1031 Replacement Property Identification Form

What is the 1031 Replacement Property Identification Form

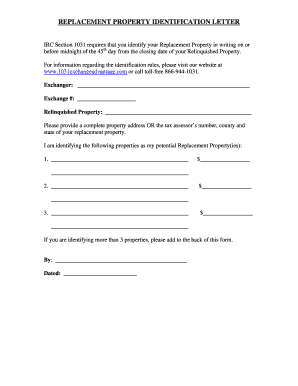

The 1031 Replacement Property Identification Form is a crucial document used in the context of a 1031 exchange, which allows real estate investors to defer capital gains taxes on the sale of a property by reinvesting the proceeds into a new property. This form serves to formally identify the replacement properties that the investor intends to acquire. It is essential for complying with IRS regulations, as it outlines the specific properties being considered for the exchange, ensuring that the investor adheres to the required timelines and rules set forth by the IRS.

How to use the 1031 Replacement Property Identification Form

Using the 1031 Replacement Property Identification Form involves several key steps to ensure compliance and accuracy. First, the investor must fill out the form with detailed information about the replacement properties, including their addresses and a description of each property. It is important to list the properties within the designated identification period, which is typically 45 days from the sale of the original property. Once completed, the form should be submitted to the appropriate parties, such as the Qualified Intermediary or the title company, to facilitate the exchange process.

Steps to complete the 1031 Replacement Property Identification Form

Completing the 1031 Replacement Property Identification Form involves a systematic approach:

- Gather necessary information about the properties you wish to identify.

- Clearly list each replacement property, ensuring you meet the identification criteria set by the IRS.

- Verify that the form is filled out accurately, with all required details included.

- Submit the form within the 45-day identification period following the sale of your original property.

- Keep a copy of the submitted form for your records and future reference.

Legal use of the 1031 Replacement Property Identification Form

The legal use of the 1031 Replacement Property Identification Form is governed by IRS regulations. To ensure its validity, the form must be completed and submitted within the specified time frames. The identification of properties must adhere to the IRS rules, which stipulate that investors can identify up to three properties without regard to their fair market value or any number of properties as long as their total value does not exceed 200% of the value of the relinquished property. Proper legal use is essential to maintain the tax-deferred status of the exchange.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the 1031 Replacement Property Identification Form. These guidelines outline the identification process, including the time limits for identifying replacement properties and the conditions under which properties can be identified. Investors must adhere to these guidelines to avoid penalties and ensure that the exchange qualifies for tax deferral. Familiarizing oneself with these regulations is vital for successful compliance during the exchange process.

Filing Deadlines / Important Dates

Filing deadlines are critical when dealing with the 1031 Replacement Property Identification Form. Investors have 45 days from the closing date of the original property sale to identify replacement properties. Additionally, the entire exchange must be completed within 180 days. Missing these deadlines can jeopardize the tax-deferred status of the exchange, making it essential for investors to stay organized and aware of these important dates throughout the process.

Quick guide on how to complete 1031 replacement property identification form

Complete 1031 Replacement Property Identification Form seamlessly on any gadget

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle 1031 Replacement Property Identification Form on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign 1031 Replacement Property Identification Form effortlessly

- Find 1031 Replacement Property Identification Form and click Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight signNow sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from a device of your choice. Modify and eSign 1031 Replacement Property Identification Form and maintain excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1031 replacement property identification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 1031 property identification?

1031 property identification refers to the process of identifying a replacement property or properties as part of a 1031 exchange, which allows investors to defer capital gains taxes when selling an investment property. This identification must be made within 45 days of selling the original property. Understanding this concept is crucial for anyone looking to maximize their tax benefits through real estate investment.

-

How can airSlate SignNow help with 1031 property identification?

airSlate SignNow streamlines the documentation process involved in 1031 property identification. With features like eSignature and secure document sharing, users can efficiently handle the essential paperwork required for identifying replacement properties. This ultimately saves time and reduces the complexity of the 1031 exchange process.

-

What documents are needed for 1031 property identification?

To properly execute 1031 property identification, you typically need a written identification of the replacement properties and any relevant agreements or contracts. airSlate SignNow facilitates this by allowing you to easily create, send, and sign required documents electronically. Ensuring that all paperwork is correctly completed helps in adhering to the IRS regulations for 1031 exchanges.

-

Are there any fees associated with using airSlate SignNow for 1031 property identification?

Yes, airSlate SignNow has a subscription pricing model that is designed to be cost-effective for businesses. The fees will vary depending on the features you choose, but the overall savings in time and the simplification of the 1031 property identification process can outweigh these costs. Investing in airSlate SignNow enhances your efficiency in managing property exchanges.

-

Can airSlate SignNow integrate with other tools for managing 1031 exchanges?

Absolutely! airSlate SignNow offers integrations with various real estate management and financial software tools, making it easier to handle 1031 property identification alongside other tasks. This connectivity ensures seamless data transfer and enhances your overall workflow. Utilizing integrated solutions can signNowly streamline the entire 1031 exchange process.

-

What are the time-saving benefits of using airSlate SignNow for 1031 property identification?

Using airSlate SignNow for 1031 property identification can save you signNow time by automating document creation and allowing for quick eSigning. The platform reduces the administrative burden associated with exchanging properties, enabling you to focus on finding replacement properties faster. Additionally, quicker document handling can help you meet the 45-day identification deadline more efficiently.

-

Is airSlate SignNow secure for handling sensitive information related to 1031 property identification?

Yes, airSlate SignNow prioritizes security and offers robust measures to protect sensitive information, especially crucial in contexts like 1031 property identification. The platform employs encryption and secure cloud storage to safeguard your documents. This ensures that your data remains confidential, allowing you to conduct transactions with peace of mind.

Get more for 1031 Replacement Property Identification Form

- Metlife 403 b withdrawal request form

- Emmaus high school excuse blank form

- Alaska usa direct deposit form

- Consent for cervical polyp removal shifa101 com the shifa clinic form

- Simple past story 2 form

- Envision rx prior authorization form

- Pharmacy policies and procedures manual alberta college of form

- William beaumont hospital grosse pointe only form

Find out other 1031 Replacement Property Identification Form

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe