Arizona Jt1 Form

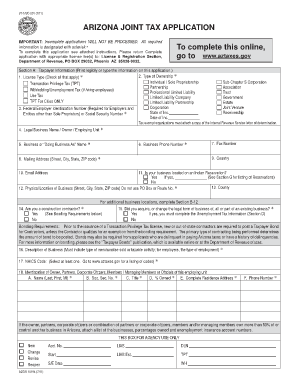

What is the Arizona JT1?

The Arizona JT1 form, also known as the Joint Tax Application, is a crucial document used by couples filing joint tax returns in Arizona. This form allows taxpayers to report their combined income, deductions, and credits, ensuring that they benefit from the tax advantages associated with joint filing. The JT1 is specifically designed to streamline the filing process for married couples or registered domestic partners, simplifying tax calculations and potentially lowering overall tax liability.

How to Use the Arizona JT1

Using the Arizona JT1 form involves a straightforward process. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements for both partners. Next, complete the form by accurately entering your combined income and deductions. It’s essential to double-check all entries for accuracy to avoid delays in processing. Once completed, you can submit the form electronically or via mail, depending on your preference.

Steps to Complete the Arizona JT1

Completing the Arizona JT1 form requires careful attention to detail. Follow these steps:

- Gather necessary documents, including income statements and deduction records.

- Fill out personal information for both partners, including Social Security numbers.

- Report total income by adding both partners' income together.

- List all deductions and credits applicable to your joint filing.

- Review the form for accuracy and completeness.

- Submit the form electronically or mail it to the appropriate state office.

Legal Use of the Arizona JT1

The Arizona JT1 form is legally binding when completed and submitted according to state regulations. It is essential to ensure that all information provided is truthful and accurate, as discrepancies can lead to penalties or audits. The form must be signed by both partners, affirming that the information is correct to the best of their knowledge. Compliance with state tax laws is critical to avoid legal complications.

Key Elements of the Arizona JT1

Several key elements must be included in the Arizona JT1 form for it to be valid:

- Personal Information: Names, addresses, and Social Security numbers of both partners.

- Income Reporting: Total income from all sources for both individuals.

- Deductions and Credits: A detailed list of all applicable deductions and credits.

- Signatures: Both partners must sign the form to validate the submission.

Form Submission Methods

The Arizona JT1 form can be submitted through various methods, providing flexibility for taxpayers. You can choose to file electronically through the Arizona Department of Revenue's online portal, which offers a streamlined process. Alternatively, you may print the completed form and mail it to the designated address. In-person submissions are also possible at local tax offices, allowing for direct assistance if needed.

Quick guide on how to complete arizona jt1

Complete Arizona Jt1 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without any delays. Handle Arizona Jt1 on any platform with airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to edit and eSign Arizona Jt1 with ease

- Locate Arizona Jt1 and click Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Arizona Jt1 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the arizona jt1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Arizona JT1 and how does it work with airSlate SignNow?

Arizona JT1 is a feature-rich document signing solution designed to streamline your signing process. With airSlate SignNow, users can easily create, send, and eSign documents online, ensuring a seamless experience from start to finish. This integration not only enhances efficiency but also maintains the security of your important documents.

-

How much does airSlate SignNow cost for Arizona JT1 users?

Pricing for airSlate SignNow varies based on the specific needs of Arizona JT1 users. We offer flexible subscription plans that cater to businesses of all sizes, ensuring you pay only for what you need. Our plans are competitively priced and provide excellent value for businesses looking to improve document management.

-

What features does airSlate SignNow offer for Arizona JT1?

airSlate SignNow provides a variety of features tailored for Arizona JT1 users, including customizable templates, automated workflows, and multi-party signing options. These features help simplify document management and enhance collaboration among team members. Additionally, electronic signatures are legally binding and compliant with regulations.

-

Can I integrate airSlate SignNow with other applications while using Arizona JT1?

Yes, airSlate SignNow offers seamless integrations with various popular applications, making it a perfect fit for Arizona JT1 users. You can connect it with CRM systems, cloud storage solutions, and more to streamline your workflow. This capability ensures that your signing process is efficient and fits within your existing operations.

-

What are the benefits of using airSlate SignNow for Arizona JT1?

Using airSlate SignNow with the Arizona JT1 feature set offers numerous benefits, including increased efficiency, reduced turnaround time for document signing, and improved security. The platform also allows users to track document progress in real-time, making it easier to manage tasks and collaborate with colleagues. Overall, it enhances the signing experience for everyone involved.

-

Is airSlate SignNow secure for Arizona JT1 transactions?

Absolutely! airSlate SignNow prioritizes the security of its users, ensuring that Arizona JT1 transactions are protected with advanced encryption and authentication measures. With compliance to international security standards, users can trust that their sensitive information is safe when using our platform. Your confidential documents remain secure throughout the signing process.

-

How user-friendly is airSlate SignNow for Arizona JT1 users?

airSlate SignNow is designed with user experience in mind, making it incredibly user-friendly for Arizona JT1 users. The intuitive interface allows users to navigate easily and utilize features without extensive training or technical knowledge. This ease of use empowers teams to adopt the platform quickly and start benefiting from faster document processing.

Get more for Arizona Jt1

- Document general form 4

- Dmf kontrakt form

- Employee advance salary form

- First bank account opening form

- Lake worth beach building department form

- Petition for grandparent visitation parent deceased handwritten www2 co fresno ca form

- Preparing for surgery at uva main hospital form

- Www thebalancecareers comletter of introductionletter of introduction examples and writing tips form

Find out other Arizona Jt1

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement