Schedule Ar1000rc5 Form

What is the Schedule AR1000RC5

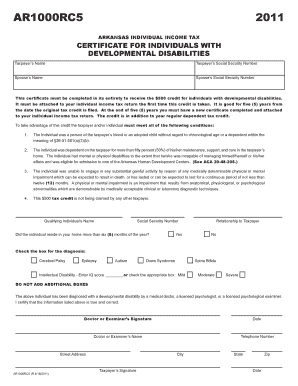

The Schedule AR1000RC5 is a specific form used in the United States for reporting certain tax-related information. This form is typically associated with the Arkansas state tax system and is essential for individuals and businesses that need to report specific deductions or credits. Understanding the purpose and requirements of the Schedule AR1000RC5 is crucial for accurate tax filing and compliance with state regulations.

How to use the Schedule AR1000RC5

Using the Schedule AR1000RC5 involves several steps to ensure that all necessary information is accurately reported. Begin by gathering all relevant financial documents, including income statements and previous tax returns. Next, fill out the form by entering the required details, such as income, deductions, and credits. It is important to follow the instructions carefully to avoid errors that could lead to delays or penalties. Once completed, the form can be submitted along with your main tax return.

Steps to complete the Schedule AR1000RC5

Completing the Schedule AR1000RC5 involves a systematic approach:

- Gather necessary documentation, such as W-2s, 1099s, and records of deductions.

- Download the Schedule AR1000RC5 form from the Arkansas Department of Finance and Administration website.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions or credits as indicated on the form.

- Review the completed form for accuracy and completeness.

- Submit the form with your state tax return by the designated deadline.

Legal use of the Schedule AR1000RC5

The Schedule AR1000RC5 is legally recognized for tax reporting purposes in Arkansas. To ensure its legal validity, it must be completed accurately and submitted in accordance with state guidelines. Compliance with relevant tax laws is essential to avoid potential penalties. Utilizing electronic filing options can enhance security and efficiency, making the process smoother for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule AR1000RC5 typically align with the general state tax return deadlines. For most taxpayers, the deadline falls on April 15 each year. However, it is important to verify any changes or extensions that may apply. Keeping track of these dates is crucial to ensure timely submission and avoid penalties for late filing.

Required Documents

To complete the Schedule AR1000RC5, certain documents are necessary. These include:

- W-2 forms from employers

- 1099 forms for other income

- Receipts or records for deductions claimed

- Previous tax returns for reference

Having these documents on hand will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete schedule ar1000rc5

Complete Schedule Ar1000rc5 effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly without interruptions. Handle Schedule Ar1000rc5 on any device with the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Schedule Ar1000rc5 without hassle

- Locate Schedule Ar1000rc5 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important parts of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, cumbersome form searching, or errors that require reprinting new document copies. airSlate SignNow caters to all your document management requirements in just a few clicks from any device you prefer. Adjust and eSign Schedule Ar1000rc5 and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule ar1000rc5

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ar1000rc5 and how does it work?

The ar1000rc5 is a state-of-the-art eSignature solution offered by airSlate SignNow. It allows users to send, sign, and manage documents electronically, making the process fast and efficient. With its user-friendly interface, the ar1000rc5 ensures that both businesses and clients can navigate the eSigning process with ease.

-

What are the key features of ar1000rc5?

The ar1000rc5 includes essential features such as document tracking, customizable templates, and multi-party signing capabilities. These features ensure that the signing process is not only streamlined but also highly efficient. Additionally, the ar1000rc5 provides integration with various business applications, enhancing overall productivity.

-

How much does the ar1000rc5 cost?

Pricing for the ar1000rc5 varies based on the subscription plan chosen, aiming to provide a cost-effective solution for businesses of all sizes. Potential customers can find detailed information on pricing tiers directly on the airSlate SignNow website. Investing in the ar1000rc5 can lead to signNow savings in time and resources related to document management.

-

What benefits does the ar1000rc5 offer for businesses?

The ar1000rc5 provides numerous benefits, including reduced turnaround time for document approvals and enhanced security through encrypted signatures. Businesses can also increase efficiency by automating repetitive paperwork tasks. Ultimately, the ar1000rc5 helps companies streamline workflows and improve customer satisfaction.

-

Can the ar1000rc5 integrate with my existing software?

Yes, the ar1000rc5 is designed to integrate seamlessly with various popular software solutions, such as CRMs and document management systems. By leveraging these integrations, businesses can enhance their capabilities and ensure a smooth transition into paperless workflows. This flexibility makes the ar1000rc5 a versatile choice for diverse business needs.

-

Is the ar1000rc5 secure for sensitive documents?

Absolutely! The ar1000rc5 employs advanced encryption protocols to protect sensitive information and ensure compliance with legal standards. With features like audit trails and secure access controls, you can trust that your documents are safe when using the ar1000rc5. Security is a top priority for airSlate SignNow.

-

How can I get started with the ar1000rc5?

Getting started with the ar1000rc5 is simple and straightforward. Visit the airSlate SignNow website to create an account and choose a suitable subscription plan. Once registered, you can explore the features and start sending and signing documents within minutes!

Get more for Schedule Ar1000rc5

- Instuctions on how to fill out straight bill of lading short form

- Inmate visiting forms

- Personal reference form 16266632

- Buyer representation agreement form

- School board of seminole county florida sanford scps k12 fl form

- Scdhhs idea part c policy for early intervention services form

- Ontario oversize application permit online form

- Name change application 10990196 form

Find out other Schedule Ar1000rc5

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer