4506t Ez Form

What is the 4506t Ez

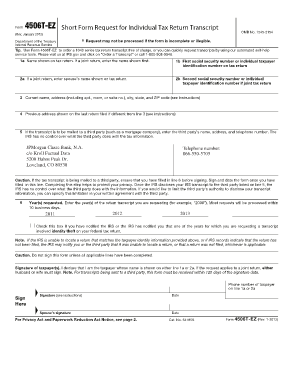

The 4506t Ez form is a streamlined version of the standard 4506 form, used by taxpayers to request a transcript of their tax return from the Internal Revenue Service (IRS). This form is particularly useful for individuals who need to provide proof of income or tax filing status to lenders or other financial institutions. By using the 4506t Ez, taxpayers can simplify the process of obtaining their tax information, making it easier to facilitate loan applications, mortgage processes, and other financial transactions.

How to use the 4506t Ez

To effectively use the 4506t Ez form, individuals need to follow a few straightforward steps. First, download the form from the IRS website or obtain a physical copy from a financial institution. Next, fill out the required fields, including personal information such as name, address, and Social Security number. It is essential to specify the type of transcript requested and the tax years needed. After completing the form, submit it either electronically or by mail, depending on the preferred method of submission. Ensure that you keep a copy for your records.

Steps to complete the 4506t Ez

Completing the 4506t Ez form involves several key steps:

- Obtain the form from the IRS website or a financial institution.

- Fill in your personal details, including your name, address, and Social Security number.

- Select the type of transcript you need and specify the relevant tax years.

- Sign and date the form to authenticate your request.

- Submit the completed form electronically or via mail, depending on your preference.

Following these steps ensures that the request for tax transcripts is processed efficiently.

Legal use of the 4506t Ez

The 4506t Ez form is legally recognized for obtaining tax transcripts, provided it is filled out correctly and submitted according to IRS guidelines. When used appropriately, it serves as a valid document for verifying income and tax filing status. Financial institutions often require this form to assess a borrower's financial situation, making compliance with its use essential for both taxpayers and lenders. It is important to understand that submitting false information on this form can lead to legal repercussions.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 4506t Ez form. Taxpayers should ensure that they are using the most current version of the form, as updates may occur. The IRS also outlines the acceptable methods for submission, whether electronically or by mail, and specifies the processing times for requests. Familiarizing oneself with these guidelines can help avoid delays and ensure that the requested transcripts are received in a timely manner.

Required Documents

When submitting the 4506t Ez form, it is important to have certain documents on hand to facilitate the process. Typically, you will need:

- Your Social Security number or Employer Identification Number (EIN).

- Details of the tax years for which transcripts are requested.

- Any supporting documentation that may be required by the financial institution or lender.

Having these documents ready can help streamline the completion and submission of the form.

Quick guide on how to complete 4506t ez

Complete 4506t Ez effortlessly on any device

Managing documents online has surged in popularity among organizations and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents promptly without delays. Handle 4506t Ez on any device through airSlate SignNow’s Android or iOS applications and enhance any document-centric task today.

The easiest way to modify and eSign 4506t Ez seamlessly

- Obtain 4506t Ez and then press Get Form to commence.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, laborious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign 4506t Ez and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4506t ez

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4506t ez form?

The 4506t ez form is a streamlined version of the traditional 4506-T form used for tax document verification. It simplifies the process for borrowers requesting a transcript of their tax returns from the IRS, making it easier for lenders to verify income information for loan applications.

-

How does airSlate SignNow support the 4506t ez process?

AirSlate SignNow facilitates the 4506t ez process by offering an intuitive eSigning solution that allows users to easily send and sign the form electronically. This speeds up the income verification process, increasing efficiency and ensuring compliance with lending requirements.

-

Is there a cost associated with using airSlate SignNow for the 4506t ez?

Yes, there is a pricing structure in place for using airSlate SignNow, which offers various plans to accommodate different business needs. The cost-effectiveness of airSlate SignNow allows businesses to manage their document signing processes, including the 4506t ez, without breaking the bank.

-

What features make airSlate SignNow suitable for handling the 4506t ez?

AirSlate SignNow features advanced document management capabilities, including customizable templates, secure cloud storage, and in-app collaboration tools. These features make it an ideal solution for efficiently handling the 4506t ez within your organization.

-

Can I integrate airSlate SignNow with other applications for processing the 4506t ez?

Absolutely! AirSlate SignNow offers seamless integrations with popular applications such as CRM systems, document management software, and email platforms. This allows for a smooth workflow when processing the 4506t ez, enhancing productivity and user experience.

-

What benefits does airSlate SignNow provide for the 4506t ez compared to paper-based methods?

Using airSlate SignNow for the 4506t ez offers signNow benefits, such as faster turnaround times, reduced error rates, and enhanced security. Businesses can efficiently manage documents without the hassles associated with paper-based processes, leading to improved customer satisfaction.

-

How secure is the airSlate SignNow platform for signing the 4506t ez?

AirSlate SignNow prioritizes security with features such as encryption, secure access controls, and audit trails. This ensures that all transactions, including the signing of the 4506t ez, are protected and comply with industry standards for data security.

Get more for 4506t Ez

- Electrical affidavit of experience form

- 3059 us bank point of contact form

- Cs 3570 caregiver monthly claim receipt for care kin child care funding form

- Right to cure letter sample form

- Lendingqb user guide form

- Face to face encounter form

- Depression self care action plan lphi lphi form

- Laryngoscopy consent form

Find out other 4506t Ez

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe