Form 940 Schedule a Internal Revenue Service Irs

What is the Form 940 Schedule A Internal Revenue Service IRS

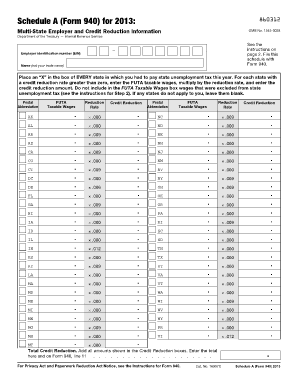

The Form 940 Schedule A is a supplemental form required by the Internal Revenue Service (IRS) for employers who are subject to the Federal Unemployment Tax Act (FUTA). This form is used to report state unemployment taxes that are eligible for a credit against the federal unemployment tax. Employers must complete this form as part of their annual federal tax return, Form 940, to determine their overall tax liability. The Schedule A provides detailed information on the state unemployment taxes paid, which can significantly affect the employer's tax obligations.

How to use the Form 940 Schedule A Internal Revenue Service IRS

Using the Form 940 Schedule A involves a few key steps. First, employers must gather all relevant information regarding their state unemployment taxes. This includes the amounts paid to each state and any applicable credits. Next, the employer should complete the form by accurately entering the required data into the designated fields. It's essential to double-check all entries for accuracy to avoid potential penalties. Once completed, the form is submitted along with the annual Form 940 to the IRS. Utilizing electronic tools can streamline this process, ensuring that the form is filled out correctly and submitted on time.

Steps to complete the Form 940 Schedule A Internal Revenue Service IRS

Completing the Form 940 Schedule A involves several important steps:

- Gather state unemployment tax payment records for the year.

- Determine the total amount of state taxes paid, including any credits received.

- Fill out the form by entering the total state unemployment taxes in the appropriate sections.

- Review the form for accuracy and completeness.

- Submit the completed Schedule A along with Form 940 to the IRS by the due date.

Legal use of the Form 940 Schedule A Internal Revenue Service IRS

The Form 940 Schedule A is legally binding when completed accurately and submitted on time. It is essential for employers to comply with IRS regulations regarding unemployment tax reporting. Failure to file the form or inaccuracies in reporting can lead to penalties and interest charges. To ensure legal compliance, employers should maintain thorough records of their state unemployment tax payments and consult with tax professionals if needed. Using a reliable electronic signature solution can also enhance the legal validity of the submitted documents.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the Form 940 Schedule A. The annual deadline for submitting Form 940, including Schedule A, is typically January 31 of the following year. If the employer has made timely deposits of all FUTA taxes, they may have until February 10 to file. It is crucial to mark these dates on the calendar to avoid late filing penalties. Additionally, employers should be aware of any changes in deadlines that may occur due to federal regulations or state requirements.

Form Submission Methods (Online / Mail / In-Person)

The Form 940 Schedule A can be submitted in several ways. Employers have the option to file the form electronically using IRS-approved e-filing software, which is often the quickest and most efficient method. Alternatively, the form can be printed and mailed to the appropriate IRS address. Some employers may also choose to deliver the form in person, although this method is less common. Regardless of the submission method, it is important to retain proof of submission for record-keeping purposes.

Quick guide on how to complete form 940 schedule a internal revenue service irs

Complete Form 940 Schedule A Internal Revenue Service Irs effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can find the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents promptly with no delays. Handle Form 940 Schedule A Internal Revenue Service Irs on any platform using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Form 940 Schedule A Internal Revenue Service Irs with ease

- Find Form 940 Schedule A Internal Revenue Service Irs and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as an old-fashioned signed signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Form 940 Schedule A Internal Revenue Service Irs to ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 940 schedule a internal revenue service irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form 940 Schedule A with the Internal Revenue Service (IRS)?

Form 940 Schedule A is used by employers to report specific information about their employees' wages and unemployment tax liability. This form helps ensure compliance with federal regulations set forth by the Internal Revenue Service (IRS) regarding unemployment taxes. It is essential for businesses to accurately complete this form to avoid penalties.

-

How can airSlate SignNow facilitate the eSigning of Form 940 Schedule A for businesses?

airSlate SignNow offers a seamless platform for businesses to eSign Form 940 Schedule A quickly and efficiently. With user-friendly features, users can easily upload the form, add signatures, and send it directly to the IRS or other parties. This streamlines the process and saves valuable time for businesses preparing to submit their tax documentation.

-

What are the costs associated with using airSlate SignNow for Form 940 Schedule A eSigning?

airSlate SignNow provides various pricing plans tailored to meet the needs of businesses of all sizes. The cost typically depends on the number of users and features required, making it a cost-effective solution for managing Form 940 Schedule A with the Internal Revenue Service (IRS). A free trial is also available to help users explore the platform before making a commitment.

-

Does airSlate SignNow integrate with accounting software to streamline Form 940 Schedule A preparations?

Yes, airSlate SignNow integrates with popular accounting software, allowing users to manage their Form 940 Schedule A preparations seamlessly. These integrations help to automatically import data, reducing manual entry errors and ensuring accuracy in documents submitted to the Internal Revenue Service (IRS). This feature enhances efficiency for businesses during tax season.

-

What security measures does airSlate SignNow have in place for sensitive documents like Form 940 Schedule A?

airSlate SignNow prioritizes user security by implementing robust encryption protocols and secure access controls for sensitive documents, including Form 940 Schedule A. The platform complies with industry standards to protect users' data during the eSigning process, ensuring peace of mind when submitting important forms to the Internal Revenue Service (IRS).

-

Is it possible to track the status of Form 940 Schedule A once sent for eSignature through airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that allow users to monitor the status of their Form 940 Schedule A after sending it for eSignature. This transparency helps businesses ensure timely signatures and provides updates on when the document is completed, crucial for adhering to deadlines set by the Internal Revenue Service (IRS).

-

How can airSlate SignNow benefit small businesses dealing with Form 940 Schedule A submissions?

Small businesses can greatly benefit from airSlate SignNow's user-friendly interface and cost-effective pricing when managing Form 940 Schedule A submissions. By simplifying the eSigning process and automating workflows, it allows small companies to focus more on growth rather than paperwork. This enables them to maintain compliance with the Internal Revenue Service (IRS) while saving time and resources.

Get more for Form 940 Schedule A Internal Revenue Service Irs

Find out other Form 940 Schedule A Internal Revenue Service Irs

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe