Philip Hardwidge Form

What is the Philip Hardwidge?

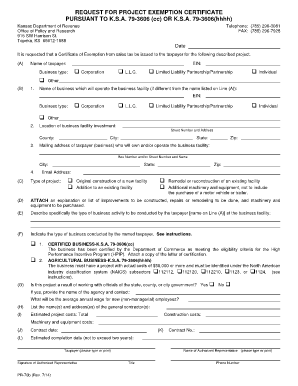

The Philip Hardwidge is a specific form used within the Kansas Department of Revenue for tax exemption purposes. It is essential for businesses seeking project tax exemptions in the state of Kansas. This form allows eligible entities to apply for tax relief on certain projects, ensuring compliance with state regulations while benefiting from available tax incentives.

Steps to complete the Philip Hardwidge

Completing the Philip Hardwidge involves several crucial steps to ensure accuracy and compliance. Begin by gathering all necessary information related to your project, including financial data and project details. Next, fill out the form accurately, ensuring that all sections are completed. After completing the form, review it for any errors or omissions. Finally, submit the form through the appropriate channels, either online or by mail, depending on the submission guidelines provided by the Kansas Department of Revenue.

Legal use of the Philip Hardwidge

The legal use of the Philip Hardwidge is governed by state laws and regulations. It is important to ensure that the information provided on the form is truthful and accurate, as any discrepancies may lead to penalties or denial of the exemption. The form must be used solely for its intended purpose, which is to apply for project tax exemptions as outlined by the Kansas Department of Revenue. Compliance with all relevant legal standards is essential for valid submission.

Required Documents

When submitting the Philip Hardwidge, several documents may be required to support your application. These typically include:

- Proof of project eligibility

- Financial statements or projections

- Details of the project location and scope

- Any prior correspondence with the Kansas Department of Revenue regarding the exemption

Having these documents ready will facilitate a smoother application process.

Form Submission Methods

The Philip Hardwidge can be submitted through various methods, depending on the preferences of the applicant and the guidelines set by the Kansas Department of Revenue. Common submission methods include:

- Online submission through the Kansas Department of Revenue's website

- Mailing the completed form to the appropriate department

- In-person submission at designated state offices

Choosing the right submission method can help ensure timely processing of your application.

Eligibility Criteria

To qualify for the tax exemption using the Philip Hardwidge, applicants must meet specific eligibility criteria set forth by the Kansas Department of Revenue. Generally, these criteria include:

- The project must be located within the state of Kansas

- The applicant must be a registered business entity

- The project must meet certain financial thresholds

- Compliance with local zoning and regulatory requirements

Ensuring that all eligibility criteria are met is crucial for a successful application.

Quick guide on how to complete philip hardwidge

Effortlessly Prepare Philip Hardwidge on Any Device

Digital document management has become increasingly favored by both businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the accurate format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without inconvenience. Manage Philip Hardwidge across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and eSign Philip Hardwidge Effortlessly

- Locate Philip Hardwidge and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Alter and eSign Philip Hardwidge to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the philip hardwidge

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Kansas Dept of Revenue PR 74 form used for?

The Kansas Dept of Revenue PR 74 form is designated for businesses to report certain payroll taxes and employee information. It is essential for complying with state regulations and ensures accurate tax filings. Utilizing airSlate SignNow can streamline this reporting process, making it easy to eSign and submit documents efficiently.

-

How does airSlate SignNow support the Kansas Dept of Revenue PR 74 process?

airSlate SignNow offers a user-friendly platform that enables businesses to easily complete and eSign the Kansas Dept of Revenue PR 74 form. With its integrated features, you can manage documents securely and ensure compliance with state requirements. This streamlines the filing process and saves valuable time for your team.

-

Is there a cost associated with using airSlate SignNow for the Kansas Dept of Revenue PR 74?

Yes, there are subscription plans available for using airSlate SignNow, tailored to fit various business needs. The pricing is competitive and provides access to powerful features that aid in managing forms like the Kansas Dept of Revenue PR 74. Investing in this solution can lead to savings through improved efficiency.

-

What features does airSlate SignNow offer for eSigning the Kansas Dept of Revenue PR 74?

airSlate SignNow allows users to upload, edit, and eSign the Kansas Dept of Revenue PR 74 form seamlessly. Key features include secure cloud storage, mobile access, and real-time tracking of document status. These capabilities enhance collaboration and ensure that all signatures are collected swiftly.

-

Can airSlate SignNow integrate with other tools for Kansas Dept of Revenue PR 74 submissions?

Absolutely! airSlate SignNow integrates with various popular business tools and software, making it easier to manage your workflow for the Kansas Dept of Revenue PR 74 form. These integrations facilitate data transfer and synchronization, allowing for a more streamlined experience across your business operations.

-

What are the benefits of using airSlate SignNow for the Kansas Dept of Revenue PR 74?

Using airSlate SignNow for the Kansas Dept of Revenue PR 74 provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are compliant and accessible from anywhere, which saves time and reduces the risk of errors during the filing process.

-

How do I get started with airSlate SignNow for Kansas Dept of Revenue PR 74?

Getting started with airSlate SignNow for the Kansas Dept of Revenue PR 74 is simple. You can sign up for a free trial to explore the features and see how it fits your needs. Once you're ready, choose a plan and start managing your documents efficiently with eSigning capabilities.

Get more for Philip Hardwidge

Find out other Philip Hardwidge

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online