Form EL101B Income Tax Declaration for Businesses Fill Out and 2022-2026

What is the Form EL101B Income Tax Declaration For Businesses Fill Out And

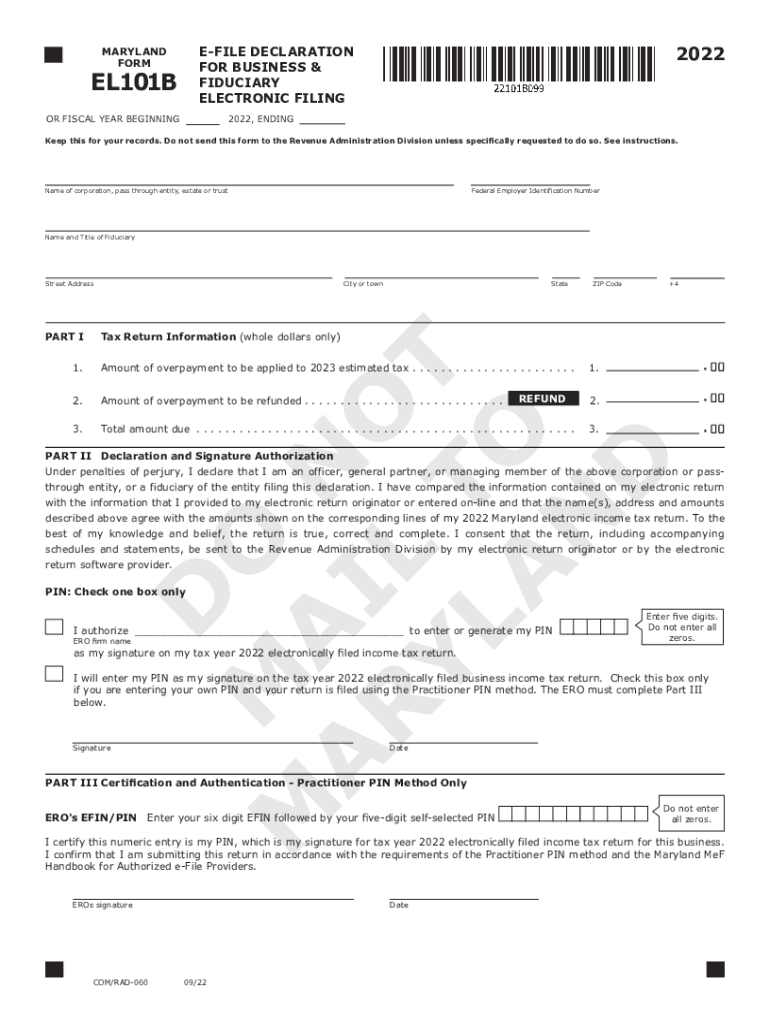

The Form EL101B is a crucial document used by businesses in the United States to declare their income for tax purposes. This form is essential for ensuring compliance with federal tax regulations and accurately reporting earnings. It serves as a declaration of the income generated by a business entity, which can include various revenue sources. Understanding the purpose of this form is vital for business owners to maintain transparency with the Internal Revenue Service (IRS) and to avoid potential penalties.

How to use the Form EL101B Income Tax Declaration For Businesses Fill Out And

Using the Form EL101B involves several steps that ensure accurate completion and submission. First, businesses must gather all relevant financial documents, including income statements and expense reports. Next, the form should be filled out with precise figures reflecting the business's income for the tax year. It's important to double-check all entries for accuracy before submission. The completed form can then be submitted electronically or via mail, depending on the preferences of the business and the requirements set by the IRS.

Steps to complete the Form EL101B Income Tax Declaration For Businesses Fill Out And

Completing the Form EL101B requires careful attention to detail. Here are the essential steps:

- Gather necessary financial documents, including profit and loss statements.

- Fill in the business's identifying information, such as the name, address, and Employer Identification Number (EIN).

- Report total income, including all revenue streams.

- Deduct any allowable expenses to arrive at the net income.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail to the appropriate IRS address.

Key elements of the Form EL101B Income Tax Declaration For Businesses Fill Out And

The Form EL101B contains several key elements that are critical for accurate income reporting. These include:

- Business Information: This section requires the business name, address, and EIN.

- Income Reporting: Businesses must list all sources of income, including sales and service revenue.

- Expenses: Allowable deductions must be clearly itemized to calculate net income.

- Signature: A signature is required to validate the information provided on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form EL101B are crucial to avoid penalties. Typically, businesses must submit this form by the due date for their federal tax return. For most businesses, this is usually April fifteenth of the following year. However, if the business operates on a fiscal year, the deadline may vary. It is essential for business owners to stay informed about these dates to ensure timely compliance.

Penalties for Non-Compliance

Failure to submit the Form EL101B on time can result in significant penalties. The IRS may impose fines based on the amount of unpaid tax and the duration of the delay. Additionally, non-compliance can lead to increased scrutiny during audits and potential legal repercussions. Therefore, it is vital for businesses to adhere to filing requirements and deadlines to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct form el101b income tax declaration for businesses fill out and

Create this form in 5 minutes!

How to create an eSignature for the form el101b income tax declaration for businesses fill out and

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form EL101B Income Tax Declaration For Businesses Fill Out And?

The Form EL101B Income Tax Declaration For Businesses Fill Out And is a crucial document for businesses to declare their income tax obligations. It simplifies the process of reporting income and ensures compliance with tax regulations. Using airSlate SignNow, you can easily fill out and eSign this form, streamlining your tax declaration process.

-

How can airSlate SignNow help me with the Form EL101B Income Tax Declaration For Businesses Fill Out And?

airSlate SignNow provides an intuitive platform that allows you to fill out the Form EL101B Income Tax Declaration For Businesses Fill Out And quickly and efficiently. With features like templates and eSignature capabilities, you can complete your tax declaration without hassle. This ensures that your documents are accurate and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the Form EL101B Income Tax Declaration For Businesses Fill Out And?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. The cost is competitive and provides excellent value considering the features available for filling out the Form EL101B Income Tax Declaration For Businesses Fill Out And. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the Form EL101B Income Tax Declaration For Businesses Fill Out And?

airSlate SignNow includes features such as customizable templates, eSignature capabilities, and secure document storage. These features make it easy to fill out the Form EL101B Income Tax Declaration For Businesses Fill Out And while ensuring that your information is safe and accessible. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for the Form EL101B Income Tax Declaration For Businesses Fill Out And?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow when filling out the Form EL101B Income Tax Declaration For Businesses Fill Out And. This allows you to connect with accounting software, CRM systems, and more, making the process seamless and efficient.

-

What are the benefits of using airSlate SignNow for tax declarations?

Using airSlate SignNow for tax declarations, including the Form EL101B Income Tax Declaration For Businesses Fill Out And, offers numerous benefits. It saves time, reduces errors, and ensures compliance with tax regulations. Additionally, the eSignature feature allows for quick approvals, making the entire process more efficient.

-

Is airSlate SignNow secure for handling the Form EL101B Income Tax Declaration For Businesses Fill Out And?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your data is protected when filling out the Form EL101B Income Tax Declaration For Businesses Fill Out And. The platform uses encryption and secure storage solutions to safeguard your sensitive information. You can trust that your documents are handled with the utmost care.

Get more for Form EL101B Income Tax Declaration For Businesses Fill Out And

- Chemical names and formulas chapter test a

- Joint operating agreement form

- Weekly sleep chart authorsdencom form

- Two rivers wi 54241 0087 form

- Mortgage form 21

- Horse boarding contract template get sample form

- Fire prevention code permit application manassascity form

- Forms applications ampamp permitshopewell va

Find out other Form EL101B Income Tax Declaration For Businesses Fill Out And

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself