtain permission to charge a guest's credit card for services or reservations. This form helps ensure that the payment information is valid and allows the hotel to process charges securely. Using airSlate SignNow, you can easily create and send this authorization form electronically, streamlining the consent process.

-

How do I fill out the Marriott credit card authorization form?

Filling out the Marriott credit card authorization form typically requires entering details such as the cardholder's name, credit card number, expiration date, and authorization signature. With airSlate SignNow, you can complete this form digitally, saving time and reducing errors. The platform offers intuitive tools that make filling out important documents like this one simple and quick.

-

What are the benefits of using airSlate SignNow for the Marriott credit card authorization form?

Using airSlate SignNow for the Marriott credit card authorization form provides numerous benefits, including enhanced security, decreased processing time, and improved user experience. The platform's eSignature capabilities ensure that transactions are both legally binding and convenient. Furthermore, it offers templates and integrations that simplify the management of your authorization forms.

-

Is the Marriott credit card authorization form secure with airSlate SignNow?

Yes, the Marriott credit card authorization form is secure when processed through airSlate SignNow. The platform employs industry-standard encryption and complies with all data protection regulations, ensuring your financial information remains safe. Additionally, eSignatures on this form are legally binding, which adds an extra layer of security to your transactions.

-

What integrations are available for managing the Marriott credit card authorization form?

airSlate SignNow offers a variety of integrations that assist in managing the Marriott credit card authorization form. You can connect the platform with popular tools like CRM systems, cloud storage services, and payment processors. This seamless integration allows you to automate workflows and maintain organization, making it easier to handle authorization forms effectively.

-

How much does airSlate SignNow cost for using the Marriott credit card authorization form?

AirSlate SignNow offers flexible pricing plans tailored to meet various business needs, including those who require the Marriott credit card authorization form. Pricing is based on the number of users and features selected, ensuring that you only pay for what you need. Exploring the pricing page on their website can help you choose the right plan for your requirements.

-

Can I customize the Marriott credit card authorization form in airSlate SignNow?

Absolutely! You can fully customize the Marriott credit card authorization form in airSlate SignNow to suit your business needs. The platform allows you to add fields, change layouts, and include your branding elements, which helps create a consistent experience for your clients. This flexibility sets you up for success as you manage essential documents.

Get more for Credit Card Authorization Form Marriott AFT Aft

- Oklahoma i9 form

- Vehicle inspection form get a genuine mopar vehicle

- Oap attestation form

- Ket form

- Format delivery order excel

- Mechanical aeronautical amp nuclear engineering undergraduate handbook form

- Request for partial withdrawal life company forms

- Fcpp npp acknowledgement ampamp patient communication consent form notice of privacy policy acknowledgement ampamp

Find out other Credit Card Authorization Form Marriott AFT Aft

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT