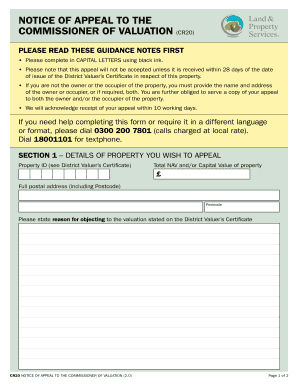

Valuation Appeal Form Cr20

What is the Valuation Appeal Form Cr20

The Valuation Appeal Form Cr20 is a legal document used by property owners in the United States to contest the assessed value of their property. This form is typically submitted to the local tax assessor's office or board of equalization. By filing this form, property owners seek to reduce their property taxes based on a claim that the assessed value exceeds the market value. Understanding the purpose and implications of this form is crucial for anyone looking to challenge their property assessment.

How to use the Valuation Appeal Form Cr20

Using the Valuation Appeal Form Cr20 involves several steps to ensure that the appeal is properly filed. First, gather all relevant documents, including your property tax bill and any evidence supporting your claim, such as recent appraisals or comparable property sales. Next, fill out the form accurately, providing all required information about your property and the reasons for your appeal. Once completed, submit the form to the appropriate local authority, either online, by mail, or in person, depending on the submission methods available in your area.

Steps to complete the Valuation Appeal Form Cr20

Completing the Valuation Appeal Form Cr20 requires careful attention to detail. Here are the steps to follow:

- Obtain the form from your local tax assessor's office or their website.

- Fill in your personal information, including your name, address, and contact details.

- Provide information about the property in question, including its address and parcel number.

- Clearly state the reason for your appeal, supported by evidence such as market analysis or property appraisals.

- Review the form for accuracy and completeness before submission.

Legal use of the Valuation Appeal Form Cr20

The Valuation Appeal Form Cr20 is legally binding once submitted according to the regulations set forth by local authorities. It is essential to comply with all legal requirements, including deadlines for submission and the provision of supporting documentation. Failure to adhere to these legal standards may result in the rejection of your appeal. Additionally, the form must be signed and dated to validate the appeal process.

Required Documents

When filing the Valuation Appeal Form Cr20, several documents are typically required to support your case. These may include:

- Your most recent property tax bill.

- Evidence of the property's market value, such as recent sales data for comparable properties.

- Any appraisal reports conducted on the property.

- Photographs of the property, if relevant to your claim.

Form Submission Methods

The Valuation Appeal Form Cr20 can often be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax assessor's website.

- Mailing the completed form to the designated office.

- In-person delivery to the local tax assessor's office.

Quick guide on how to complete valuation appeal form cr20

Complete Valuation Appeal Form Cr20 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Handle Valuation Appeal Form Cr20 on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-centered workflow today.

The simplest way to alter and eSign Valuation Appeal Form Cr20 with ease

- Find Valuation Appeal Form Cr20 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming document searches, or mistakes that necessitate printing new copies. airSlate SignNow caters to all your document management needs in a few clicks from any device you prefer. Modify and eSign Valuation Appeal Form Cr20 to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the valuation appeal form cr20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Valuation Appeal Form Cr20?

The Valuation Appeal Form Cr20 is a specific document used to challenge the assessed value of a property. By submitting this form, property owners can formally appeal their valuation and potentially lower their property taxes. airSlate SignNow simplifies the process of filling and submitting the Valuation Appeal Form Cr20 efficiently.

-

How can airSlate SignNow help with the Valuation Appeal Form Cr20?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Valuation Appeal Form Cr20. With its intuitive interface, users can quickly fill out required sections, attach supporting documents, and send the form electronically. This streamlines the appeal process, making it faster and more efficient.

-

Is there a cost associated with using the Valuation Appeal Form Cr20 through airSlate SignNow?

While the Valuation Appeal Form Cr20 itself is typically free to file, airSlate SignNow offers various pricing plans for its document management solutions. These plans provide access to useful features like template creation, document tracking, and secure eSigning. Choose a plan that best fits your needs to manage the appeal process effectively.

-

What features does airSlate SignNow offer for processing the Valuation Appeal Form Cr20?

airSlate SignNow offers numerous features for processing the Valuation Appeal Form Cr20, including customizable templates, real-time collaboration, and automated reminders for deadlines. Users can also benefit from secure cloud storage to keep their documents safe and easily accessible throughout the appeal process.

-

Can I track the status of my Valuation Appeal Form Cr20 submission?

Yes, airSlate SignNow allows users to track the status of their Valuation Appeal Form Cr20 submission. With notification features, you receive updates when your document is viewed and signed. This ensures that you remain informed about your appeal’s progress at every stage.

-

What integrations does airSlate SignNow support for managing the Valuation Appeal Form Cr20?

airSlate SignNow integrates seamlessly with various applications and services, enhancing the management of the Valuation Appeal Form Cr20. Whether using CRM systems, cloud storage, or project management tools, these integrations streamline workflows and enhance productivity during the appeal process.

-

Can I access the Valuation Appeal Form Cr20 on mobile devices?

Absolutely! airSlate SignNow is compatible with mobile devices, allowing you to access, complete, and eSign the Valuation Appeal Form Cr20 from anywhere. This mobility ensures that you can handle your property valuation appeals conveniently, even when you’re on the go.

Get more for Valuation Appeal Form Cr20

Find out other Valuation Appeal Form Cr20

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF