Ar Tax for Et 179a Form

What is the Ar Tax For Et 179a

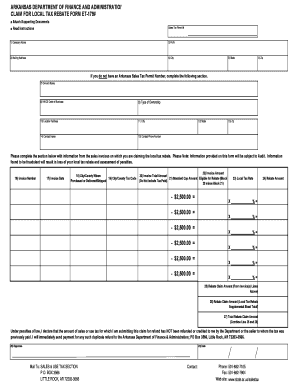

The Ar Tax for ET 179A is a specific tax form used in Arkansas for claiming certain tax benefits related to the purchase of qualified property. This form allows taxpayers to report their eligibility for tax deductions under Section 179A of the Internal Revenue Code. It is particularly relevant for businesses that invest in equipment and other tangible assets that can help reduce their taxable income.

Steps to Complete the Ar Tax For Et 179a

Completing the Ar Tax for ET 179A involves several key steps:

- Gather necessary documentation, including details of the property purchased and its cost.

- Determine eligibility for the deductions by reviewing IRS guidelines related to Section 179A.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline, either online or via mail.

Legal Use of the Ar Tax For Et 179a

The legal use of the Ar Tax for ET 179A is governed by both state and federal tax laws. To ensure compliance, taxpayers must adhere to the stipulations set forth by the IRS regarding the eligibility of property for deduction. This includes ensuring that the property is used for business purposes and falls within the qualifying categories outlined in the tax code.

Filing Deadlines / Important Dates

Filing deadlines for the Ar Tax for ET 179A typically align with the annual tax return deadlines. For most taxpayers, this means the form should be submitted by April fifteenth of the following tax year. It is essential to stay informed about any changes to these dates, as they can vary based on specific circumstances or extensions granted by the IRS.

Required Documents

To complete the Ar Tax for ET 179A, several documents are necessary:

- Proof of purchase for the qualified property, such as invoices or receipts.

- Documentation of the business use of the property, including usage logs if applicable.

- Any prior year tax returns that may impact current deductions.

Examples of Using the Ar Tax For Et 179a

Examples of using the Ar Tax for ET 179A include businesses that have purchased new machinery, vehicles, or technology that qualifies for tax deductions. For instance, a small manufacturing company that invests in a new production line can use this form to deduct the cost of the equipment from their taxable income, thereby reducing their overall tax liability.

Quick guide on how to complete ar tax for et 179a

Effortlessly Prepare Ar Tax For Et 179a on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Ar Tax For Et 179a on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Ar Tax For Et 179a with Ease

- Locate Ar Tax For Et 179a and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, the hassle of searching for forms, or the need to print new document copies due to errors. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign Ar Tax For Et 179a and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ar tax for et 179a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is AR tax for ET 179A?

AR tax for ET 179A pertains to the tax guidance for businesses related to Equipment Tax Exemption. This allows taxpayers to claim exemptions that signNowly lower their tax obligations, ensuring compliance and maximizing savings. Understanding AR tax for ET 179A is crucial for effective financial planning.

-

How can airSlate SignNow help with AR tax for ET 179A documentation?

AirSlate SignNow streamlines the documentation process for AR tax for ET 179A by enabling businesses to create, send, and eSign relevant documents efficiently. This simplifies compliance and aids in maintaining organized tax records. Our platform signNowly reduces the paperwork burden while ensuring legal validity.

-

What are the pricing options for airSlate SignNow concerning AR tax for ET 179A?

Our pricing options for airSlate SignNow are designed to be cost-effective, making it accessible for businesses of all sizes dealing with AR tax for ET 179A. We offer various plans based on features and usage needs, ensuring you find the right fit without overspending. Each plan offers excellent value, especially for tax documentation tasks.

-

Does airSlate SignNow include features specifically for managing AR tax for ET 179A?

Yes, airSlate SignNow includes features specifically tailored for managing AR tax for ET 179A. You can customize templates, track document statuses, and set reminders for key tax filing dates. These features enhance efficiency and reliability in your tax-related operations.

-

Can I integrate airSlate SignNow with other tools I use for AR tax for ET 179A?

Absolutely! AirSlate SignNow offers seamless integrations with various tools and software that can assist in managing AR tax for ET 179A. This ensures you can have everything from your eSigning needs to document management in one centralized platform, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for AR tax for ET 179A?

Using airSlate SignNow for AR tax for ET 179A provides numerous benefits, including reduced paperwork, improved compliance tracking, and faster document turnaround times. Our user-friendly interface ensures that even those unfamiliar with eSigning can navigate it easily. Additionally, it helps eliminate errors in documents, preserving your tax records' integrity.

-

Is airSlate SignNow secure for handling sensitive information related to AR tax for ET 179A?

Yes, airSlate SignNow prioritizes security and ensures that all sensitive information related to AR tax for ET 179A is protected. With industry-standard encryption and compliance with regulations, you can trust that your documents are safe throughout the entire eSigning process. Our platform is routinely audited to maintain these high-security standards.

Get more for Ar Tax For Et 179a

- Beachbody bat form

- Aotea college enrolment form

- Risk based pricing model excel form

- Self attested scanned copy of authorization letter on the letter head of the company agency form

- Target detection exercise form

- How to join panhellenic council texas state university form

- Horse ownership transfer form usef

- Certificate of progress 14931705 form

Find out other Ar Tax For Et 179a

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA