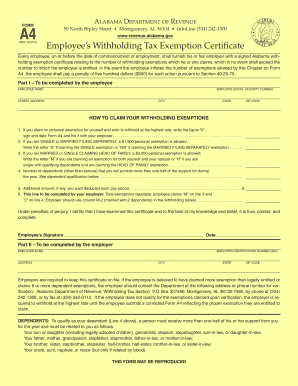

Withholding Tax Alabama Department of Revenue Form

What is the Withholding Tax Alabama Department Of Revenue

The withholding tax administered by the Alabama Department of Revenue is a tax that employers are required to withhold from their employees' wages. This tax is a prepayment of the employee's state income tax liability. Employers must calculate the amount to withhold based on the employee's earnings and the applicable tax rates, which can vary based on income levels and filing status. Understanding this tax is essential for both employers and employees to ensure compliance with state tax regulations.

Steps to complete the Withholding Tax Alabama Department Of Revenue

Completing the withholding tax form involves several key steps to ensure accuracy and compliance. First, employers must gather necessary employee information, including names, addresses, and Social Security numbers. Next, determine the correct withholding amount by referring to the state tax tables provided by the Alabama Department of Revenue. After calculating the withholding, employers should fill out the form accurately, ensuring all required fields are completed. Finally, submit the form to the appropriate state agency, either electronically or by mail, before the designated deadlines.

Filing Deadlines / Important Dates

It is crucial for employers to be aware of the filing deadlines associated with the withholding tax. Generally, employers must remit the withheld taxes to the Alabama Department of Revenue on a monthly or quarterly basis, depending on the amount withheld. The specific due dates can vary, so it is advisable to consult the Alabama Department of Revenue's official guidelines to avoid penalties. Additionally, annual reconciliation of withheld amounts is typically required, with deadlines for submission falling in early February of the following year.

Legal use of the Withholding Tax Alabama Department Of Revenue

The legal framework governing the withholding tax in Alabama is established by state tax laws. Employers must adhere to these regulations to avoid legal repercussions, including fines and penalties. The withholding tax form must be completed accurately and submitted in compliance with state guidelines. Furthermore, the Alabama Department of Revenue provides resources and support to ensure that employers understand their obligations and the legal implications of non-compliance.

Required Documents

To properly complete the withholding tax form, employers must have several key documents on hand. These include employee W-4 forms, which provide necessary information about each employee's filing status and allowances. Additionally, employers should maintain records of employee earnings and previous tax filings to ensure accurate calculations. Keeping these documents organized and readily accessible is essential for compliance and efficient processing of the withholding tax.

Who Issues the Form

The withholding tax form is issued by the Alabama Department of Revenue. This state agency is responsible for administering tax laws and ensuring compliance among employers and employees. Employers can obtain the form directly from the Alabama Department of Revenue's website or through official state publications. It is important for employers to use the most current version of the form to ensure compliance with any updates to tax laws or regulations.

Quick guide on how to complete withholding tax alabama department of revenue

Effortlessly prepare Withholding Tax Alabama Department Of Revenue on any device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents rapidly without any delays. Manage Withholding Tax Alabama Department Of Revenue on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and electronically sign Withholding Tax Alabama Department Of Revenue seamlessly

- Obtain Withholding Tax Alabama Department Of Revenue and click on Get Form to initiate.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or obscure confidential details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Withholding Tax Alabama Department Of Revenue and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the withholding tax alabama department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Withholding Tax Alabama Department Of Revenue?

The Withholding Tax Alabama Department Of Revenue refers to the tax that employers withhold from employees' wages to pay for state income tax obligations. It is essential for businesses to comply with these regulations to avoid penalties. Understanding this tax is crucial for proper payroll management.

-

How can airSlate SignNow help with Withholding Tax Alabama Department Of Revenue documents?

airSlate SignNow simplifies the process of preparing and signing documents related to Withholding Tax Alabama Department Of Revenue. With our user-friendly platform, businesses can easily create, send, and eSign tax forms securely. This streamlines compliance efforts and saves valuable time.

-

Is there a cost associated with using airSlate SignNow for Withholding Tax Alabama Department Of Revenue forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including those handling Withholding Tax Alabama Department Of Revenue forms. The pricing is competitive, and businesses can choose a plan that fits their budget and operational requirements. An investment in our service can lead to signNow time and cost savings.

-

What features does airSlate SignNow offer for Withholding Tax Alabama Department Of Revenue processing?

airSlate SignNow features electronic signature capabilities, document templates, and integration with popular accounting software, making it ideal for handling Withholding Tax Alabama Department Of Revenue. These tools enhance efficiency and ensure all documents are completed accurately and submitted on time.

-

Can airSlate SignNow integrate with other systems for Withholding Tax Alabama Department Of Revenue?

Absolutely, airSlate SignNow offers multiple integrations with major accounting and payroll systems, streamlining the process for Withholding Tax Alabama Department Of Revenue. This ensures seamless data transfer and compliance with state tax obligations. Businesses can easily manage their tax documentation alongside their existing systems.

-

What benefits does eSigning provide for Withholding Tax Alabama Department Of Revenue documents?

eSigning with airSlate SignNow for Withholding Tax Alabama Department Of Revenue documents signNowly speeds up the approval process. It eliminates the need for physical signatures, reduces paperwork, and allows for instant document retrieval. These benefits promote efficiency and ensure compliance with tax deadlines.

-

How secure is the data when using airSlate SignNow for Withholding Tax Alabama Department Of Revenue?

Security is a top priority at airSlate SignNow. When handling Withholding Tax Alabama Department Of Revenue documents, data is encrypted and stored securely, ensuring confidentiality and integrity. Our platform adheres to strict security protocols to protect sensitive information from unauthorized access.

Get more for Withholding Tax Alabama Department Of Revenue

Find out other Withholding Tax Alabama Department Of Revenue

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter