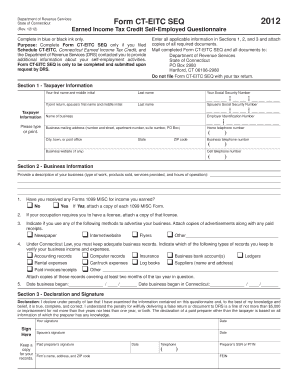

Ct Eitc Seq Form

What is the Ct Eitc Seq

The Ct Eitc Seq, or Connecticut Earned Income Tax Credit Sequence, is a crucial tax form for residents of Connecticut who qualify for the Earned Income Tax Credit (EITC). This form allows eligible taxpayers to claim a credit that reduces their state income tax liability, promoting financial stability for low- to moderate-income families. The credit is designed to incentivize work and assist those who may be struggling to make ends meet. Understanding the specifics of the Ct Eitc Seq is essential for ensuring that taxpayers maximize their benefits and comply with state tax regulations.

How to use the Ct Eitc Seq

Using the Ct Eitc Seq involves several steps to ensure accurate completion and submission. First, taxpayers should gather necessary documentation, including income statements and personal identification information. Next, the form must be filled out accurately, detailing income levels and family size, as these factors determine eligibility. After completing the form, it should be submitted to the Connecticut Department of Revenue Services, either electronically or via mail. Utilizing a reliable digital solution can streamline this process, ensuring that all information is securely transmitted and properly recorded.

Steps to complete the Ct Eitc Seq

Completing the Ct Eitc Seq requires careful attention to detail. Here are the essential steps:

- Gather necessary documents, including W-2 forms and proof of residency.

- Review the eligibility criteria to confirm qualification for the EITC.

- Fill out the Ct Eitc Seq form, ensuring all sections are completed accurately.

- Double-check the information for any errors or omissions.

- Submit the form electronically or by mail, following the guidelines provided by the state.

- Keep a copy of the submitted form and any supporting documents for your records.

Eligibility Criteria

To qualify for the Ct Eitc Seq, taxpayers must meet specific eligibility criteria. These include:

- Filing status: Must be a resident of Connecticut and file a state income tax return.

- Income limits: Must fall within the income thresholds set by the state for the EITC.

- Dependent status: Taxpayers may need to have qualifying children or meet other criteria to claim the credit.

It is essential for applicants to review these criteria carefully to ensure they meet all requirements before submitting the form.

Required Documents

When completing the Ct Eitc Seq, several documents are necessary to support the application. These typically include:

- W-2 forms from all employers for the tax year.

- Proof of residency, such as a utility bill or lease agreement.

- Social Security numbers for all qualifying dependents.

- Any additional documentation that may be required to verify income or eligibility.

Having these documents ready will facilitate a smoother completion process and help avoid delays in processing the claim.

Form Submission Methods

The Ct Eitc Seq can be submitted using various methods to accommodate taxpayer preferences. These methods include:

- Online submission through the Connecticut Department of Revenue Services website, which allows for quick processing.

- Mailing a paper copy of the completed form to the designated state office.

- In-person submission at local tax offices, if preferred.

Choosing the right method can depend on individual circumstances, including access to technology and personal preferences for record-keeping.

Quick guide on how to complete ct eitc seq

Complete Ct Eitc Seq effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Ct Eitc Seq on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to edit and electronically sign Ct Eitc Seq with ease

- Obtain Ct Eitc Seq and click Get Form to initiate.

- Utilize the tools we offer to finish your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Ct Eitc Seq to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ct eitc seq

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a ct eitc state id number and why do I need it?

The ct eitc state id number is an identifier assigned for tax purposes in Connecticut, specifically for those claiming the Earned Income Tax Credit. Businesses and individuals may require this number to ensure correct tax filings and to take advantage of the benefits associated with the EITC. It's essential for financial documentation, which airSlate SignNow can assist with by streamlining document management.

-

How can airSlate SignNow help me use my ct eitc state id number effectively?

AirSlate SignNow provides a seamless solution for managing documents that require your ct eitc state id number. With customizable templates and eSignature capabilities, you can easily prepare and sign documents digitally. This not only saves time but also ensures accuracy in tax-related documentation.

-

Are there any costs associated with obtaining my ct eitc state id number using airSlate SignNow?

While airSlate SignNow primarily offers services for document management and eSigning, obtaining your ct eitc state id number itself is typically free from the state. However, using airSlate SignNow to prepare the necessary documents could have associated subscription costs. Explore our pricing plans to find the most economical option for your needs.

-

What features does airSlate SignNow offer for tax documentation involving the ct eitc state id number?

AirSlate SignNow offers features like document templates, collaborative editing, and secure eSigning. These tools are essential when handling tax documentation that requires the inclusion of your ct eitc state id number. Easy sharing options also streamline communication with tax professionals.

-

Can I integrate airSlate SignNow with accounting software to manage my ct eitc state id number?

Yes, airSlate SignNow integrates with various accounting software to enhance your tax document management, including those that involve your ct eitc state id number. This integration allows for seamless data transfer and document creation, improving efficiency and accuracy in your financial processes.

-

What type of customer support does airSlate SignNow provide for users dealing with the ct eitc state id number?

AirSlate SignNow offers robust customer support, including live chat, email assistance, and a comprehensive knowledge base. Whether you have questions about using your ct eitc state id number within our platform or need help with document preparation, our support team is ready to assist you.

-

Is airSlate SignNow user-friendly for someone unfamiliar with using a ct eitc state id number?

Absolutely! AirSlate SignNow is designed with user experience in mind. Even if you're unfamiliar with processes related to the ct eitc state id number, our intuitive interface and guided workflows make it easy to navigate and complete your document signing needs.

Get more for Ct Eitc Seq

Find out other Ct Eitc Seq

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document